Rent-to-Own on the Rise

Can’t scrape together a down payment? Now your monthly rent checks can go toward one, writes our own Gabby Warshawer in The Real Deal this month. The model is called rent-to-own, and a few Williamsburg buildings, including the Decora and the Toll Bros.’ Northside Piers, are offering it, along with Fort Greene’s Forté. Gotta make…

Can’t scrape together a down payment? Now your monthly rent checks can go toward one, writes our own Gabby Warshawer in The Real Deal this month. The model is called rent-to-own, and a few Williamsburg buildings, including the Decora and the Toll Bros.’ Northside Piers, are offering it, along with Fort Greene’s Forté. Gotta make up your mind fast if you want to stay, though. “The fine print on an advertisement for a rent-to-own unit at Northside Piers noted that 100 percent of the rent will go to closing costs if the tenant commits to buying the unit within six months, while 50 percent of the rent will go to toward closing costs if he or she decides to buy six to nine months after a lease is signed.”

Buying a Condo, One Piece at a Time [The Real Deal]

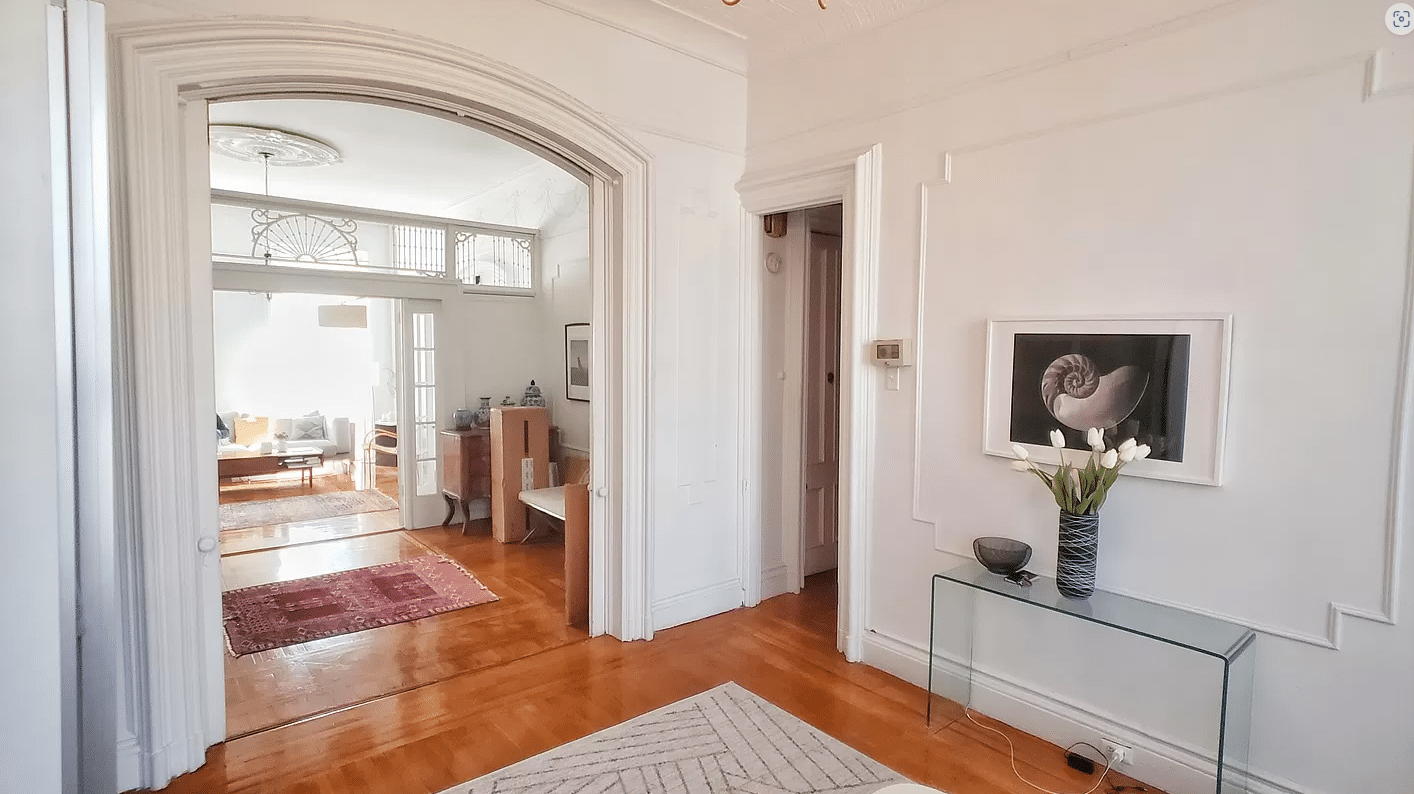

Photo by TheTruthAbout.

Where can I find apartments with the option to purchase wile renting???????

People are talking but no realtors are getting back to me??

Thanks!

Thanks NSR. All good points.

“Am I missing something with the math? I’m not being facetious, I really want to understand the benefit.”

Possible benefits are:

1. You really really love the place but don’t have the money to buy right now but will in 6 months, so you get the place off the market and get to live there while you wait to get your finances in order.

2. The terms of the deal could be financially beneficial (e.g., the cost of renting somewhere else for 6 months and then buying the place might be more expensive than the lease-to-own deal). This has to be assessed case-by-case, of course.

3. If you think prices are going to go up in the next 6 months but don’t want to commit to a purchase now, you could lock the place in at today’s price and not have to worry about getting priced out (less of a worry now than it was the last few years, I think).

4. Like I mentioned in the other post, there is a chance to live there for a few months and getting to know the place before committing to a full purchase but still maintaining the option to purchase if you like it.

The deal can also be bad for the purchaser and, as you say, they could end up spending more money than if they’d just waited to save up and bought it outright, but there is no reason why it *has* to be bad.

The fact that you see more of these deals now, in what is increasingly a buyer’s market, should tell you that sellers would rather not sell this way.

nsr, i bet that’s particularly useful with these new condos, given that it seems the standards of construction are so variable. and “fringe” neighborhoods, too, or even a neighborhood like williamsburg, which isn’t fringe but could easily turn out to be a poor fit.

I’m not a “finance person” but my gut reaction is that this is the equivalent of buying a flat screen TV from Rent-A-Center. That in the end you overpaid for something you could have just saved up for.

Am I missing something with the math? I’m not being facetious, I really want to understand the benefit.

I doubt ‘rent to buy’ is a great option in the current market (because I believe purchase prices are going down so much that you wouldn’t want to exercise your option when the time came), but one nice thing about it is if you don’t know the building/neighborhood real well it gives you a lower risk chance to really know the place before committing to a full purchase.

Probably the single biggest mistake one could make is purchasing property and later realizing that the building or neighborhood is not really a place you are happy living in.

“along with Fort Greene’s Forté”

I knew the lack of lights turned on at night spelled trouble. Rents are about to take a nosedive.

Asking sale prices mean nothing right now. The lowball rules the day. Rents will suffer a similar fate.

Whether the option is cheap depends on the transaction costs of buying the option, e.g. moving, and the probability that it will expire in the money, i.e. that you can afford to and want to close.

This seems to explain rent-to-own pretty clearly (I didn’t quite understand the concept)

http://money.howstuffworks.com/personal-finance/real-estate/rent-to-own-homes.htm