Foreclosure Sale of Bay Ridge Building Paused After Alleged Landlord Fraud

A bankruptcy claim has temporarily paused a foreclosure sale that would put dozens of tenants in a Bay Ridge apartment building at risk of eviction after their landlord allegedly defrauded them out of hundreds of thousands of dollars.

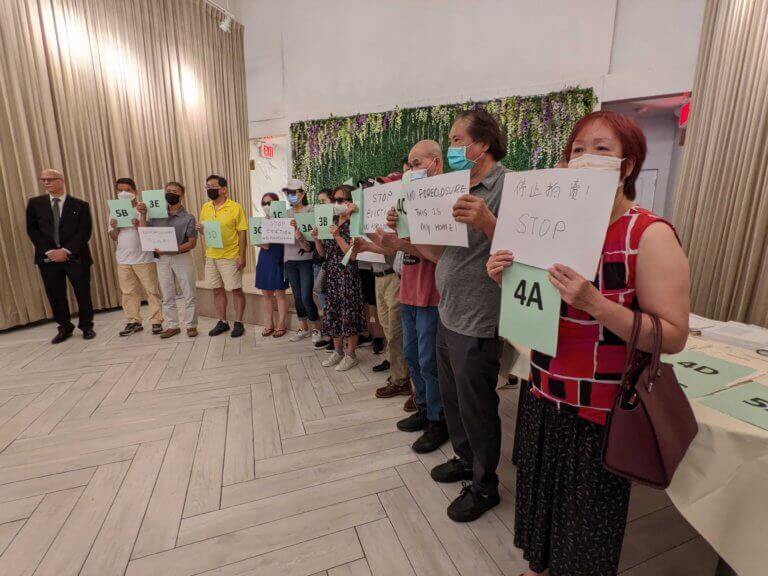

The foreclosure auction of 345 Ovington Avenue, an apartment building in Bay Ridge, has been temporarily delayed, giving tenants, their lawyer, and local politicians time to find a way to keep them in their homes. Photo via Google Maps

A bankruptcy claim has temporarily paused a foreclosure sale that would put dozens of occupants of a Bay Ridge apartment building at risk of eviction after their landlord allegedly defrauded them out of hundreds of thousands of dollars.

According to a lawsuit filed in Kings County Supreme Court and first reported by the New York Post, tenants say Xi Hui Wu, the landlord at 345 Ovington Avenue, “sold” them their apartments in the 25-unit building — but did not have permission from the state to complete the sales as condominiums and never handed over the deeds to the would-be buyers.

Wu was also not paying the mortgage and still owed more than $5 million as of October 2018, when his lender, Maxim Credit Group, started foreclosure proceedings, according to court documents.

Maxim’s legal representation did not return request for comment.

The building was set to be sold at auction on the steps of the court on July 28, but the sale was called off on the evening of July 27, when three of Wu’s former tenants filed an involuntary bankruptcy claim against the limited liability company through which he owns the building in federal court.

The claim gives residents and the mortgage holder time to work out a deal that will allow the tenants to stay in their homes, said Edward J. Cuccia, who represented a number of the tenants in the foreclosure case.

A new note holder recently took over the mortgage from Maxim and is willing to negotiate a deal that would keep everyone in their homes, Cuccia said.

“It’s given us breathing room to negotiate,” he said. “This is good, we’re good, we’re talking. Whenever people are talking, it’s a good sign.”

Years of fraud

Wu purchased 345 Ovington Avenue, then the site of Salam Arabic Lutheran Church, from the Lutheran Metropolitan New York Synod for $1.5 million in 2011, according to city records. Within days, he filed plans to demolish the structure and build his a five-story, 25-unit apartment building.

In the spring of 2012, he received his first partial deposit for a condominium — $20,000, part of a $150,000 total deposit for a condo worth nearly $400,000 in total, according to court documents.

Wu collected hundreds of thousands of dollars from the tenants of at least 17 units, in some cases re-using the same document and scribbling over names and dollar amounts in pen.

Many of the agreements, though not all, include a note that the state attorney general, who must grant would-be sellers a license to sell condominiums, had not yet approved the sale, and that the agreements were not binding.

But because Wu did not have a license at the time — and never received one — none of the sales were legitimate. Cuccia said some tenants were paying monthly condo fees on top of the massive sums they had paid for their units.

The scale of the fraud Wu pulled off is “horrifying,” Cuccia said, and the situation made it difficult to even know how to refer to the people living in the building during court proceedings.

“They’re technically called contract lendees in possession, that’s legal mumbo jumbo,” Cuccia explained. “They’re not really tenants, because they’re not renting. They’re not really owners, they can’t own it. You can’t own it, there’s not a title, there’s not a condo.”

Tenants were shocked to receive thick packets of foreclosure paperwork in the mail in 2019 and immediately tried to contact Wu, to no avail, he said. At some point, according to court documents, he left the country.

Many of the tenants are immigrants, Cuccia said, and do not speak much English. One of his clients — one of the youngest people who gave money to Wu — said she just didn’t see the warning signs at the time.

“He looked the part, he built the building,” Cuccia said. “He wore a nice suit, walked around, you trust him! You see a guy who built a building, you figure it’s real, why would you suspect it’s not?”

In late July, just about a week before the auction was set to occur, Council Member Justin Brannan and State Senator Andrew Gounardes caught wind of the fact that an entire building full of people were at risk of being evicted after the sale and jumped into action, contacting city and state government offices who might be able to help.

“We’re trying just to stop the clock, basically, to give us more time to find a creative solution here,” Brannan said on Tuesday, before the auction was paused. “What we need right now is time. Obviously the main concern, the number one concern, is keeping these folks in their house, in their homes.”

It’s not clear how long the foreclosure claim will delay the sale, said Ethan Ganc, who is representing the three tenants. Wu has three weeks to respond to the suit, and the rest depends on how the proceedings go.

If the negotiations with the new note holder don’t pan out, it will be back to the drawing board for the tenants of 345 Ovington Avenue.

“It’s not like an off-the-shelf solution, we’re going to have to really figure out how we can put together the right combination of money from either public pots of money or from a private lender to get this building back into the hands of residents,” Gounardes said.

The property was granted a 421-a tax exemption in around 2015, according to city records, but, late that year, an investigation by then-Attorney General Eric Schneiderman found that the landlord had failed to offer rent-stabilized leases to its tenants, as required by the law.

The abatement was revoked sometime in 2016, according to tax documents.

Wu is listed as the head officer of another condominium building in Brooklyn, according to Who Owns What in NYC. The address he and other shareholders of that building are registered under is home to several LLCs, according to state records.

If the auction had gone forward — or does go forward in the future — it’s unlikely that the tenants will see any payout, Cuccia said, despite a separate lawsuit against Wu that was ruled in their favor.

The bulk of the money from the auction would go right to the mortgage holder, he explained, and anything left will go to the other creditors — like Cuccia’s clients. But it’s unlikely the sale would generate enough money to fulfill what they were promised by the court, and he doubted Wu would have traceable assets for the court to pursue further.

“My clients are probably all going to be left holding nice pretty pieces of paper that are worthless,” he said.

The court delivered the foreclosure decision in late 2019, noting that none of the defendants — including Wu — had responded to the summonses issued to them.

In March 2020, Wu filed to vacate the foreclosure and sale, claiming in an affidavit filed by a new lawyer — Frank Seddio, the former head of the Brooklyn Democratic Party — that he had not been able to respond because he was in China for treatment of a spinal injury.

The affidavit, which appeared to be signed by Wu and which was stamped by a notary public, was later found to be fraudulent — Wu was in China at the time, and could not have signed the document in person, according to court documents.

Seddio did not return request for comment.

“There was just massive fraud from the get-go,” Cuccia said. “There was fraud from Wu, there was fraud in the legal representation, there was fraud all over.”

The next steps

Cuccia, Brannan, Gounardes and various government agencies and housing organizations are continuing to hammer out a deal for the tenants at 345 Ovington Avenue. The fact that the new mortgage holder is willing to negotiate is a great sign, Cuccia said.

“I’m actually optimistic, which is nice,” he said.

Depending on how the negotiations go with the new company and the various government agencies involved, there are several options for the building.

“We have to find either a new owner who wants to own and manage the building or we’d have to figure out a transition owner that would take possession in the short term while we try to transition this property to like a co-op,” Gounardes said.

Cuccia said the intervention of the pols was critical to the progress they have made in making sure the tenants remain in their homes, noting that even a few weeks ago, before they intervened, the options for keeping the building in the hands of tenants were much more limited.

“This is fraud in the highest order, here, and I really feel for these folks,” Brannan said. “This is the American Dream, you save up a bunch of money and you finally feel that you can buy a home for yourself or for your kids or for your parents. We need to do everything we can to make sure these folks are protected and frankly to make sure everyone is made whole here.”

Editor’s note: A version of this story originally ran in Brooklyn Paper. Click here to see the original story.

Related Stories

- Tenants Coalition Warns Bushwick Renters About Private Equity-Backed Landlord

- RiseBoro and Private Equity Giant Blackstone Reach Bushwick Affordable Housing Settlement

- City Mulls Ditching Controversial Property Transfer Program as Federal Class-Action Lawsuit Looms

Email tips@brownstoner.com with further comments, questions or tips. Follow Brownstoner on Twitter and Instagram, and like us on Facebook.

What's Your Take? Leave a Comment