Last Week's Biggest Sales

1. MIDWOOD $3,750,000 2202 Avenue J GMAP All we know about this house is that it is huge: 6,434 square feet on a 10,000 square foot lot. Entered into contract on 1/12/10; closed on 3/3/11; deed recorded on 3/14/2011. 2. FORT GREENE $1,915,000 131 Fort Greene Place GMAP This two-family brick townhouse has been on…

1. MIDWOOD $3,750,000

2202 Avenue J GMAP

All we know about this house is that it is huge: 6,434 square feet on a 10,000 square foot lot. Entered into contract on 1/12/10; closed on 3/3/11; deed recorded on 3/14/2011.

2. FORT GREENE $1,915,000

131 Fort Greene Place GMAP

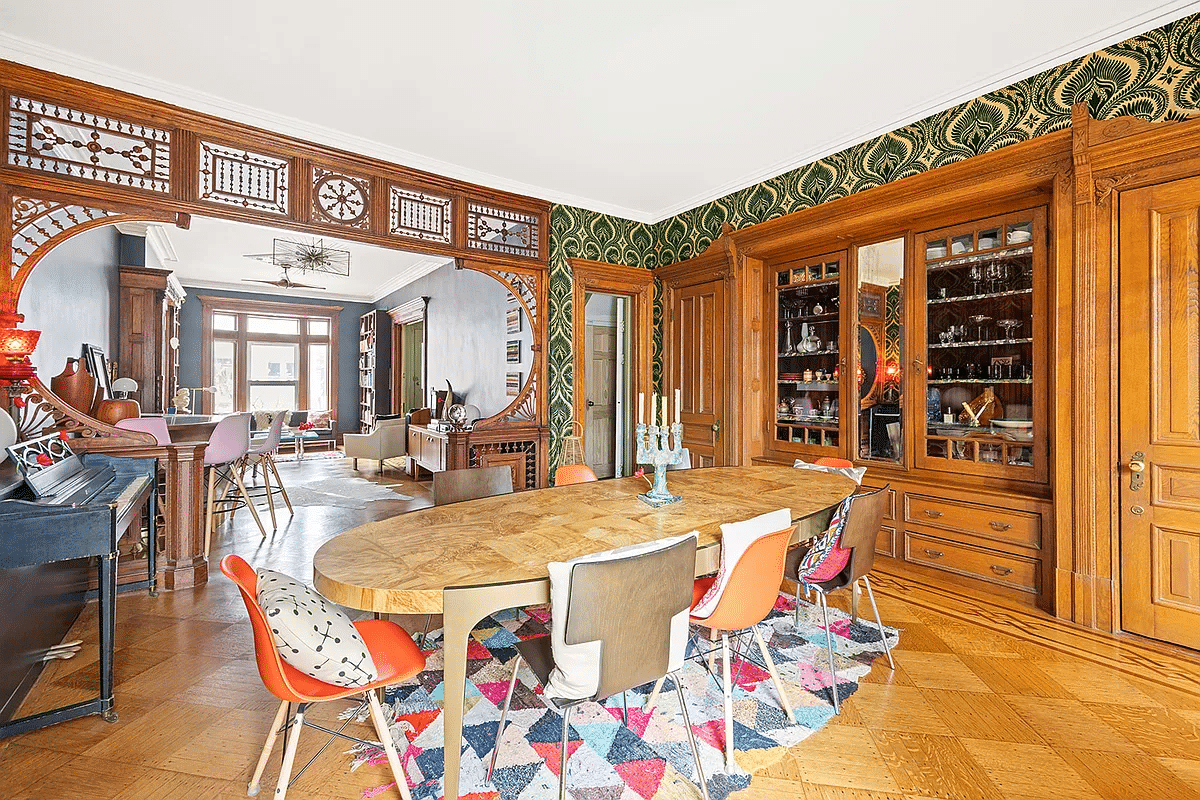

This two-family brick townhouse has been on the market since 2009. It’s an owners triplex with “self contained guest quarters” and a two-bedroom rental. There aren’t a ton of pictures of the listed interior details. It was first priced at $2,500,000 and cut a few times before selling. Entered into contract on 12/18/10; closed on 2/25/2011; deed recorded on 3/17/11.

3. PROSPECT HEIGHTS $1,900,000

126 St. Marks Avenue GMAP

This home at 126 St. Marks had a swift life on the market. It was listed in October 2010 for $2,100,000, entered contract in January and sold this month. From the listing: “this restored four family brownstone provides close to 4000 square feet of living space offering a host of options for the new owner(s).” Entered into contract on 1/12/2011; closed on 3/4/2011; deed recorded on 3/16/11.

4. CARROLL GARDENS $1,875,000

100 2nd Place, #1 GMAP

This brownstone unit was a Condo of the Day last September. We thought the duplex, complete with a master suite and two more bedrooms, was “immaculately renovated.” Couple that with an appealing layout and we were sold, although we thought the ask of $1,890,000 was somewhat ambitious. Guess we were wrong! Entered into contract on 1/5/2011; closed on 2/22/11; deed recorded on 3/18/11.

5. BRIGHTON BEACH $1,600,000

125 Oceana Drive East, #5C GMAP

This condo unit is from the Oceana, a gated community in Brighton Beach. #5C isn’t a penthouse unit but is priced on the higher end for the development. The unit also comes with a parking space. Entered into contract on 7/20/2010; closed on 3/2/2011; deed recorded on 3/14/11.

Photos via PropertyShark.

BTW, totally agree with Grand Army on the London/Midwood house. I think the privet hedging helps.

I always think how cheap French and Italian wines are in this country compared to what they were back in the UK. Must be excise duties or something. Given the prices charged on California wines I inevitably ignore them at the vintners and head straight to the French wines section. Even today I still feel like I’m getting a bargain.

I’m sure there are plenty of examples out there of people who paid, or rather overpaid, at market peak and due to timing right now are forced to sell at break even or, God forbid, at a loss. I won’t argue your cost numbers for 2nd Street although they hardly seem conservative to me – FYI, I’ve been a broker for 28 years. And if you don’t like my analogy with fine wine I’m sure that I could find other examples where the cost of something, anything, was inflated when demand far out stripped supply – the Dutch tulip craze, our own tech stock mania of the 90’s, last season’s must have Christmas toy.

The bottom line is that our homes are indeed luxury goods – even a modest neighborhood brownstone fetches 40 times the annual income of an average American. Does anyone really need three bathrooms, a 600 square foot kitchen, a tiny yard when Prospect Park is five minutes away? Of course not, but we live in the strongest financial market in the country, which happens to be the strongest country financially in the world, deficit notwithstanding, in an area that is increasingly popular, and consumption, including housing, is a competitive game. All that attention, and the money behind it, will drive prices in one direction and one direction only. Should you run out and throw caution to the wind and buy without regard to current relative value? I wouldn’t but even if you did a little patience is all you would need to eventually get your money back and then some.

Where is the money coming from? I have no idea but look at recent sales and try to deny that there is an avalanche of money rumbling towards this neighborhood. We’re still taking baby steps out of the recent recession, what do you think will happen when the irrational exuberance returns?

Selling just a couple of years or so after buying usually isn’t a win barring some major renovation.

371 Clinton Street now in contract. 20 days on the market. The 2-fam was asking $2,695,000.

Hey Dude – I understand your view of owning a single fam versus condo as it is shared by many. Not so easy to convert on that desire in this market though. Just a few minor points – 100 2nd is a 3 unit bldg and they use a third party manager, which I think is a great idea for a small building.

thanks for the update. didn’t have a chance to write a letter yet, but we will.

I live up the block and this is a recent flip job (ie. done before it sold).

Regarding #97, the case went before the Board of Standards and Appeals last week. They’ve called for another hearing in April. Lots of community resistance with letters from civic groups and home-owners alike. Unlikely the appeal for the curb-cut will succeed ‘though one never knows. If it did go through, would be viewed as a repudiation of landmarking and lead to all kinds of compliance problems in the new PH historic district.

Supply of nice places is very tight in Brownstone Brooklyn which is why selling prices are so high – unclear what would happen for supply to go up relative to huge demand as unfortunately many Manhattanites are starting to discover Brooklyn is actually nicer to live and trendiness is flowing from Brooklyn to Manhattan. Don makes a good point that $/psf selling price is in line with comps especially with garden and basement. That said, if I personally could afford this price I’d buy a smaller single family and avoid the 2-person condo nightmare.