Dixon Selling, Renting in "Prime" Brooklyn

Dixon is selling one of its Brooklyn homes and has started leasing another batch of rentals, including properties in prime areas of Brooklyn such as Park Slope. The sale is unexpected, its first in Brooklyn although not the greater New York area. Dixon’s strategy has always been to buy and rent out its properties, not…

Dixon is selling one of its Brooklyn homes and has started leasing another batch of rentals, including properties in prime areas of Brooklyn such as Park Slope.

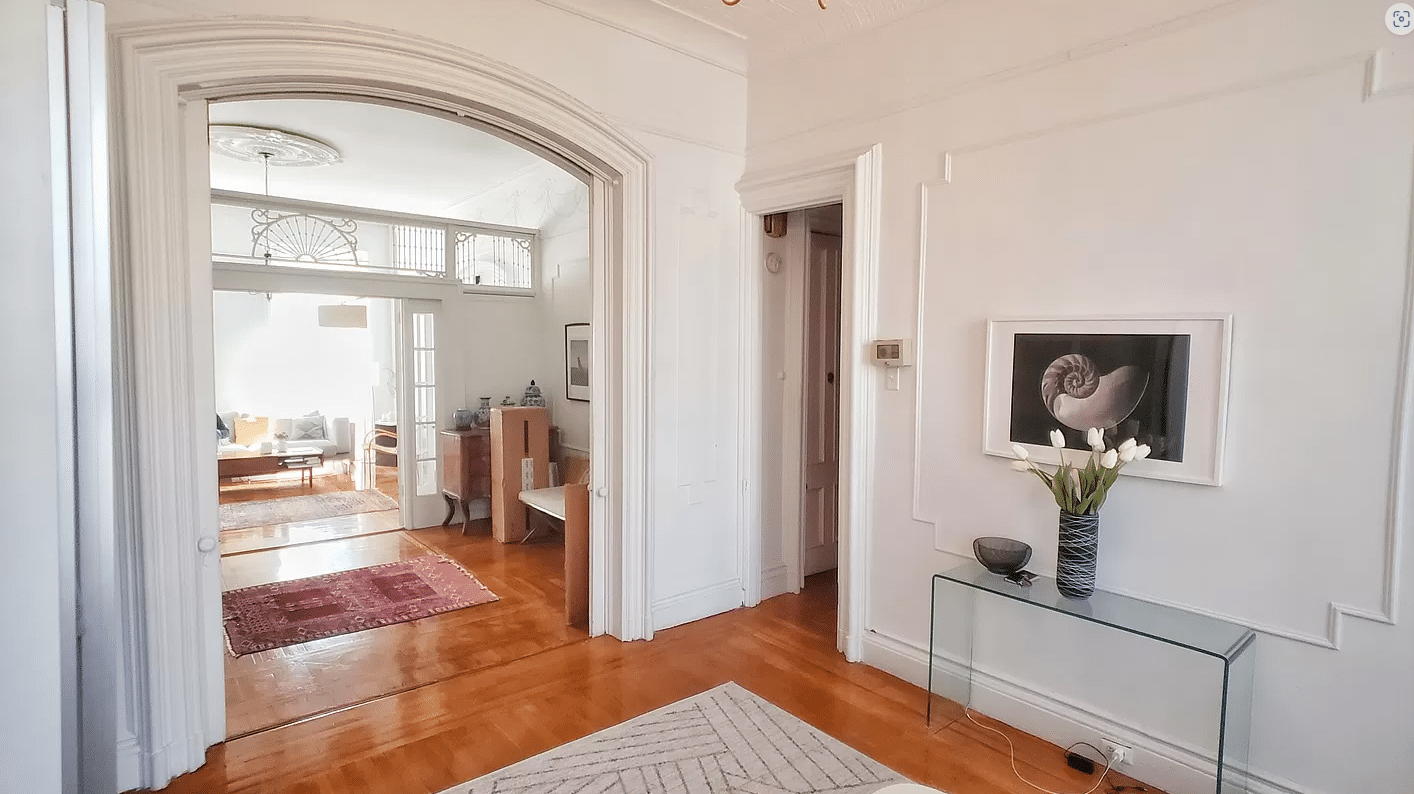

The sale is unexpected, its first in Brooklyn although not the greater New York area. Dixon’s strategy has always been to buy and rent out its properties, not flip them, holding them for at least five years, because of a U.S.-Australia trade agreement. Dixon purchased 777 Rugby Road, a standalone Victorian in Ditmas Park that had been on and off the market for years, pictured above, from its longtime owner for $1,055,000 in May of 2013.

The firm spent $120,000 on a “light renovation,” Managing Director and Chief Executive Officer for Dixon Advisory USA Alan Dixon told us. Dixon is selling the property because it has been unsuccessful at accumulating a large portfolio in the neighborhood.

“We really love Ditmas Park and were hoping to pick up a good selection of houses, at least 20 plus in the area. Unfortunately, we were outbid on a large number of houses and were unsuccessful in getting any other houses in this location. As such, it is not efficient for our fund to keep just the one house in the area and we are best to look to sell it to the open market. We no longer think it is possible to get an economic size parcel of properties in the location so we want to sell this one.”

As it happens, Halstead agent Ban Leow, who specializes in brownstones in Bed Stuy and recently sold 22 Arlington to Dixon for the record breaking price of $2,250,000, is the selling agent on the property. It is asking $1,350,000. If it sells at ask, Dixon stands to make about $267,000 $167,000 $94,000 on the deal.

Meanwhile, Dixon has already put 22 Arlington on the market as a rental, along with several other properties it has renovated in Park Slope, Bushwick and Crown Heights, all of which include landscaped outdoor space. About 16 more rentals are coming later this summer and in the fall, including three others in Park Slope. All the Park Slope properties are clustered near each other and will share parking in a renovated and historic four-car garage behind one of the homes.

The single family townhouse at 22 Arlington Place in Bed Stuy is available for $11,995 a month with one month free and no broker fee, which works out to $10,995 a month for the first year. As with all Dixon rentals, Town is the agent and Dixon will pay an unheard-of 12 percent to renters’ brokers. Rents can be paid by credit card.

The house at 302 Weirfield Street has already been rented. It was asking $4,995 a month.

Dixon gut renovated 568 Park Place in Crown Heights. The Italianate had some detail left, such as wood moldings under windows, but Dixon decided it wasn’t worth saving and turned it into a completely modern home with a working gas fireplace and wall of windows in the rear of the parlor floor with a huge folding door that opens up to the outside. The ask is $11,995 a month, although with one month free rent it works out to be $10,995 a month the first year.

Over at 37 Prospect Place in Park Slope, Dixon made some slight alterations to the house but preserved and restored the detail that was still there, including an unusually ornate tin ceiling in what is now the parlor-level kitchen that looks as if it could date from the 1870s or so. The firm also added radiant heat to the bathroom floors and other upgrades. The asking rent at 37 Prospect Place is $11,495 for the triplex, although the garden floor rental can also be included for an as yet undetermined price.

So far, Dixon has rented out about 25 properties, Town agent Josh Carney told us. The firm recently updated its count of the number of properties it owns in Brooklyn: It is 87, not 73. The firm can sell a small number of properties every year but not its entire portfolio. “We are super bullish on Brooklyn and plan to hold the overall portfolio for the long term,” said Dixon.

37 Prospect Place, Park Slope:

22 Arlington Place, Bed Stuy:

568 Park Place, Crown Heights:

First photo by Kate Leonova for PropertyShark; ceiling at 37 Prospect Place by Cate Corcoran; other photos by Dixon

I liked these observations:

This stuff needs to be covered as discussion of self-renovating townhouses (this probably isn’t happening as much as it was).

Very good point: “The prized Dixon properties ripped off the longstanding owner’s these aren’t things to celebrate at all”.

My thoughts: But here is what I want to know, what prevents owners from doing these renovations themselves? If the company did a light renovation at $120,000, did the owners not imagine that possibility? Cash poor but house rich? Not willing to take out a mortgage, ie., subprime mortgage problems or fears? Or is the presumption that the long time owners did not benefit? From what I’m reading, it seems that some of the owners sold to Dixon in return for million dollar sales. Could they have gotten more? Might they have gotten more if they did these renovations? These might be older owners who didn’t have the energy for it, especially if their children don’t live nearby and they wanted to make a quick profit instead. That kind of money can do a lot more in a less expensive part of the country, and in the world, even!

It was unrealistic of Dixon to think that they could accumulate 20 houses in Ditmas Park due to the neighborhood’s low inventory of houses for sale. They may have had all cash offers but they were consistently outbid by people looking for homes that they intended to occupy long term. These buyers were willing to pay a little more because they saw more than investment potential in their purchase.

So how much of Ban’s ascent is due to his relationship with Dixon?

Either way, good for him! He’s been great for Bed Stuy owners, at least.

Well said! 🙂

Peterinbrooklyn,

I hate to be the one to break it to you, but you hit the nail on the head. It’s one of those things that you either accept it for what this site has sadly become or you move on. I’ve noticed this over the last year has gotten much worse, this site has become a shell of its former self. They have sadly lost their charm and have joined the sheep just yelling the same stories, which in this case appear not even to be flushed out or properly fact checked. On that note I’m with great disappointment leaving the nonsense behind. Who wants to read the same exact story from curbed or whatever other blog here, its like buying a knock off Louis. – big waste of time an energy. The energy of this site is no longer positive in my eyes, but harmful. One I choose no longer to be a part of. The prized Dixon properties ripped off the longstanding owner’s these aren’t things to celebrate at all. The sales have been doubled flips as has been glazed over in many post. Dixon deserves no further energy or attention. Done!

Wouldn’t you use a 1031 to avoid taxes?

http://www.irs.gov/uac/Like-Kind-Exchanges-Under-IRC-Code-Section-1031

For those unfamiliar with this, it’s not a good idea for primary residence; if you have an investment property using like-kind exchange is preferred tax deferment method.