Manhattan Real Estate In a World of Its Own

The cover story in yesterday’s real estate section of The Times looks at the astonishing gulf that has formed between Manhattan (along with parts of Brooklyn!) and most of the rest of the country in terms of home sales, inventory and prices. Simply put, Manhattan’s residential market continues to be red hot while the majority…

The cover story in yesterday’s real estate section of The Times looks at the astonishing gulf that has formed between Manhattan (along with parts of Brooklyn!) and most of the rest of the country in terms of home sales, inventory and prices. Simply put, Manhattan’s residential market continues to be red hot while the majority of the U.S. struggles with plunging home sales and excess inventory. The article gives plenty of possible reasons for Manhattan’s resilience, including the island’s dearth of subprime loans, greater demand for large apartments, record Wall Street bonuses, increased demand from foreign buyers, a tight rental market leading people to buy, and the city’s job and population growth. The story doesn’t really examine the state of Brooklyn’s market—there’s an aside in one sentence lumping sought-after pockets of Brooklyn with Manhattan—and it’s difficult to assess whether Brooklyn is faring as well as Manhattan. It certainly remains to be seen whether problems with the credit market, rising rates on jumbo loans and diminished Wall Street bonuses will signal an end to the good times in Manhattan (and across the East River). Given the uptick in foreclosure rates in some areas of Brooklyn, it’ll be interesting to see if Brooklyn and Manhattan fortunes continue to be aligned.

The City of Gold [NY Times]

Brooklyn Nowhere Near Top of Foreclosure List [Brownstoner]

To 1:08pm and the other brokers propping up their commissions and calling me an idiot: screw you, I was right.

http://www.bloomberg.com/apps/news?pid=20601103&sid=a4qWlWyw2C0I&refer=news

bonus punch bowl drained by sub-prime fiasco.

that’s weird.

my mortgage broker said he’s seen little to no decrease in people looking for and obtaining jumbo mortgages.

guess you live in a poor area.

Since last week all jumbo mortages (loans over 417K which is most of NY home purchases) have gone up at least 1,5%. My mortage broker says he’s never seen anything like it in 20 years. Buyers are priced out of their range that way or they are getting turned down altogether, while must affect prices at some point.

So please, 10:05, never, ever leave Manhattan. TIA.

Once you leave Manhattan cheri, it’s all Cleveland.

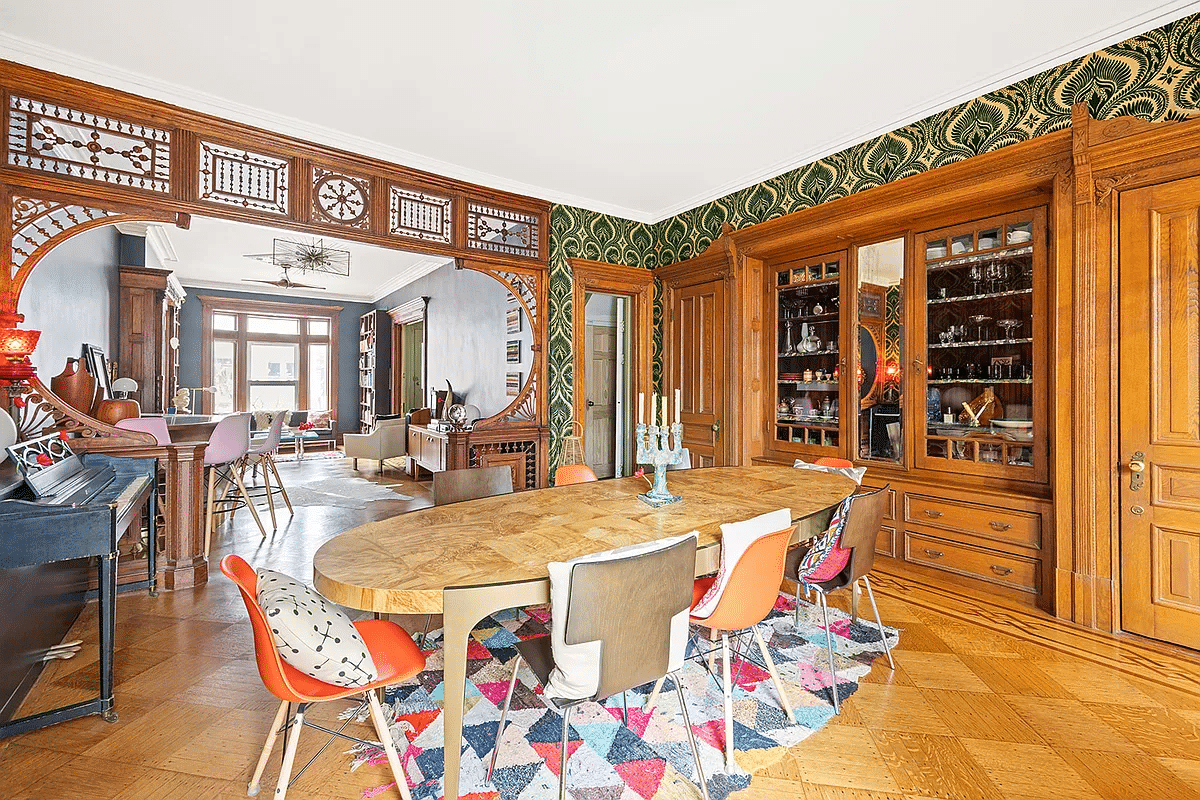

getting back to the subject about the stability of Brooklyn real estate, if you look at prime Brooklyn brownstones, they are a relative good value compared to Manhattan real estate. For those in that price range, it’s really a case of making the decision to go over the bridge vs. finding (and getting approved for) a scarce classic 6 or 7 in a co-op.

I don’t think the condo developers — especially in fringe areas — will fare as well.

you had me at bj

There’s no publication more inclined to shill for the Real Estate industry than the Times RE section.

This article was in direct contradiction to at least five other stories in Sunday’s paper. And it didn’t even deliver on it’s headline. A pure BJ for advertisers.

ok.

so bonuses will be 5 million intead of 10 million.

let’s get out the violins.