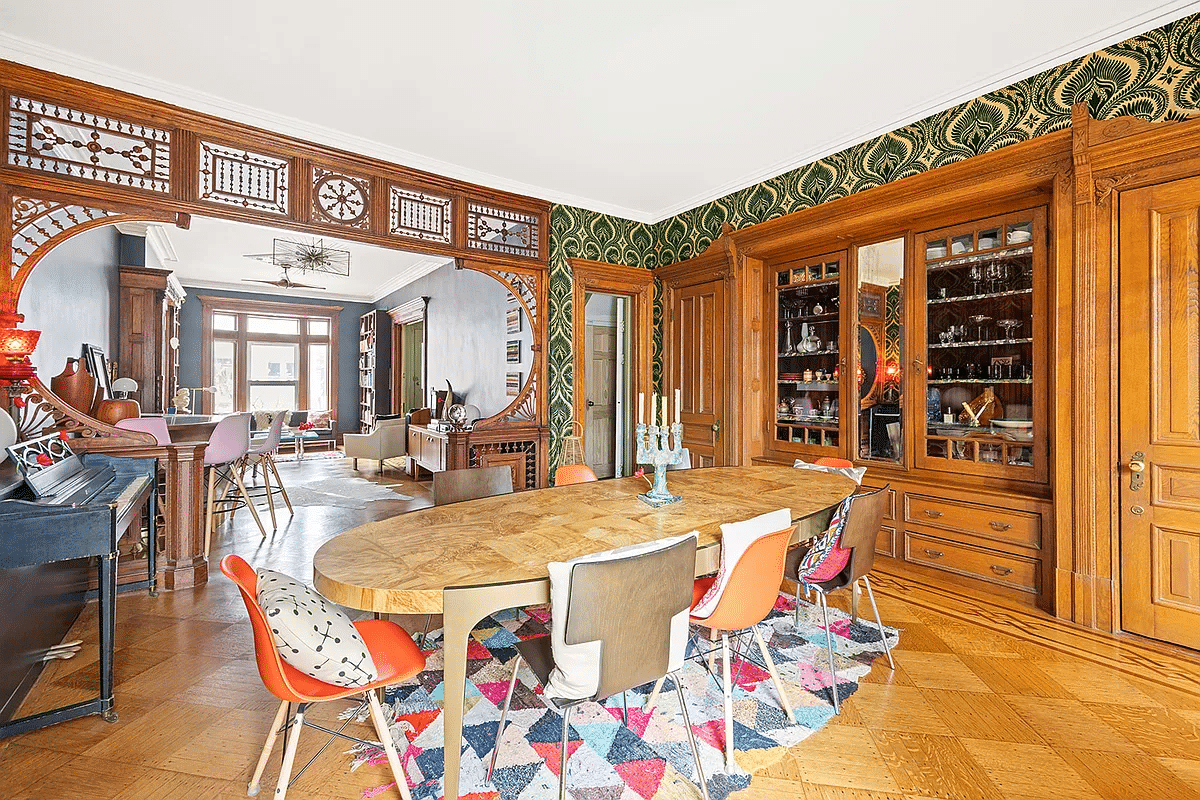

House of the Day: 485 4th Street

This unusual-looking house at 485 4th Street in Park Slope hit the market in the last week of the year with an asking price of $2,495,000. The location and exterior are great and there are some preserved details on the interior, but the house has certainly suffered from being cut up into three apartments. Given…

This unusual-looking house at 485 4th Street in Park Slope hit the market in the last week of the year with an asking price of $2,495,000. The location and exterior are great and there are some preserved details on the interior, but the house has certainly suffered from being cut up into three apartments. Given the fact that this will require some dough to turn back into a one- or two-family, the price seems high to us. What about you?

485 4th Street [Corcoran] GMAP P*Shark

friends and family and modest browsing.

case-shiller geography is too big; same issue in nyc.

check zillow in and around 94306. nice modest houses in 1-2 mio range. no collapse folks. (yet!)

“house prices in silicon valley have dropped less than nyc”

C’mon BHO, in the new paradigm anecdote is the new fact.

That would be about the best argument I’ve heard from Team Bull, ecoux. Oh wait! Second to Last Week’s Biggest Sales.

***Bid half off peak comps***

“house prices in silicon valley have dropped less than nyc”

Source please. SF Metro Case-Shiller (includes Silicon Valley) touched -46% from ’06 peak.

http://tinyurl.com/yejw5or

“bear hari-kari”

Ha! Nice. Even if the spigot gets jacked back up and debt gets inflated away, prices will still be half off in gold or 2009 dollars. But I don’t think that’s going to happen because there’s not enough real GDP to service it. This is a deflationary crash. I am hedged with gold though.

***Bid half off peak comps***

That should have been 8 not *. Been banging my head against the wall and I’m seeing ***.

Argument sold! Total US Debt is now deflating, bkhabitat. Government, Business, Consumer – it’s all deteriorating.

Large chunks of flesh from your torso also continue to remain available (anological to Jumbo Loans) during the early stages of a devestating gangrene attack.

I expect NY Case-Shiller YOY to turn postive far sooner than 10 years. Why those numbers? What previous housing market took that long to bottom?

***Bid half off peak comps***

The bulls may be right in the end and the last 10 years have signaled a new paradigm in NYC real estate values. * million people in search of a jumbo loan. At last, New York, the greatest gated community in the world!

put this in your bubbly tech pipe while you rush to judgement…

house prices in silicon valley have dropped less than nyc.

bkh makes a very important point about leverage. jumbo loans are still available but are difficult to get these days (and acting as a constraint) but does anyone believe that that spigot is off for good? i tried pointing this out months ago to one of bho’s favored sons, moneyfornothing, but he was having none of it. otoh, he committed bear hari-kari and actually went long on real estate. oh the shame.

I’m sorry ‘dope I lost you. Are you saying means are meaningless? Or just meaningless this time?