Brooklyn Brownstoners Pay Lowest Property Taxes

Homeowners in Brownstone Brooklyn can find plenty of things to gripe about, but property taxes ain’t one of them. Along with members of other affluent neighborhoods around the city, Brooklyn brownstoners benefit from assessment caps that have kept taxes low while real estate prices have skyrocketed. A recent study by the city’s Independent Budget Office…

Homeowners in Brownstone Brooklyn can find plenty of things to gripe about, but property taxes ain’t one of them. Along with members of other affluent neighborhoods around the city, Brooklyn brownstoners benefit from assessment caps that have kept taxes low while real estate prices have skyrocketed. A recent study by the city’s Independent Budget Office found that owners of houses in Park Slope and Carroll Gardens have the lowest effective tax rate in the five boroughs. While one-, two- and three-family homes account for 41 percent of the market value of all city property, they generate less than 14 percent of property tax revenues. Rental buildings, on the other hand, get hit much harder than houses, co-ops or condos. When we renovated our house, the property taxes doubled from about $2,400 to about $4,800, or about $1 per square foot per year. How does that compare to what you’re paying?

Tax Breaks Seem to Favor Affluent Areas [NY Times]

Large Share of Property Taxes Borne by Rentals [NY Sun]

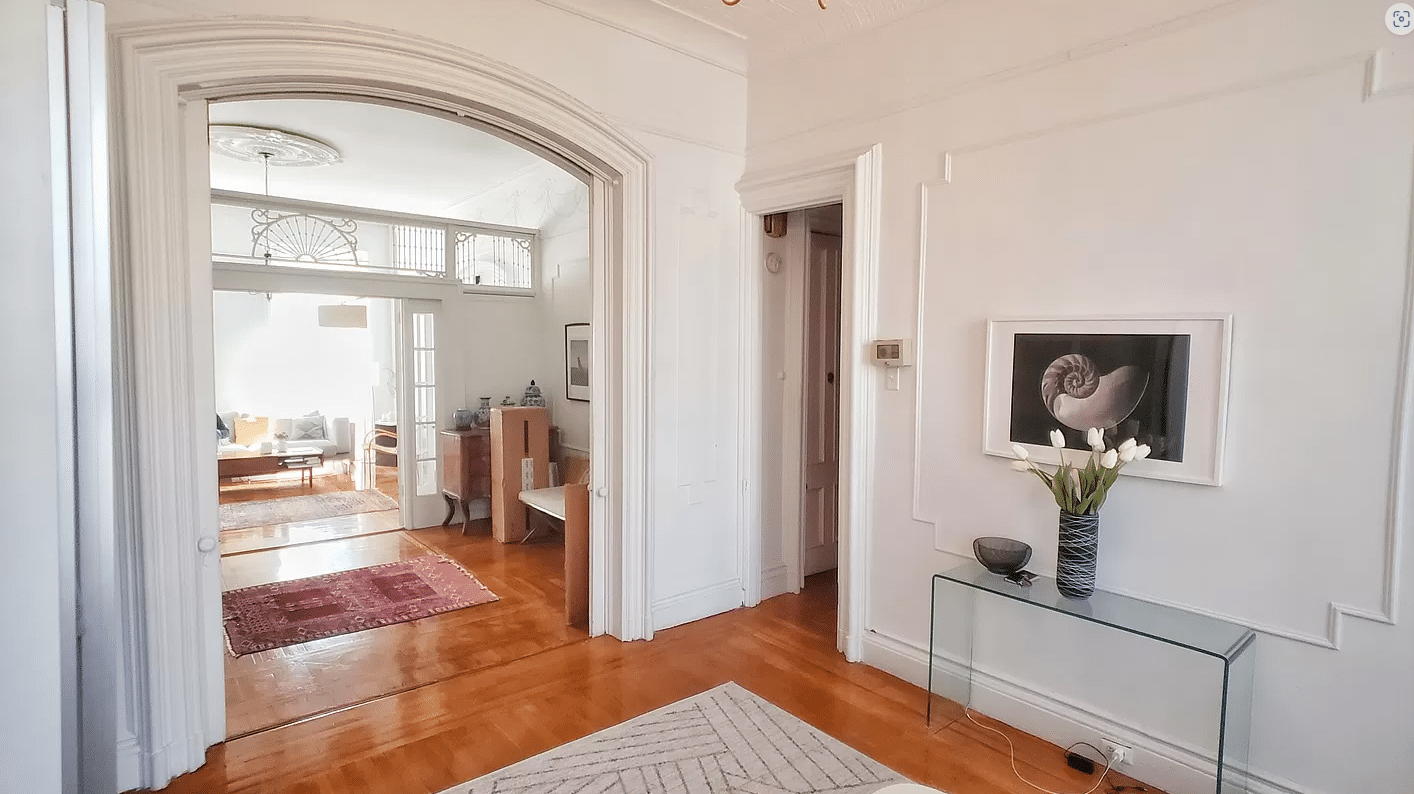

Photo from Dahl’s House

We pay just about $6,ooo on a park block park slope house of 4,500 sq. ft.

We pay about $11,000.00 a year in taxes on our 4-family brownstone in Clinton Hill. I researched this some years ago and found no comps in the area paying anything close, so I took it to the Department of Finance who pointed out that my taxes are based on an assessment wildly lower than market value. This system treats housing property primarily as an investment as opposed to a home. I’m certainly not unhappy that my home has jumped 500% in market value since I bought it eight years ago, but I have absolutely no interest in selling it now, so the appreciation serves only to hike my taxes even more. Maybe taxes should be reapportioned to be lighter on resident/homeowners who stay put, who in my experience have a more positive impact on the neighborhood, and heavier on the quick-turnaround stripmining investor. I’m not holding my breath in this climate, though.

Oe – safe for what? to hypocritically call for the end of tax breaks for new condos?

Politicians care about large homogoenous group of swing voters… those are the people they tend to favor. In this case, we’re talking about all those middle class white families in Queens, from Flushing to Little Neck, in their little houses, paying, at most, $2000/year in taxes. Since screwing them is a political third rail, we’re safe as a by-product.

These disparities only get worse in the cauldron of down-zoning. Watch out Brooklyn.

This whole tax system here is psychotic. I live in a condo worth about $700k, and have a 14 year J-51 tax abatement. The J-51 is an incentive for investment/redevelopment in targeted neighborhoods as determined by the City. Developers and buyers obviously love these programs.

So right now everything is fine and dandy, but without the tax break my apartment’s tax rate would be over $7 per square foot! Insane! How can brownstones that sell for 2million right now only pay less than one third of that rate? What’s with that? And those posters that pay .50 per square foot. Ugh…not exactly what I would call fair.

And remember, before you rag on me for getting a free ride, this is a different animal than a 421a, PLUS, within a year of closing, The City jacked our rate up FOUR TIMES from the estimate that was given in the prospectus. Talk about legal extortion.

1:28, I recall reading that it was the legal 4 fam houses that were getting hammered the worst; in fact, converting to legal 3 family status was the solution for these townhouse owners in manhattan who were in serious trouble as 4 families…even though you potentially lose 1/4 of your rent roll (or 1/3 if you live in one of the units yourself) the tax savings more than compensated for the loss of one unit’s rental income.

i would recommend that you consult with an accountant who specializes in NYC property taxes FIRST – do not go to the DOF until you are absolutely positive you will save money.

forgive me, but aren’t property taxes were deductible?

1:28, it looks from the NYT article like you should be OK, as it’s the 4-family and larger owners who were hit hardest. Actually, you may even reduce your taxes, though I’m not an accountant:

http://www.nytimes.com/2005/02/20/realestate/20cov.html?ex=1165467600&en=36751b4cf5f600a4&ei=5070