Tenants Fight Eviction on Bergen Street

A Prospect Heights block party yesterday had homemade food, loud music and a louder message: Good neighbors do not evict neighbors. The Fifth Avenue Committee-organized event was aimed at drawing attention to the plight of four rent-stabilized tenants facing eviction from 533 Bergen Street, and it highlighted bubbling tensions over affordable housing, gentrification and Atlantic…

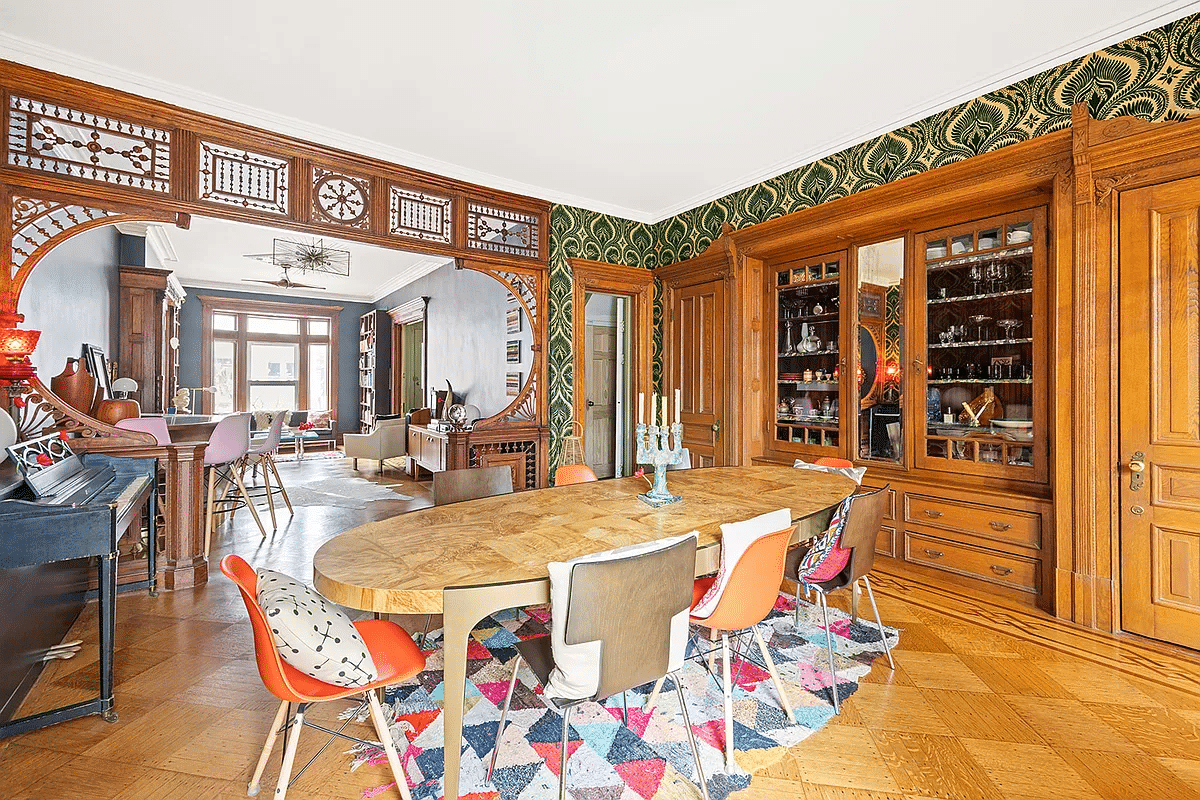

A Prospect Heights block party yesterday had homemade food, loud music and a louder message: Good neighbors do not evict neighbors. The Fifth Avenue Committee-organized event was aimed at drawing attention to the plight of four rent-stabilized tenants facing eviction from 533 Bergen Street, and it highlighted bubbling tensions over affordable housing, gentrification and Atlantic Yards. Councilmember Letitia James, State Senator Velmanette Montgomery and various activists spoke in support of the longtime tenants, who are fighting lawsuits from 533 Bergen’s new owners. The two couples that bought the building last year—Dan Bailey and Felicity Loughrey, along with Deanne Cheuk and Andre Wiesmayr—claim they want to evict the tenants because Bailey and Loughrey intend to construct a triplex for themselves out of the units. Under current laws, landlords of rent-stabilized buildings are allowed to evict tenants if they plan to live in the units themselves.

Most speakers called for reforming rent-regulation laws and maintaining affordability for low-income residents. Rents in Prospect Heights are increasingly beyond the means of most working-class families, said Councilmember James. We must preserve this community’s diversity. James and Senator Montgomery both characterized the push to evict 533 Bergen’s tenants as secondary displacement from Atlantic Yards. Brent Meltzer, a lawyer with South Brooklyn Legal Services who is representing one of the tenants, noted that if the landlords succeed with the evictions, 3,500 square feet that four families live in will be given over to just one family. The most basic articulation of the situation, however, came from Rosa Negron, one of 533 Bergen’s residents: How you going to evict people who’ve been living here all these years?

You should all check out this blog post: “Entitlement Gone Wild”:

http://afropologe.blogspot.com/2008/10/entitlement-gone-wild.html

This is retarded. The problem with long term rent control is it gets people used to living in areas they realistically cannot afford to. Another way of looking at it is rent control removes a major incentive to improve your lot in life through hard work and sacrifice: financial stress.

The guy who lived there for 17 years and didn’t bother to learn English…gee, I wonder why he’s not rolling in money right now? Must be the rich peoples’ fault. They’re so cold and heartless.

My view? Don’t punish achievers (like the buyers) and don’t coddle losers (like at least some of the tenants). Give the tenants their Section 8 housing and be done with it.

Shove your sob stories up your ass. I need a house!

Tough shit. Those renters frankly have ZERO right to live in what is now someone else’s home, and the neighbors have no right to begrudge the buyers from buying a home for themselves. This is New York. It’s not for pussies.

well said 12.37!

to 11:48

I agree wholeheartedly that we all make choices everyday. What I object to is the “Morality Police” that seems to patrol this blog. The main reason people are upset is that they think the owners have found a way to get a property at below market rates legally. Just like the main reason the tenants are upset is that they are faced with the possibility of no longer being able to lease an apartment while paying below maket rents.

How can you make a moral judgement here? Both sides are either exibiting greed (the landlords) or expressing a misgotten sense of entitlement and greed (the tenants)

If you forced the tenant to pay market rents would they stay? If you forced the owner to pay market price for the building would they have bought it? In both cases I think not.

Trust me, the real issue here is not a moral one. It is economic. It is whether the tenants can cause the owners enough pain to extract the maximum settlement. Frankly this is the American way. You use whatever leverage you have to benefit yourself the most. But please spare me the notion that either side here sits on a moral high ground.

Rent controls causes shortage:

No signal to entrepreneurs to build new homes.

No incentive to maintain existing ones.

There can be no doubt that rent control creates housing shortages. For almost 20 years, national vacancy rates have been at or above 7 percent–a figure generally considered normal. Cities such as Dallas, Houston, and Phoenix, where development is welcomed, have often had vacancy rates above 15 percent. In these areas of the country, there usually is a surplus of housing rather than a shortage.

In rent-controlled cities, on the other hand, vacancy rates have been uniformly below normal. New York City has not had a vacancy rate above 5 percent since World War II. (The state’s rent control law, supposedly temporary, would automatically expire if it did.) In rent-controlled San Francisco, the vacancy rate is generally around 2 percent, and in San Jose the rate is 1 percent, the nation’s lowest. Meanwhile, comparable nonrent-controlled cities, such as Chicago, Philadelphia, San Diego, and Seattle have normal vacancy rates at or above 7 percent.

Rent-controlled cities absorb these shortages in a variety of ways. Higher rates of homelessness are a manifestation of rent control. Another is the traditional difficulty individuals have in finding a new apartment in these cities. Crowding is a manifestation of rent control.

In large metropolises a housing shortage can severely damage the city’s economy. Experience shows that when such cities adopt rent control, they usually try to avoid outright housing shortages by leaving segments of the market unregulated. Unsatisfied demand is diverted into this unregulated sector. Because of the shadow-market effect, people in this sector pay higher-than-market prices. Still, they are rarely conscious of the causation. Instead, they simply regard the city as “an expensive place to live” and often become a constituency for extending rent control to their own apartments.

Using standard supply-and-demand theory, it is predicted that prices in the unregulated portion of the market will be forced higher than their normal market value. This is because the limited supply in the shadow market must absorb the shortage, the excess of demand over supply, in the regulated part of the market. Because prices are pushed too low in the regulated sector, they are forced above what would otherwise be the market price in the unregulated sector. The result is that average prices in both sectors are likely to end up about as high as their free-market level. They could end up higher because of maldistributions and diseconomies in the regulated sector of the market.

Those cities that succumb to the disease of rent control are doomed to never-ending, house-to-house warfare over an everdiminishing supply of unaffordable housing.

Seriously, if you don’t think that the simple act of buying a house or apartment, making improvements and increasing the property value ultimately forces renters of 20 plus years out of their homes, you are mistaken. It doesn’t only happen under one roof.

” I also wanted to add that 12:03am’s post about all of us benefiting from the mortgage tax deduction subsidy is right on. Talk about welfare for the rich — I guess it’s completely fair that if you buy an expensive home with a big mortgage, you get to save a huge amount more on your taxes than the middle class person whose mortgage is 1/10th of yours. While low income renters pay a much higher % of tax on their significantly smaller income, since they can’t afford to buy anything and benefit from the deduction.”

How do you get to save a huge amount more than middle class people if you buy an expensive home? And when do lower income people pay a higher % of tax than higher income earners?