Last Week's Biggest Sales: Slope Supreme

All about the Slope this week. 1. PARK SLOPE $2,855,000 590 2nd Street GMAP (left) House originally listed for $3,200,000 late last year and then reduced to $2,995,000 this spring. Two-family, four-story brownstone. Deed recorded 7/02. 2. BROOKLYN HEIGHTS $2,792,500 69 Joralemon Street GMAP (right) Can’t find a listings trail for this one. Property Shark…

All about the Slope this week.

1. PARK SLOPE $2,855,000

590 2nd Street GMAP (left)

House originally listed for $3,200,000 late last year and then reduced to $2,995,000 this spring. Two-family, four-story brownstone. Deed recorded 7/02.

2. BROOKLYN HEIGHTS $2,792,500

69 Joralemon Street GMAP (right)

Can’t find a listings trail for this one. Property Shark has it as a 3,040-sf two-family. Deed recorded 7/03.

3. PARK SLOPE $2,788,000

130 Lincoln Place GMAP

Asking $2,995,000 when we had it as a House of the Day in early March. Two-family brownstone. Deed recorded 6/30.

4. PARK SLOPE $2,400,000

22 POLHEMUS PLACE GMAP

3,240-sf, 1-fam townhouse. Listing MIA. Deed recorded 7/03.

5. PARK SLOPE $1,725,000

398 Bergen Street GMAP

Asking $1,750,000 when it was an Open House Pick in February. Last sold for $1,140,000 in May 2005. Three-fam, 2,400-sf. Deed recorded 7/02.

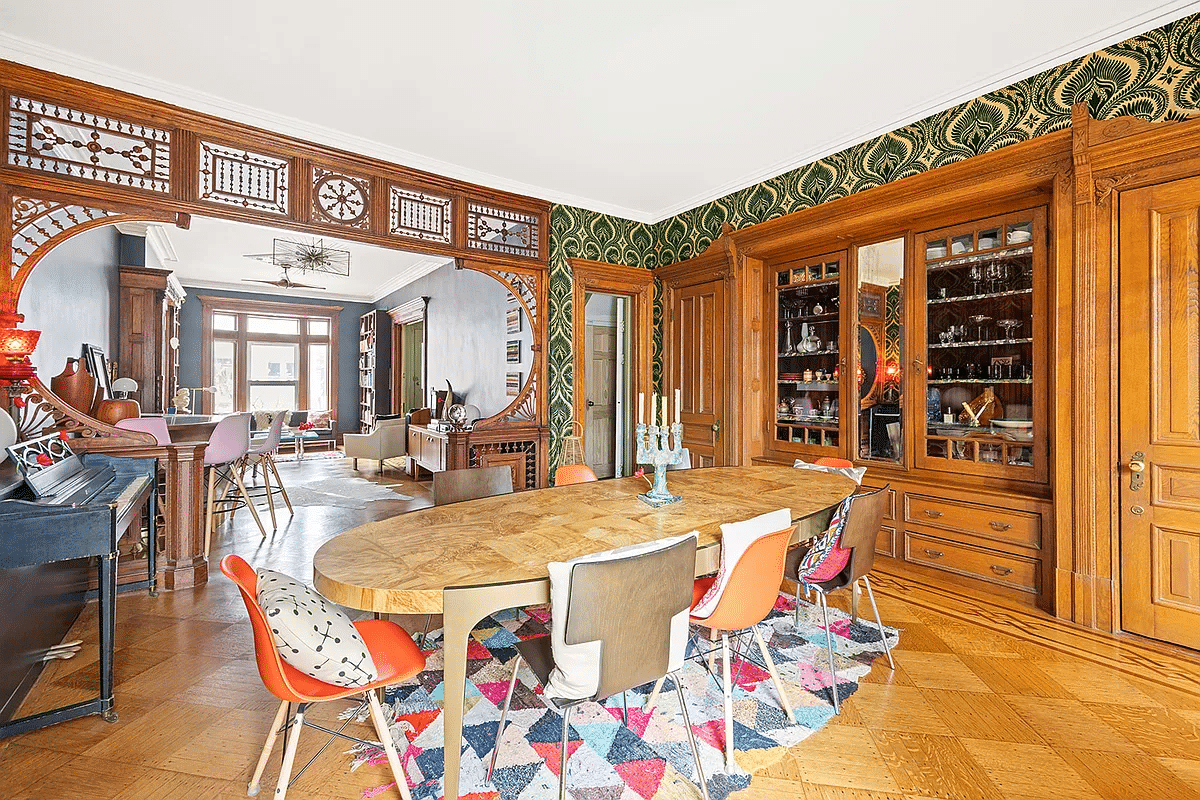

Photo of 69 Joralemon from Property Shark.

real estate bubbles “pop” slowly — the metaphor is wrong — because buyers who overpaid can live in their tulips and, if they can make their mortgage payments, need not realize their losses. Most people prefer paper losses to cash ones, so a lot of that happens.

Similarly, all developers are optimists, so they convince themselves that if they can just hold on a little longer, the buyers will reappear. Cutting prices, in contrast, would usually mean default and admission of failure, something that isn’t very attractive to the developers or their banks (many of which are going to go under as soon as they have to admit that their loans aren’t being paid back). Much better to simply pretend that nothing is wrong and maybe the next surge will work.

On the other hand, NY real estate turns over slowly, and more slowly in recent years as prices have gotten too high for most of the people who live in these neighborhoods. So most owners would still have plenty of equity even if prices dropped 50%. Once those folks accept that the market is really down, they’ll have relatively little problem selling for less than they hoped, especially since most of them will be putting most of their profits into a new house that has also declined in value.

Bottom line: housing declines start very slowly and often with a long period of flat prices. But this one may well accelerate once it gets going, and isn’t likely to stop until prices are back to trend, which would also put them more or less back in line with replacement cost and with rental value.

That requires about a 50% REAL drop, which could mean ten years flat selling prices while inflation, pay and rents catch up with current prices, or a sudden collapse if a few large condo developments go into foreclosure and the banks decide to cut their losses and move on, or anything in between.

In any event, it’s a strange time to consider buying unless you have met your dream home and don’t care what prices are going to be next year.

you can’t live inside a tulip.

unless you’re alice in wonderland.

Father Time is also Real Estate’s enemy – i.e. time a property lingers on a market, time that reveals prices going down (see just about everywhere in the nation, with NYC traditionally lagging behind). Of course, in long run, real estate recoups its value, but it may be a long time before that happens. NYC may be headed for several years of softening/stagnation, and possibly declines…

yes 14 million will be worth around 2million in about 40 years after a great deal of inflation.

tulips are very intriguing.

Yes indeed no way around it. Prime NYC RE is still hot. Despite the adjusments needed for mortgage approvals.

I remember in 1992 being shocked at the 500k price tag for a Harlem Brownstone. Brooklyn is making great progess and I believe in our life time we will see 14 million dollar Brownstones in PS.

Father Time is Real Estate best friend.

10:22 – the house that was billed as being designed by IM Pei was revealed to NOT have been designed by him – it was some kind of typo/misunderstanding. Also, that house has had it’s price reduced since coming on market by several 100K. Really, it’s silly to say any brownstone under 3 mil is a bargain – some are smallish (16′ wide) so even 2 mil for such a house would be too expensive.

10:22 sounds like a broker. How on earth can you say 3 mil for a brownstone is a bargain? It really depends on size, condition, exact block, etc. There’s a lot of variation in brownstones!!

10:08 – I think you meant March 2008 was the peak, the month that Bear Sterns went bust.

Park Slope has gone way up in price, but even it is softening a bit but sellers can still make huge profits if they bought before 2005. Even a 20% price decrease would not be so painful to most sellers, and is certainly a possibility, though a total crash seems unlikely, more like an overall weakening.

8:09, which house are you talking about?

the one designed by im pei?

did it sell recently?

i agree that people getting a brownstone in a super prime area for less than 3 million are getting a relative bargain. the prices have gone in manhattan, even if prices dropped 50%, the price of a Brooklyn Brownstone would be cheaper.

As a Manahattan Brownstone owner, I find what’s going on in Park Slope really impressive right now and it’s by far my top choice in looking at a move to BK hopefully within the next year.

Anyone seen that limestone on 3rd asking over 4.1 million?

It intrigues me.