Home Prices Level Out in Brooklyn, But Bidding Wars Increase With Drop in New Listings

Home prices in Brooklyn are slowing following the rise of interest rates after the pandemic buying frenzy, but as fewer new listings hit the market, buyers are increasingly getting into bidding wars, a fourth quarter market report shows.

Brownstones are still in high demand as house prices level out in Brooklyn. Photo by Susan De Vries

Home prices in Brooklyn are slowing following the rise of interest rates after the pandemic buying frenzy, but as fewer new listings hit the market, buyers are increasingly getting into bidding wars, a fourth quarter market report shows.

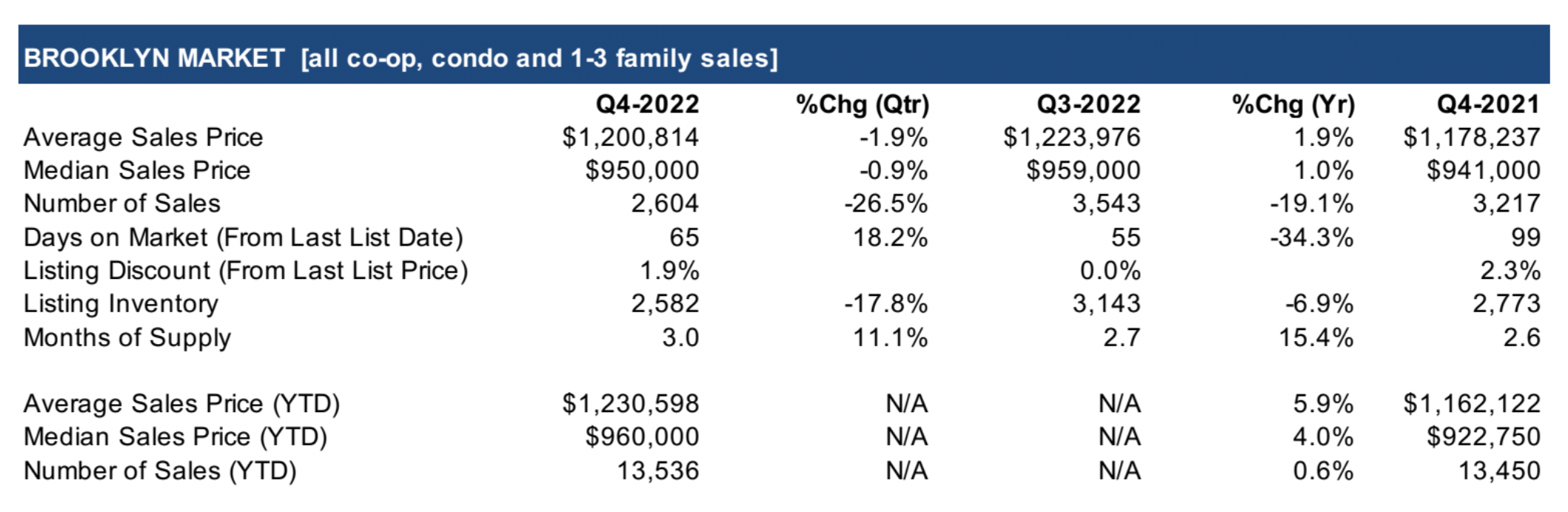

The median sales price for an apartment or house in Brooklyn over the past three months was $959,000, up just 1 percent on last year’s median of $941,000, according to a report prepared by appraiser Jonathan Miller of Miller Samuel for Douglas Elliman. The flatlining was first seen midway through 2022, according to previous reports, and it caps the end of the pandemic-induced home price frenzy, as well as a boom in real estate prices that took off in 2012.

The number of sales in the borough has also dropped: there were just 2,604 sales recorded in Brooklyn last quarter, 19.15 percent less than the same time last year. Listing inventory was also down almost 7 percent, the report shows.

Despite the dip, real estate in the borough is still far above pre-pandemic prices, when the median home price in Brooklyn was $800,000, according to the brokerage’s 2019 Q4 market report.

“The pandemic housing boom has thrown year-over-year [comparisons] temporarily out the window,” Miller told Brownstoner. “So we’re looking at prices that are up slightly, but they’re substantially higher than pre-pandemic; sales are down substantially from the year ago, which was a rocketship, but sales are up slightly from pre-pandemic; and listing inventory on a year-over-year basis actually declined 6.9 percent and then compared to pre-pandemic inventory is 12.3 percent below pre-pandemic.”

Miller told Brownstoner that Brooklyn had always had a “notoriously low level of supply” and inventory right now was even lower than that. He said a number of things had happened to cause the drop in inventory, but the easiest explanation was that many homeowners that had either refinanced or purchased in the last three to four years were wedded to an unusually low mortgage rate, and they would be hit with a much higher rate if they were to sell now.

“There should be no expectation that rates are going to return to where they were,” Miller said. “But there is an expectation that rates will eventually come down a bit, but that’s more likely to happen in a year and not imminently. As a result, many people are pausing and waiting to be more comfortable and as a result inventory is somewhat stuck.”

This quarter’s report shows property prices in north and northwest Brooklyn rose substantially, in some cases posting double-digit increases year over year per square foot, while homes in other areas of the borough dropped or rose by modest single digits.

One- to three-family brownstones in northwest Brooklyn remain highly sought after, with buyers paying a median price of $3.1 million, a jump on last year’s median price of $2.7 million. The average price per square foot — widely considered a more true picture of value — for brownstones in the area reached $1,464, up 11.8 percent from $1,310 in the same period in 2021. To put that in perspective, the price per square foot was $1,277 in 2019.

Brooklyn condos were also pricier at the end of 2022 than they were at the end of 2021, with the median price hitting $999,000, up 6.4 percent from $939,000. The price per square foot jumped 7.2 percent over the year to $1,090.

Meanwhile, sales prices of one- to three-family townhouses throughout the borough remained roughly the same as in 2021, with a median sales price of $1.1 million both years and an increase in the price per square foot of 2.5 percent to $668 in 2022. Co-ops saw the largest price drop of all house types in Brooklyn in the fourth quarter, shrinking from a median price of $530,000 in 2021 to $460,000 by the end of 2022.

Mirroring a trend from the third quarter in 2022, competition amongst buyers greatly increased in Brooklyn given the reduced number of listings. Homes are staying on the market for an average of 65 days, down from 99 days this time last year, the report shows, and bidding wars — measured by the closing price versus the asking price at time of contract — are at the highest level seen since Douglas Elliman started measuring bidding wars in 2017, reaching a third of all closings.

Going into 2023, Miller said, he expects to see more “tepid” interest rate increases from the Fed in coming months, meaning that a stabilization in interest and mortgage rates won’t come until 2024.

“I’ve sort of got 2023 as the year of disappointment because sellers aren’t going to sell for the prices they could have gotten in 2021, that’s not realistic, and buyers aren’t seeing a significant improvement in affordability. So both sides are disappointed,” Miller said.

Related Stories

- Brooklyn Home Prices Seem to Stabilize From Pandemic Frenzy, But Bidding Wars Increase

- Brooklyn ‘Starter’ Homes Scarce as Real Estate Prices Hit New High in Borough

- Brooklyn Townhouse Sale Prices Jump Almost 30 Percent in the Third Quarter

Email tips@brownstoner.com with further comments, questions or tips. Follow Brownstoner on Twitter and Instagram, and like us on Facebook.

What's Your Take? Leave a Comment