Brooklyn Home Prices Barely Budge in First Quarter as Sales, Inventory Dip After Mortgage Rate Hike

The dizzying pace of the Brooklyn real estate market over the last decade is slowing as prices flatline across the borough and the number of sales and inventory both drop, according to a first quarter market report.

Brownstones on Willoughby Avenue. Photo by Anna Bradley-Smith

The dizzying pace of the Brooklyn real estate market over the last decade is slowing as prices flatline across the borough and the number of sales and inventory both drop, according to a first quarter market report.

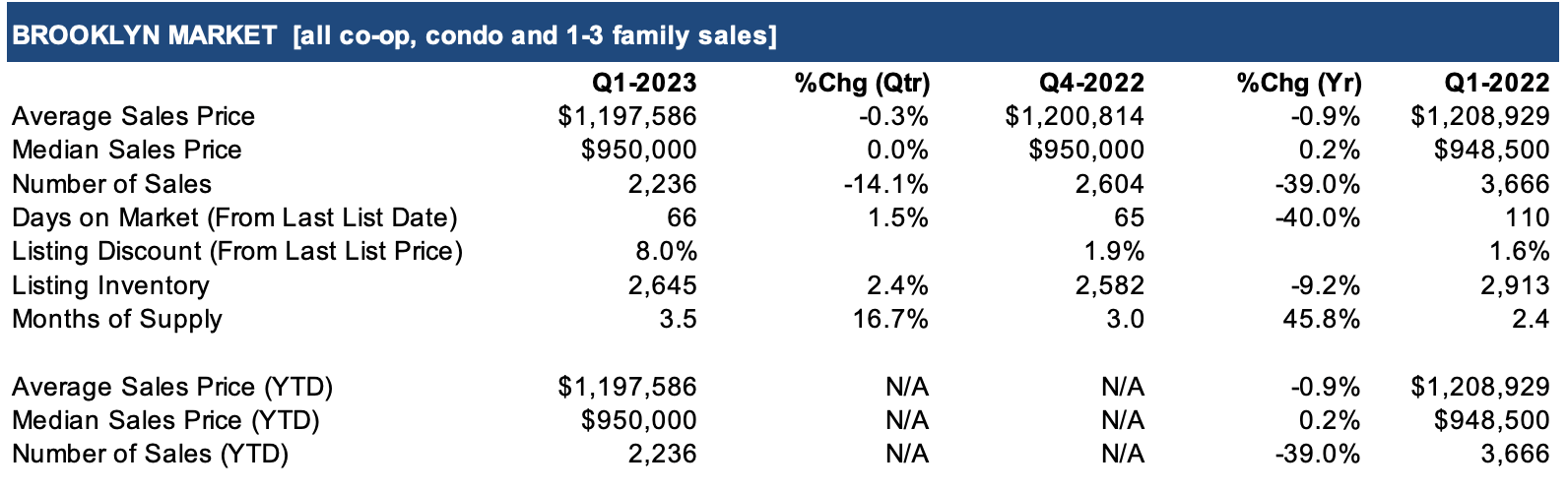

Rising only .2 percent over last year, the median sales price for an apartment or house in Brooklyn now stands at $950,000, “the third-highest level on record,” according to appraisal firm Miller Samuel, which prepared the report for Douglas Elliman. Average sales price declined .9 percent to $1,197,586.

Average price per square foot — widely considered a more true picture of value — fell slightly across most property types and neighborhoods measured, with condos down 5.7 percent to $1,026 and one- to three-family houses down 3.8 percent to $676. The exception was townhouses in the northwest, whose average price per square foot rose 3.7 percent to $1,432.

The number of sales in the quarter dove 39 percent to 2,236 vs. 3,666 in the same period a year earlier. Discounts on the last listing price were at 8 percent, compared with 1.6 percent in the same quarter last year. Miller told Brownstoner that as we exited the pandemic, prices were moving sideways, but still leaps and bounds above pre-pandemic levels.

The price stabilization is likely due to higher mortgage rates, he said, which rose starting in mid-2022 as the Federal Reserve raised interest rates to combat inflation.

Miller told Brownstoner that, in a nutshell, “you have a market that’s coming out of one of the biggest housing booms of the modern era. It’s stabilizing in price because supply remains low, but we’re also seeing a lower level of sales activity because of the uncertainty.”

Despite the dramatic decline in the number of sales in the borough, the total is more in line with the decade average for first quarter sales, pointing more towards stabilization. Listing inventory was also down 9.2 percent, with 2,645 properties on the market in the quarter.

Miller said inventory levels were “anemic” in Brooklyn, but that trend is also occurring nationwide. He put it down to people being pushed into rentals for two reasons: “One, because the price, they’re priced out of the purchase market, or there’s too much uncertainty for them. They’re essentially parking in the rental market.”

The fact that houses were selling almost twice as fast as last year is likely because of the declining inventory, he added, with older houses being sold off, and also because houses were properly priced. Sellers were also “capitulating to market conditions,” he said, as shown by the high level of discounted closings. “I think what the 8 percent represents going into the first quarter of this year is that sellers are being a bit more negotiable.”

This quarter’s report shows that condo sales in new developments across the borough have taken a hit, with the median sales price dropping 11.3 percent to $835,000 and homes staying on the market for 20 percent longer than in 2022. Meanwhile, all other property types are seeing listing times shortened.

Continuing a trend that appeared in 2022, competition among buyers for the limited number of listings in the borough is increasing. Homes are staying on the market for an average of 66 days, down 40 percent from 110 days this time last year, the report shows.

Through the rest of the year, Miller expects to see “this continuation of moving sideways,” although he added there could be a seasonal uptick and possible price increase in the second quarter, which is typically the biggest quarter of the year.

“I don’t see a significant change in the direction of the market, unless we go into a recession, which, you know, let’s be honest, we’ve been talking about going into recession for about two years.”

Related Stories

- Home Prices Level Out in Brooklyn, But Bidding Wars Increase With Drop in New Listings

- Brooklyn Home Prices Seem to Stabilize From Pandemic Frenzy, But Bidding Wars Increase

- Brooklyn ‘Starter’ Homes Scarce as Real Estate Prices Hit New High in Borough

Email tips@brownstoner.com with further comments, questions or tips. Follow Brownstoner on Twitter and Instagram, and like us on Facebook.

What's Your Take? Leave a Comment