Million-Dollar Townhouse Sale Likely a Record for Bed Stuy East

A house at 585 MacDonough Street between Ralph and Howard appears to have set a record for two-family brownstone in Bed Stuy east of Malcolm X when it closed for $999,999 in June, according to PropertyShark. The house, profiled on here previously, has gorgeous wood work and Aesthetic Movement style fireplaces and tile. It looked like…

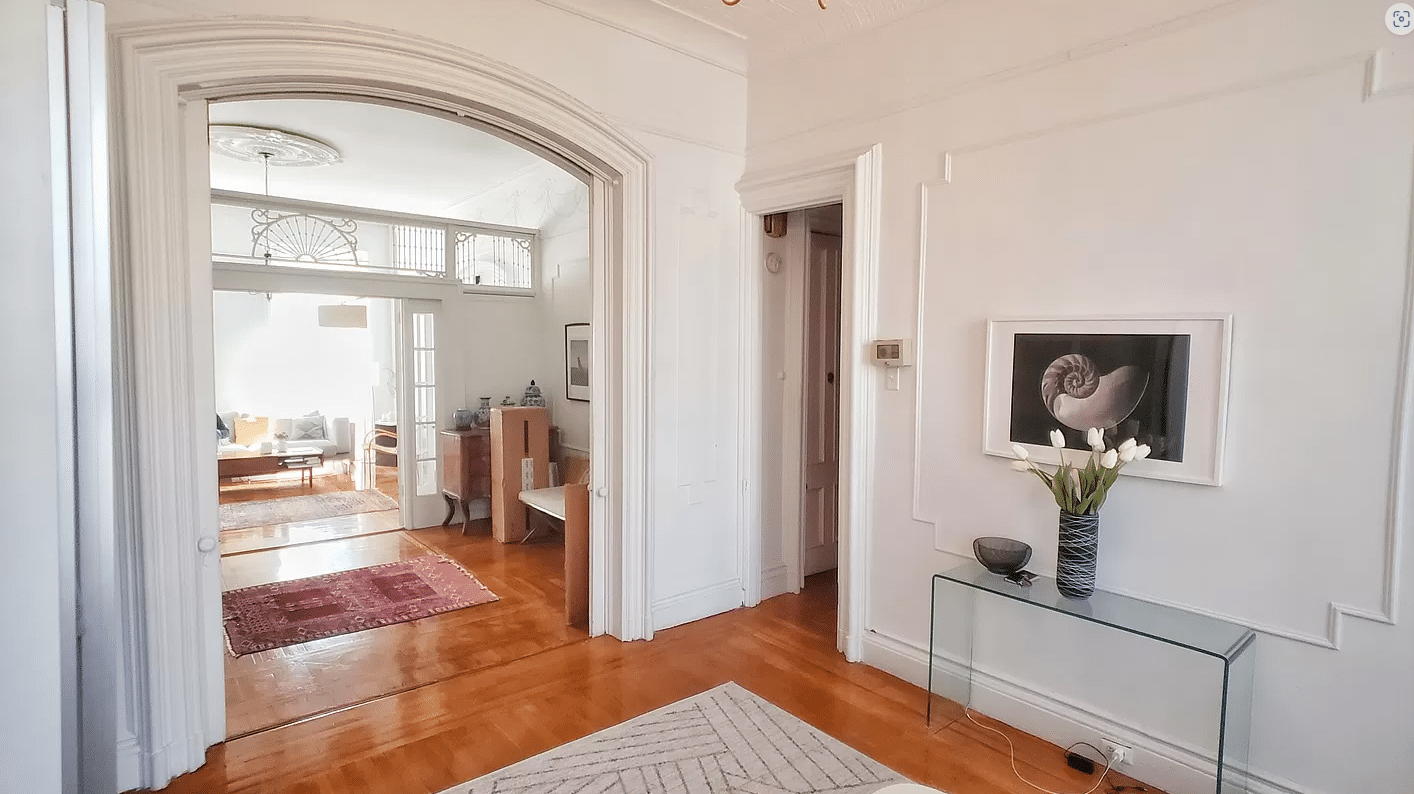

A house at 585 MacDonough Street between Ralph and Howard appears to have set a record for two-family brownstone in Bed Stuy east of Malcolm X when it closed for $999,999 in June, according to PropertyShark. The house, profiled on here previously, has gorgeous wood work and Aesthetic Movement style fireplaces and tile. It looked like it needed a little plaster and skim coating here and there. (The photos can still be seen on Streeteasy.) The final price was $100,000 above the $899,000 ask. This area is part of the proposed Bed Stuy East Historic District. This block can also put on a rocking block party, as we discovered this past weekend. A little farther east in Bushwick, a similarly ornate townhouse on Bushwick Avenue likely set a record when it closed for $1,225,000 last month.

So… schools? Infrastructure? Shopping? Crime? Blight?

There’s a point where numbers don’t make sense, and a million dollars in eastern bed stuy may be that point. I’ve been thinking about this a lot–thinking about the artificially low inventory, the landrush mentality of buyers and brokers, the preponderance of investor purchasing, warehousing…. none of that builds a stable community. Long term, I think this area’s a great place to live, but this feels like 2007 again.

same people who’ve been on the sidelines for years complaining when other neighborhoods were hot.

Yeah, that’s me. Heather from Park Slope. Heather, the Park Slope mom! You know, in between my yoga classes and my co-op shifts, I post on Brownstoner. And what’s the time? I think I was supposed to pick up Viola and Cash at Cique D’Ete today, or possibly it is the nanny’s job and they’re already asleep? She’s great by the way, from one of the islands, I forget which one. We love her so much we got her cable, although we don’t have it ourselves.

My point is, a million dollars for an “emerging” neighborhood is absurd and unsustainable. Either the neighborhood will turn into Park Slope, which, all jokes aside, I’ve never wanted to live in–or those prices will tank and there will be a glut of bad flip jobs standing empty, much as there once were a glut of abandoned crack houses standing empty. Am I bitter? Maybe a little–but I rejected that neighborhood at a third of its current price for good reasons–reasons that still exist. When you’re sending your kids to the zoned public in Stuy East, then get back to me. Tell me how it’s going, I will be genuinely curious.

Some of us don’t want a return on investment–we want a community.

yeah, who the hell wants to live in bay ridge? lulllz

Nothing about what you say is wrong, but what you say is also very telling. You couldn’t have afforded your house if you’d waited one month? You couldn’t afford it now? Do you think that’s the sign of a healthy market, that houses in a quite recently redlined part of town have literally doubled in price in less than a year?

The difference between what you spent and what your new neighbors will spend is considerable. Is it sustainable? And, if the bubble crashes, and large portions of your neighborhood are owned by investors, what will happen then? Like I said, I have nothing against your part of town. I think houses there are probably a good investment. If they’re about 500-600K. More than that? Why would I want to bother? I could buy in Forest Hills, Inwood, Midwood, Ditmas, Bay Ridge–a hundred other neighborhoods with more amenities, less crime and better schools.

I’d have to agree. There is a risk reward trade-off and you can’t pay for the promise of something better being actualized. There are still risks in the neighborhood, and if you are willing to take them on to get the reward (read: promise) of a better neighborhood in the future, I get that. But these homes seems to be priced as if those were realities today. I get the logic that it is getting better, but the people buying are still the ones taking on the risk that it may or may not happen (and in the time frame in which most are expecting). I’m a bit biased of course because I am seeking a home in the area and willing to stick it out through the long-term – just am a little concerned paying for what isn’t there just yet. Essentially expectations should be discounted somewhat since it continues to be a risk.