Brooklyn's Long Foreclosure Process: Help or Hindrance?

Via Bloomberg News: New York’s Kings County, also known as Brooklyn, wears the crown as the U.S. community where it takes longest to foreclose on a delinquent homeowner. Lenders took an average of 1,187 days — more than three years — to repossess a home in Kings County during the last three months of 2011,…

Via Bloomberg News:

New York’s Kings County, also known as Brooklyn, wears the crown as the U.S. community where it takes longest to foreclose on a delinquent homeowner. Lenders took an average of 1,187 days — more than three years — to repossess a home in Kings County during the last three months of 2011, according to data compiled by Bloomberg. The protracted process led to just 32 fourth-quarter foreclosure completions in a borough where more than 27,000 homes got delinquency notices last year, New York Department of Financial Services data show. The 10 U.S. counties with the longest foreclosure timelines were all in New York and New Jersey. While delays give some struggling homeowners time to renegotiate loan terms and limit supply on the market, they eventually depress housing values by postponing the inevitable for borrowers who can’t pay their mortgages or maintain their properties, said Jonathan Miller, president of New York appraiser Miller Samuel Inc. “You aren’t doing anybody any favors in the long run,” he said in a telephone interview. “In markets where it takes longer for the foreclosure process, it takes longer to recover.”

As we have been tracking regularly, New York City has seemed relatively immune to the foreclosure morass that has plagued the rest of the country. This article begs many questions. First: Will we not actually have a clear view of “the market” until foreclosures jump through all the necessary hoops? Second: To what extent does the protracted foreclosure process in Brooklyn actually lead to homeowners keeping their homes? Third: Does New York’s foreclosure system need to be reformed? We don’t know the answers to any of these questions. And this doesn’t even touch commercial properties, as far as we know.

Brooklyn Shelters Homeowners With Longest Foreclosures [Bloomberg]

PropertyShark: Decline in Foreclosures Continues [Brownstoner]

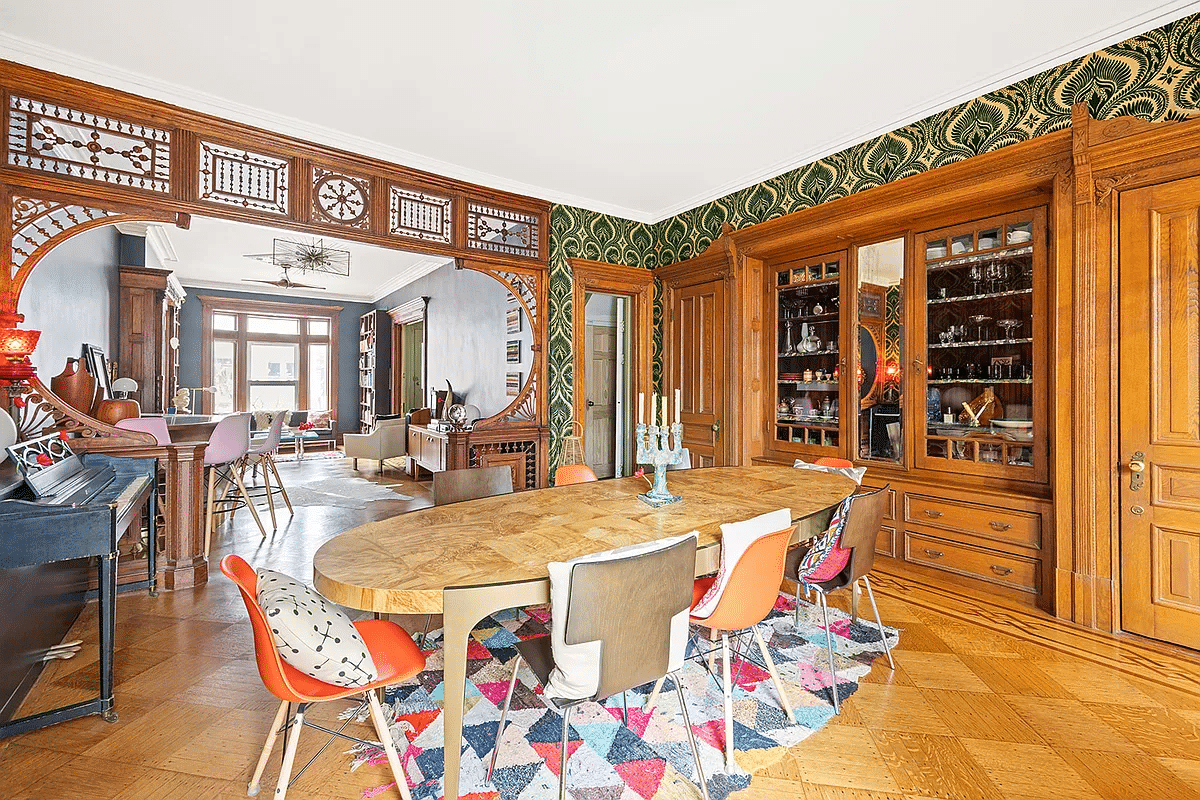

Photo by dominic bartolini

What's Your Take? Leave a Comment