Landmarked Apartment Building for Sale for $3.2 Million in Bed Stuy

A striking 1902 Renaissance Revival apartment building at 75 Macdonough Street is for sale for $3,200,000. The four-story, eight-unit building, which is called The Raleigh, was designed by architect William Debus. A good amount of the interior detail seems to be intact. The apartments are four- and five-bedrooms, Marcus & Millichap, which is handling the sale, told us….

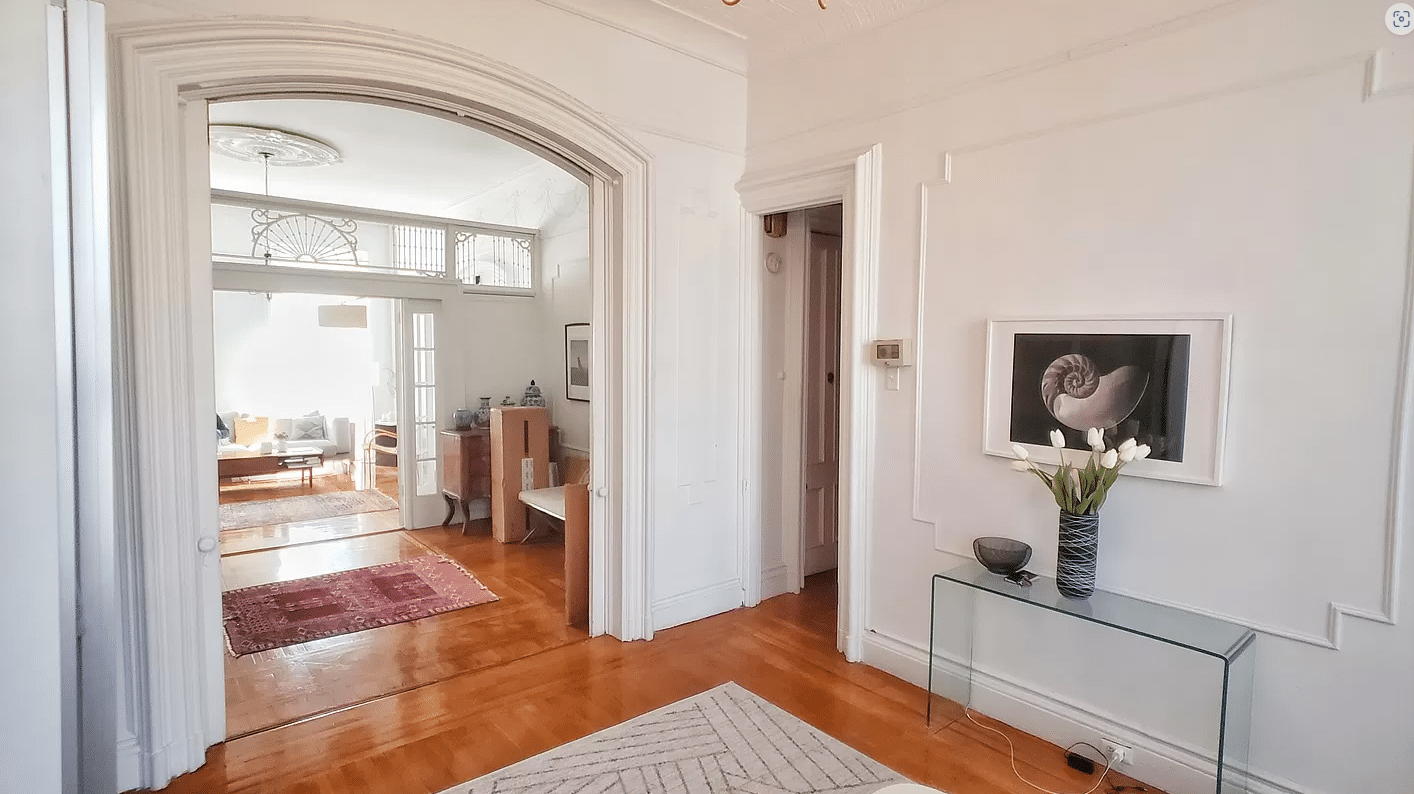

A striking 1902 Renaissance Revival apartment building at 75 Macdonough Street is for sale for $3,200,000. The four-story, eight-unit building, which is called The Raleigh, was designed by architect William Debus. A good amount of the interior detail seems to be intact. The apartments are four- and five-bedrooms, Marcus & Millichap, which is handling the sale, told us. It was a Building of the Day in 2010. Click through to see some interior shots.

75 Macdonough Street Listing [Marcus & Millichap]

Building of the Day: 75 Macdonough Street [Brownstoner]

Photos by Marcus & Millichap

just walked by building, the listing picture is out of date, one of the balconies is missing, and they must have run it through a filter because the facade and windows look a lot worse for wear than represented….

Seems a bit rich, Building has a ton of open violations and is more than half stableized. If you walk by it, which I do every day, it is poor condition, trashed windows and cornice, big signs of water damage so I can only imagine what the inside looks like. Beautiful building though with great potential managed by the right hands. Here is hoping someone gives it a good polish!

Combine the vacant apartments for one 6000 sq ft super apartment. The rent stabilized income from the rest will pay for the heat.

Well maybe a French Polish……