Co-op of the Day: 75 Henry Street

The listing for this 1,500-square-foot three-bedroom at 75 Henry Street makes a big deal about architectural lineage of its renovation but we gotta say it’s not doing a whole lot for. Nor is the asking price of $1,600,000 which seems very pricey for this building. Most folks who can drop this kinda dough on an…

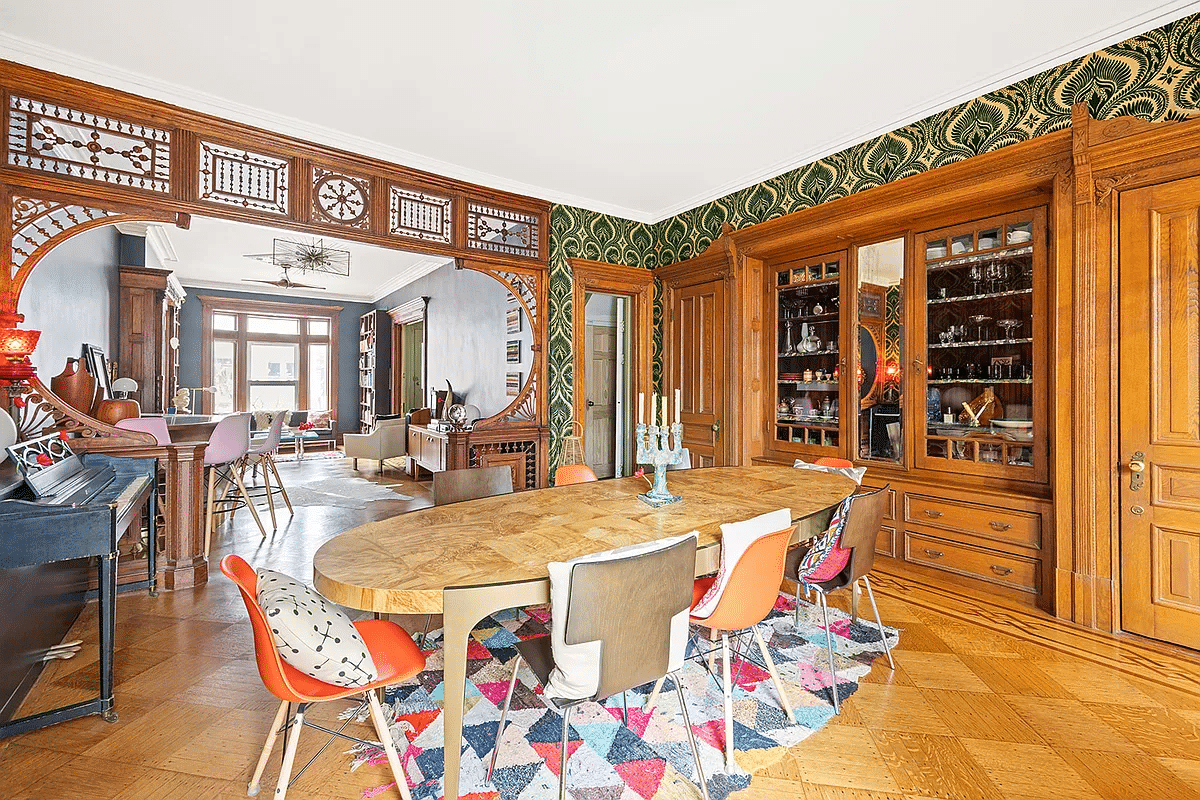

The listing for this 1,500-square-foot three-bedroom at 75 Henry Street makes a big deal about architectural lineage of its renovation but we gotta say it’s not doing a whole lot for. Nor is the asking price of $1,600,000 which seems very pricey for this building. Most folks who can drop this kinda dough on an apartment in The Heights are going to want something prewar. Granted, we’re sure the views are nice and there’s some cheap parking available, but we’ll be very surprised if this fetches anywhere near the asking price.

75 Henry Street [Douglas Elliman] GMAP P*Shark

Homowners take more risk and put out more capital than renters Financeguy? Please see current bailout situation and what this country has become thanks to your risk taking homeowners.

Finance Guy — thank you for taking the time to explain all of this.

Who still uses a blow dryer? I retired mine in the 80s.

think that’s code for the other blow j***

“So . . . no one thinks “gives great blow drys” is a joke?”

Apparently many posters think the asking price is a joke.

fsrq, you hit right on the nail. to buy now, this baby is $1M or more. Anyone who wants to buy it cheaper than that or to find what is the bottom, only time can tell. Conceptually, there’s no real reason why prices cant drop 50% in a 24month period. Fundamentals (income, savings, consumer confidence, job security,…) are much much worst now than when prices spiked during this bull run so a 50% drop is possible conceptually (albeit even my bearish selfish is not that confident that could happen). Do agree a 50% drop comes with more troubles than most bears care to admit – ie any banks solvent then? how many of us will be unemployed? MTA solvent?…..

> “no one thinks “gives great blow drys” is a joke?”

Either that, or a glimpse into the broker’s future.

So . . . no one thinks “gives great blow drys” is a joke?

fsrq – I agree with you that it will take alot of cash to buy this place. And the rental market is close to irrelevant (though not totally). But the fact remains that the market for $1.6 million residences arent looking at Mitchell-Lama buildings. Ive got all types of friends, and my piss-poor friends who live in s__holes and are cool with that, would kill for this building. But my rich friends who can pay $1.6M on the other hand wouldnt consider it.