Shopping for Condo or Co-op Insurance? Think Local

Insurance rates are based on rebuilding or replacement cost, not market value.

You’re done renting and you’re in the market for a condo or co-op. Before you close the deal, consider these questions when it comes to protecting your investment.

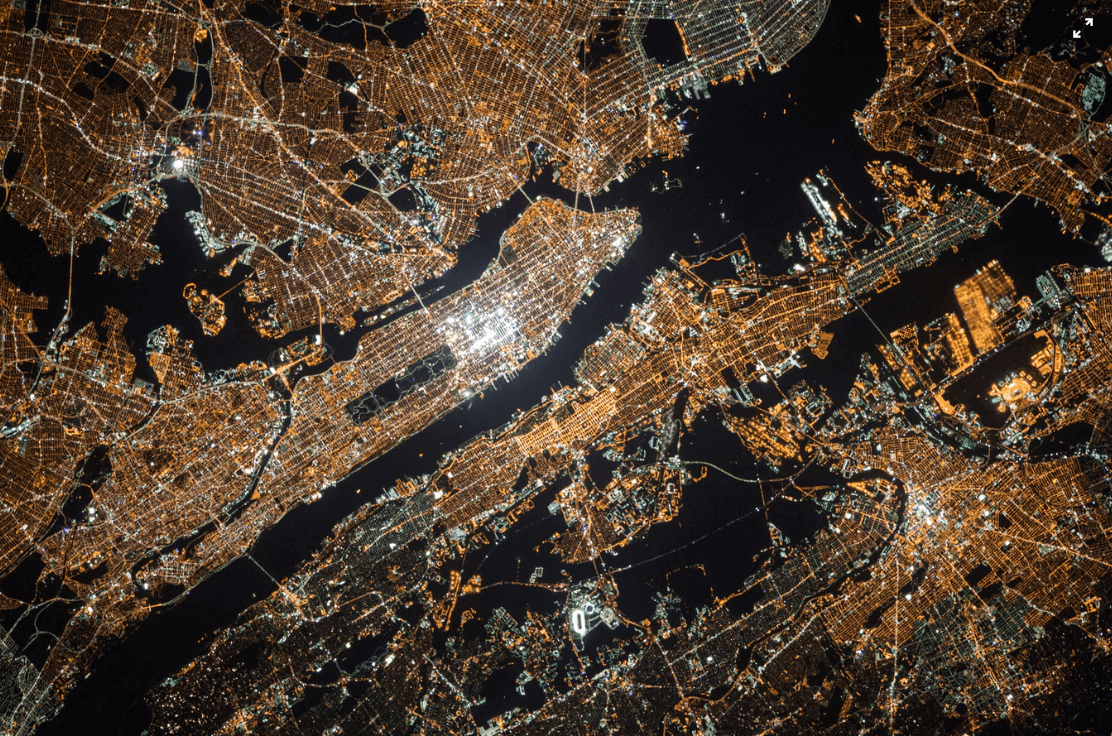

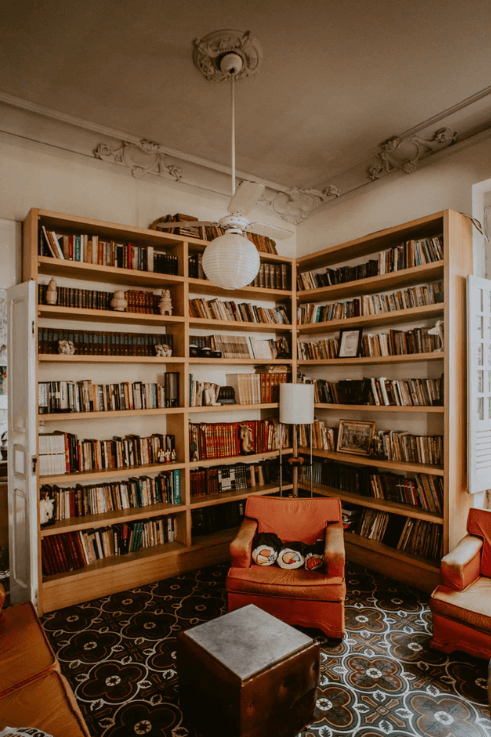

1. Are there particularities to New York City I should consider? New York City has a variety of housing stock — inland and coastal properties, dry areas and flood zones. There’s also new, old and very old buildings with pipes that are sometimes way past their expiration date. These all factor into how much premiums cost.

2. Does it cost more to insure an old property? A slight difference, mostly because newer buildings are more likely to be fire resistant with updated safety requirements.

3. What happens to my insurance when the value of my home increases or decreases? Insurance rates are based on rebuilding or replacement cost, not market value. Your investment may be less attractive if the economy tanks, but if you have to hire a contractor to rebuild a kitchen after a fire or need to replace your furniture, those costs tend to be stable or a bit higher year to year.

4. Does condo or co-op insurance come with free pizza delivery? Uh, no, as awesome as that would be, it’s not financially viable, so currently no carriers include that option with their policies.

Gotham has been helping New Yorkers find co-op and condo insurance for over 50 years. They can also recommend a good pizza joint in any neighborhood.

Just fill out the quick form, give them a call at 212-406-7300 or shoot them an email at info@gothambrokerage.com.

[Photos courtesy of Unsplash]

What's Your Take? Leave a Comment