Levine Walks, Bossert Back in Play

At the eleventh hour, R.A.L. Companies has walked away from its contract to purchase the former Bossert Hotel from the Watchtower Group, a source familiar with the situation tells us. RAL, the development company headed by Robert Levine, had signed an agreement to purchase the 14-story former hotel at 98 Montague Street in Brooklyn Heights…

At the eleventh hour, R.A.L. Companies has walked away from its contract to purchase the former Bossert Hotel from the Watchtower Group, a source familiar with the situation tells us. RAL, the development company headed by Robert Levine, had signed an agreement to purchase the 14-story former hotel at 98 Montague Street in Brooklyn Heights for $92 million back in the spring of this year with the intention of leasing it out as student housing; the deal reportedly had been scheduled to close by the end of last month. Our source says that financing had been difficult to come by; it’s also possible that with sales at One Brooklyn Bridge Park not as far along as hoped Levine didn’t want any more Brooklyn Heights exposure right now. Either way, expect the 224-unit property to start being shown again soon. Tough break for Watchtower: It’s hard to imagine the building fetching anywhere near $92 million in this environment.

The Bossert Finds a Buyer [Brownstoner] GMAP

The Bossert on the Block [Brownstoner]

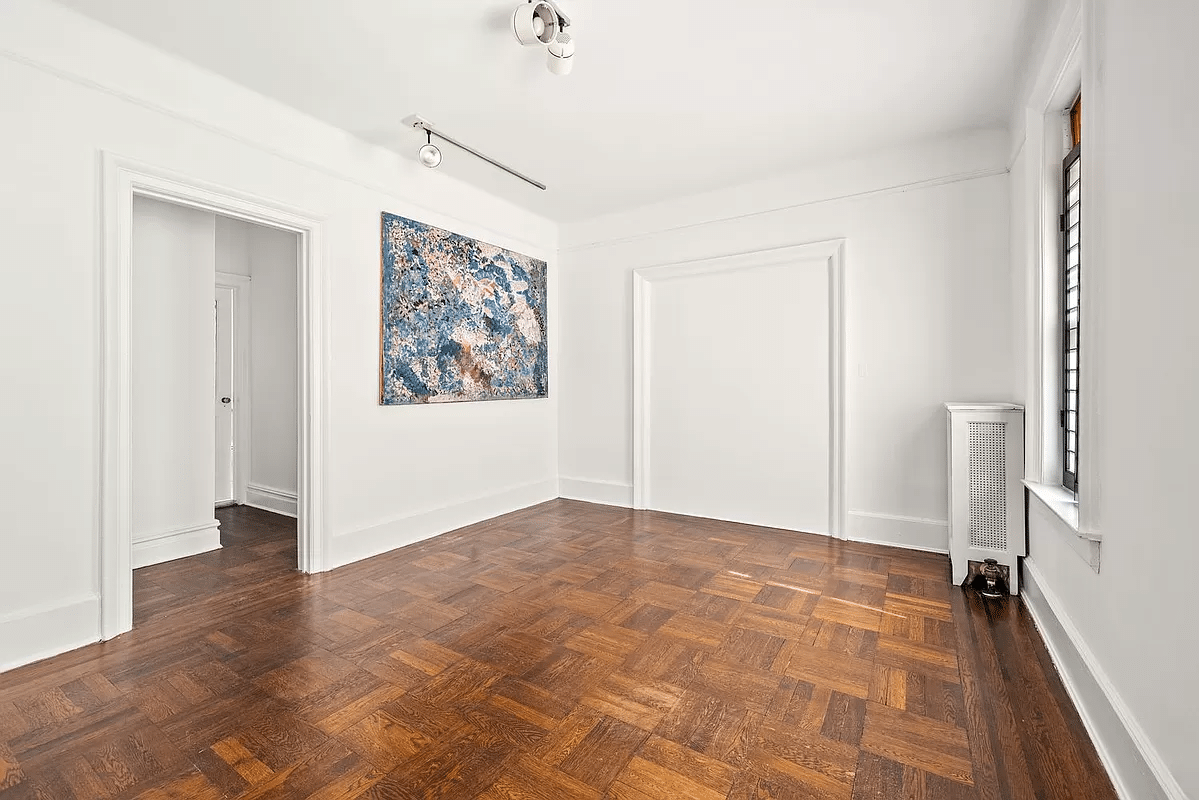

Photo by hetteix

BrooklynBandana:

the average daily rate is not the asking rate – it is the average across all sold rooms (the number of rooms x 365 days in a year). You have corporate clients, seasonable variability, and other factors that reduce the average from the typical asking.

I just got a survey from Smith Travel for the Roosevelt Hotel, the Intercontinental Barclay, the Novotel New York, The Millenium UN Plaza Hotel, and the Grand Hyatt by Grand Central. They had an ADR of $277 in 2007. So, that’s how I got my number (I just did a major midtown hotel).

When you see lower cap rates, they usually don’t use stabilized income – they use actual income. So, the lower rate reflects the upside potential. In this case, I used what I thought was stabilized income where there was relatively little upside potential. There is also the issue of financing. Rising mortgage rates are going to drive up cap rates, no question. Right now, a mortgage for a hotel will probably run you 5.75% a year with a 65% LTV. The rate should much higher based on that methodology. It’s a tough call at the moment.

I chose a higher rate too because there are a number of hotels planned to be built in the next 3 years. A lot of developers might be uncertain about the demand for so many rooms.

The point though is I think a hotel is a profitable use for the space. If my conservative numbers make it comparable to a student housing facility – probably the use most in demand at the moment – I really hope people put pressure on the future developer to take that route.

If you read this site enough, you’ll know my feelings about neighborhood associations. They probably would stonewall it, as they stonewall everything.

Nice back of the envelope analysis Polemecist but don’t you think a hotel here could charge more than $200 a night? I’d guess guests would pay more than $200 a night to stay in a swank hotel (this was Brooklyn’s “Waldorf Astoria” people) in Brooklyn Heights. also, I see commercial deals at 6% cap rate for buildings in crummier condition and not as nice a location. Why 7% cap rate? Final question is… could this actually be used as a hotel now? What would the Brooklyn Heights Association say? Where would cars park?

I lived on that block when the Witnesses bought it and they did a helluva reno job in and out. Of course I don’t know what the actual rooms are like but I don’t think a developer would have much in the way of exterior reno to do.

Nice breakdown on the numbers, Polemicist.

It will be interesting to see what happens to the Bossert. It’s a jewel of a building. I’d much rather see the Jehovah’s stay there than have it turned into another NYU dorm, although I agree that a dorm conversion is probable.

My guess is that it will be bought ny New York University/Brooklyn Polytech as student housing.

Wonder how much dough Levine had to forfeit in this deal?

I’ve been in that building. Lots of those rooms are pretty small so it would be tough to get 3 beds in there. Also there are some pretty big ballroom type spaces on the ground floor and in the basement, and an incredible rooftop bar/restaurant space so you’d probably make a bit more on the restaurant/retail space. The building is in incredible condition. I guess when you have what is essentially free labor, you can keep your buildings in excellent condition. But otherwise, I think Polemecists’ analysis is spot on. Optimisitcally this thing is worth $70 million. In today’s market with crappy leverage and ramapant pessemism about the economy in genreal , probably a number in the sixties makes more sense.

Good analysis…though do not think those rooms are triples, or at least not all of them…there may even be some single…no idea, never joined the cult to gain access.

A hotel would be great, including a roofdeck bar and restaurant on the groundfloor. Better option than staying across from the HoD. Tough mkt though.

Well, let’s say the 224-units are hotel size.

3

Occupancy rates and average daily rates will probably fall over the short term. So let’s say it will have an 85% occupancy and an ADR of $200 a night. That’s $200 x 365 x 224 x 85%. That’s about $14M of room revenue a year. Assuming a bar/restaurant at the space and some other sources of income, the $14M would probably be about 80% of gross revenue. So figure $17.5M of gross revenue.

A full service hotel that is new and well managed typically has an operating expense ratio of 70% to 80%. Let’s say 70% because we’re optimistic. Thats $5.25M of net operating income.

A 7% cap rate is probably appropriate in this market, which gives us a stabilized value of $75,000,000. I don’t know the condition of the building, so I can’t possibly speculate on renovation costs – but you’d probably have to deduct some additional ramp up costs after you estimate how long it would take to achieve stabilized occupancy. Probably a year of reduced occupancy from the market average.

NYU students typically pay about $15,000 a year per bed for the school year. If you figure 224 units can have 3 beds each, that means you have 672 beds. That gives us $10,800,000 in gross income. Figure a 60% overhead for managing a bunch of drunken hedonists, and you get $4,032,000 of NOI.

There used to be bond financing available for student housing, although I don’t know the situation now. Definitely a lower cap rate than a hotel. Say 5.5% today. About $73,000,000.

The dorm value might be higher with lower operating expenses, but it could be higher if bond financing isn’t available.

In both instances, I didn’t factor in renovation costs, which would have to be deducted from those values.

Sorry, Pete. We’ve spoken to several real estate investors who looked at the building last spring–and in some cases bid on it–and they couldn’t get to $92 million back then, so it’s hard to believe they will now. You should go for it though if you think it’s such a great price!