Price Cuts at Bed Stuy Townhouses: Is This a Trend?

Browsing Natefind, we noticed that three Bed Stuy townhouses had their asking prices cut last week. (Actually four, if you count the $1,000 trim that this place got to give it the psychologically more appealing price of $699,000.) Some readers may remember we spotted a similar spate of reductions back in June, when Corcoran cut…

Browsing Natefind, we noticed that three Bed Stuy townhouses had their asking prices cut last week. (Actually four, if you count the $1,000 trim that this place got to give it the psychologically more appealing price of $699,000.) Some readers may remember we spotted a similar spate of reductions back in June, when Corcoran cut three houses in Bed Stuy and three houses in Crown Heights in one week. Despite eliciting the strange accusations that we had it in for Bed Stuy, the post touched on the kinda obvious idea that when the market gets nervous, it’s the more fringe areas that feel it first. Another explanation was that you had these big firms who didn’t really understand the area marching in there slapping unrealistically high initial asking prices on the houses. In this current batch, two houses are Douglas Elliman listings and one is Corcoran. So, anyway, are these cuts significant or are we reading more into this than there is?

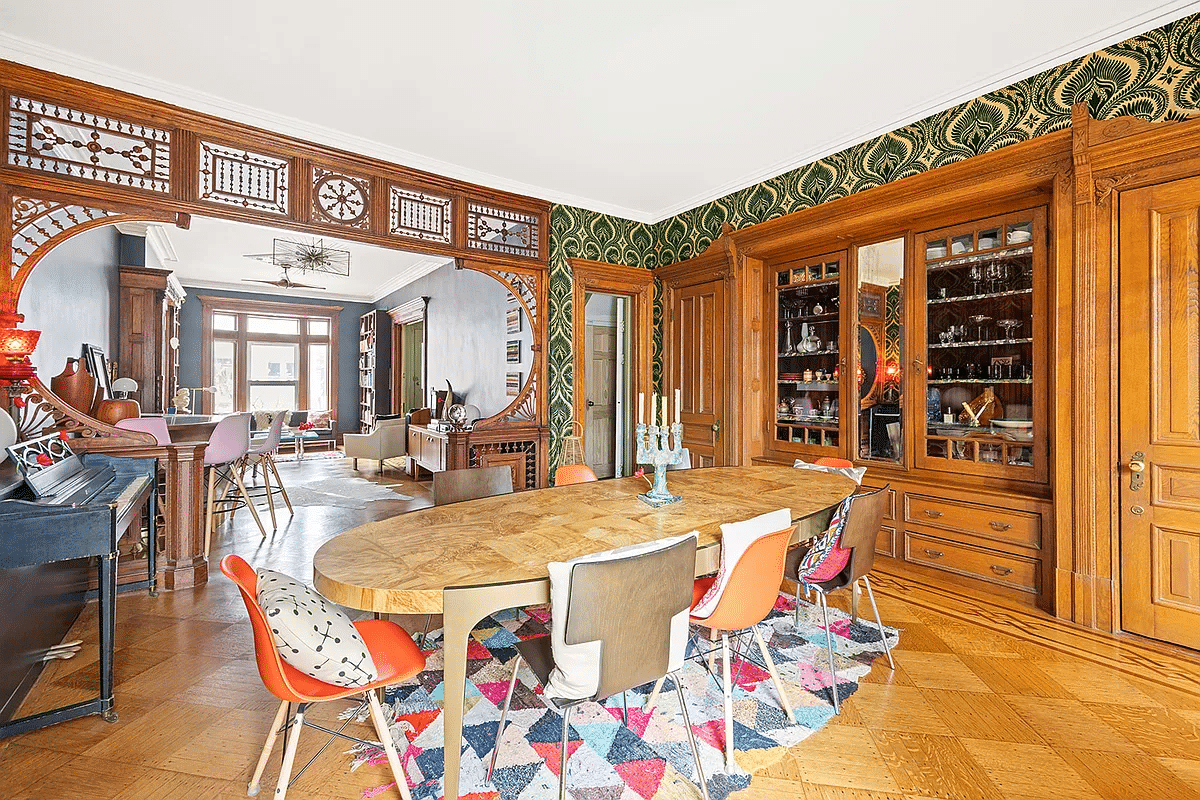

576A Monroe Street [Douglas Elliman] GMAP P*Shark Natefind

456 Bainbridge Street [Douglas Elliman] GMAP P*Shark Natefind

585 Macon Street [Corcoran] GMAP P*Shark

Corco Cutting Prices East of Classon [Brownstoner]

attention freaks:

It is always darkest before the dawn.

You just don’t know when you should open your eyes, after finally getting some sleep.

B.M.N.T.

The Appraiser.

12:34, you’re the one who sounds hysterical.

“I think the only people buying right now are sellers who are transferring the money from their old place into a new place. That’s a sign of a very unhealthy market, it needs some new blood but who can afford these prices?”

Yup. Classic pyramid/ponzi scheme. Mathematically destined for failure. No more “new blood” to support the pyramid. ‘Crash’…’Boom’!!!

I say AY problems internationally.

The entire east coast, from northern Maine down to the southern tip of Florida, will be worthless once AY is built.

US July pending home sales index falls 12.2 pct to lowest in six years .

I can remember sitting in a friend’s apartment in the East Village in the late 1980s after the market crash. My friend had bought a place between Avenues C&D when it seemed like NY real estate would never stop going up. Speculators were actually buying apartments sight unseen in those days. Market crashed, he needed to move, but he was stuck with a mortgage higher than what he could sell it for.

NY is the greatest city in the world and it’s worth a premium to live here, but speculation, greed, and insane Wall Street bonuses have been driving this market the last few years. If those bonuses dry up which they probably will with the credit crunch, next year will be a terrible time to be selling but a great time to be buying. The market may even go down for years which it did between 88 and about 94 or in the 60s and 70s. I think the only people buying right now are sellers who are transferring the money from their old place into a new place. That’s a sign of a very unhealthy market, it needs some new blood but who can afford these prices?

Quality houses will sell and ARE selling, as a previous poster noted, at above asking price. I have gone to two open houses on my block in the past two months and both houses, which were in good condition and appropriately priced by their brokers, sold for above asking. Blanket statements about the state of the market are misleading, the value of homes in this area and in this market are case-by-case.

I, for one, was hoping to buy a place (my first) this year and have decided to hold off for at least another year. It seems like a pretty volatile time to buy a home considering the conditions right now (maybe things won’t take a dive here in NY, but it seems to be getting more likely that they will). I’m selfishly hoping that they will so I can actually afford a decent place to live!