Rapidly Rising Home Prices Narrow Gap Between "Emerging" and "Prime" Brooklyn

The first report is out that confirms anecdotal evidence of rapid price gains in Brownstone Brooklyn and North Brooklyn in the last year. Prices of homes of all types were up 34 percent in the first quarter, compared to the same period last year, according to a report from real estate firm Ideal Properties Group….

The first report is out that confirms anecdotal evidence of rapid price gains in Brownstone Brooklyn and North Brooklyn in the last year. Prices of homes of all types were up 34 percent in the first quarter, compared to the same period last year, according to a report from real estate firm Ideal Properties Group. Prices were also up 16 percent in the first quarter compared to the previous quarter.

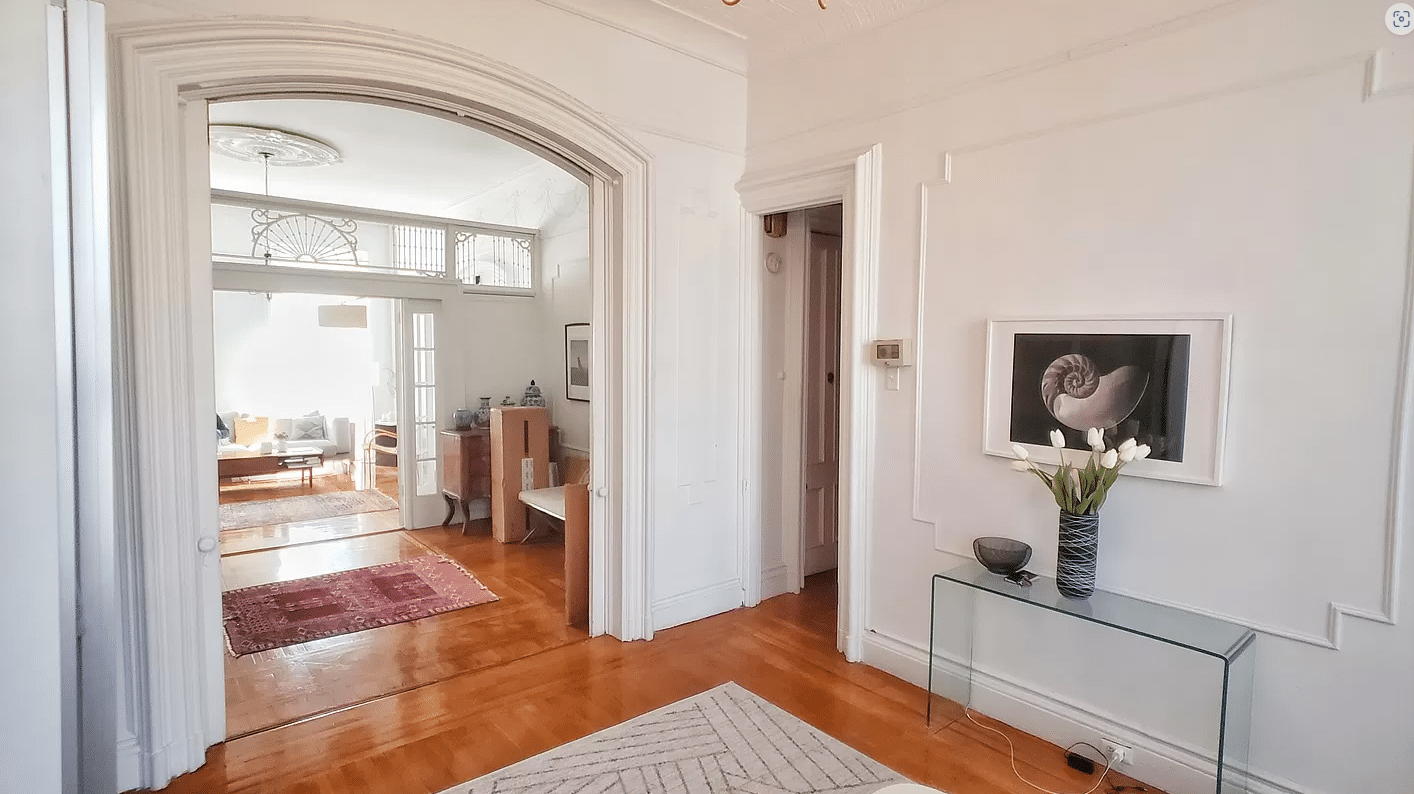

The gains have been particularly steep in so-called emerging markets, according to our own calculations. Buyers looking for bargains on townhouses in Bed Stuy, Crown Heights and Prospect Lefferts Gardens have seen price increases of anywhere from 30 to 100 percent since January, depending on location and type of house, we believe. For example, nice but not spectacular three- and four-story brownstones, renovated and with details, in east Bed Stuy that would have gone for $600,000 to $700,000 or so at the end of 2012 are now selling for $800,000 to over a million dollars.

In January of 2013, we started hearing reports from real estate agents and buyers of open houses packed with 300 or 400 people and lines to get in from Carroll Gardens to Bed Stuy. There have been a handful of cases of flippers turning around properties with little to no work and asking as much as double in a short time, common in markets where prices are rising rapidly.

On April 1, 2013, the headline on our April Fool’s Day story was “Brownstone in Park Slope Sells for Half Off,” which would be unthinkable now. The price difference between “prime” and “emerging” neighborhoods for townhouses is narrowing, as top-of-the-line brownstones in Crown Heights and Bed Stuy are pushing the $2,000,0000 mark — and sellers are now starting to ask close to that for estate-condition townhouses. Top-of-the-line properties in Park Slope are currently selling for $3,000,000 to $4,000,000.

The average price for townhouses in Brownstone Brooklyn and North Brooklyn was $2,205,000 in the first quarter, according to the report. The areas included were Williamsburg, the Navy Yard, Greenpoint, Boerum Hill, Brooklyn Heights, Carroll Gardens, Clinton Hill, Cobble Hill, Park Slope, Prospect Heights, Windsor Terrace, the Columbia Waterfront District, Dumbo, Fort Greene, Gowanus, Red Hook, Vinegar Hill, and parts of Downtown.

Ideal Properties Group expects demand and prices to stay strong in the next year. “The start of 2014 continued to show strong demand for Brownstone Brooklyn and North Brooklyn properties,” said Ideal Properties Group Managing Director Aleksandra Scepanovic. “With a tightening market and rising prices, we expect this trend to herald a busy and productive year. Increasingly sought after by affluent buyers, townhouses are expected to continue to set new records in this market.”

Do you believe the rapid price gains in Brooklyn reflect U.S.-wide trends, or is Brooklyn seeing unprecedented demand and/or low inventory? If investors paying all cash for rental properties pull back here as they are starting to do elsewhere, do you believe prices will decline in Brooklyn or is demand simply too strong?

“nice but not spectacular three- and four-story brownstones, renovated and with details, in east Bed Stuy that would have gone for $600,000 to $700,000 or so at the end of 2011 are now selling for $800,000 to over a million dollars”

Erm, that god-forsaken period piece needing $1M of reno on Decatur St was at $1.7M all cash. Show me the renovated brownstone for 800k.

what are these lines for open houses like? think i could make some money selling treats to people waiting in line?

The Cypress Hills section of East New York will be next, those families should look there or possibly western Woodhaven/Ozone Park Queens for Brick Row Houses with rental units. Bed-Stuy and Bushwicks exaggerated bad reputations kept people away before, not anymore. ENY, especially Cypress Hills is dealing with that now but if history is an indicator we’ll see the “Columbus” effect kicking in soon. We’ve been receiving a lot of the refugees* previously from the trendy neighborhoods to the west, so cheap rentals have become a thing of the past.

My family owns a brick barrel front row house in Cityline on a very quiet block full of families, we’ve been seeing prices and rents shooting up and have had solicitors knocking on doors offering to buy homes cash. It’s becoming more difficult for average people to afford the down payment on a $500K+ even in the ghetto.

Agree about Ocean Hill. I know several people that recently bought in Ocean Hill and whole buildings in east Williamsburg and Bushwick – basically places that wouldn’t have even been considered by the same people in the not so distant past. I think that Ridgewood is also getting hot. Went to a party at a great single family there. Totally renovated, etc… For schools, people just figure it out and will travel kids to different neighborhoods in Brooklyn and Manhattan. I can probably come up with 50 families that I know that do this without even trying very hard. I don’t think that young middle-class families are powerless though, as I know many that just moved to a location that they could afford. Know 2 families that bought in East New York even.

Market turbulence for the savvy generates massive wealth, just ask the likes of Warren Buffett. Thus their wealth grows around a deep recession unlike the masses.

I agree that this is odd. The report is silent as to Bed-Stuy and Crown Heights and no analysis is provided. I assume that there is an extrapolation from this report from what they determine to be Brownstone Brooklyn and Bed-Stuy and Crown Heights.