NYC Awards $191 Million Tax Break to Landlord With 3,000 Housing Code Violations

The Bistricer family will receive a 40-year tax exemption in exchange for cleaning up the mess it has long been blamed for at Brooklyn’s beleaguered Flatbush Gardens.

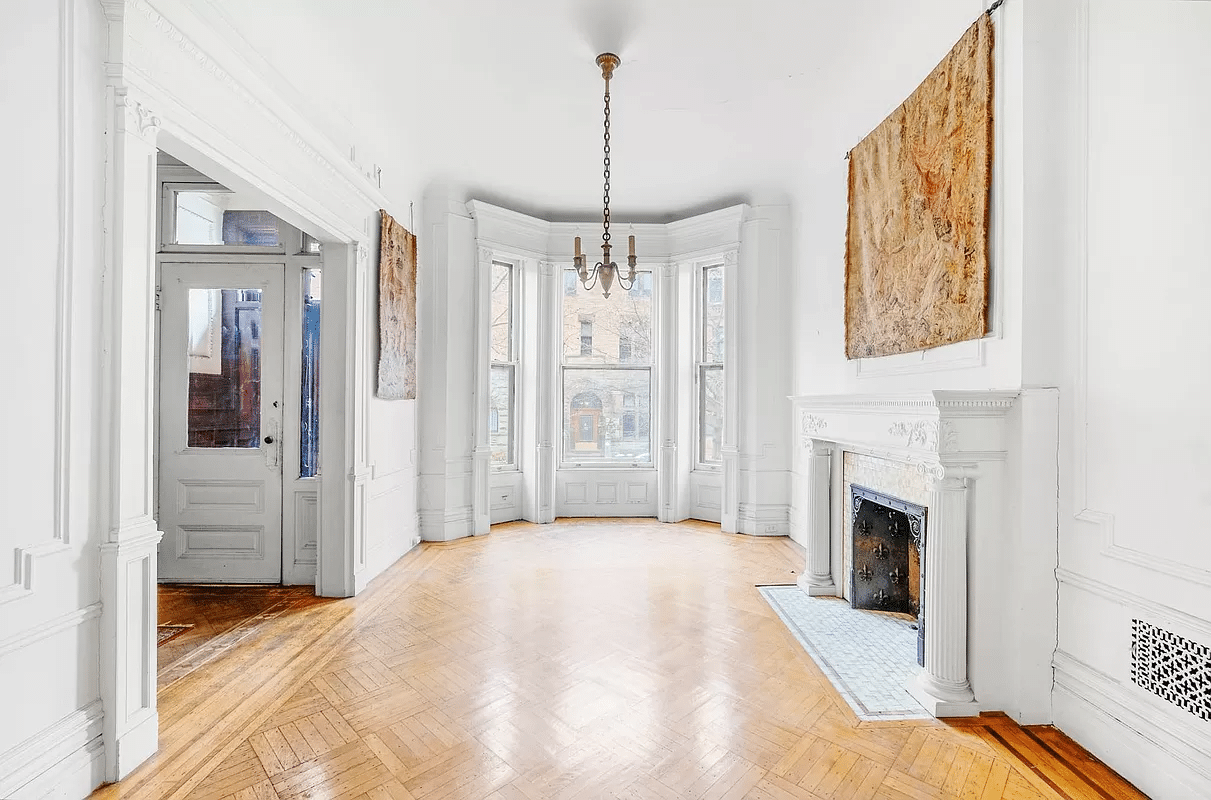

At Flatbush Gardens, residents have long complained about conditions inside the complex, August 1, 2023. Photo by Ben Fractenberg/THE CITY

Tom Robbins, The City

This article was originally published on by THE CITY

The owner of a sprawling Brooklyn apartment complex repeatedly cited for deteriorating conditions and lack of repairs has received one of the most generous tax breaks awarded by City Hall since Mayor Eric Adams took office.

Officials at the city’s Department of Housing Preservation and Development quietly signed off on a deal last month to provide a 40-year tax exemption worth an estimated $191 million to the owners of Flatbush Gardens, a cluster of aging red-brick buildings with almost 2,500 rent-stabilized apartments located in East Flatbush.

The tax exemption was granted under a provision of the state housing finance law known as Article XI, which is designed to keep housing affordable. The deal calls for the landlord to resolve the nearly 3,000 outstanding housing code violations, keep the apartments rent-regulated, and reserve a total of 250 apartments for the homeless as vacant units become available. The exemption was approved without objection by the City Council in June.

The complex is owned by Clipper Realty, a publicly traded company whose chief executive officer is David Bistricer, a Brooklyn businessman who has long been a controversial player in major city real estate. In 2007, Bistricer’s bid to buy Starrett City, the 5,800-unit complex in southern Brooklyn now known as Spring Creek Towers, was rejected by the federal Department of Housing and Urban Development, which cited concerns about Bistricer’s “commitment to affordable housing.” The Starrett bid was also opposed by state Attorney General Andrew Cuomo, who said the landlord had “a long and troubled history of tenant abuse.”

In 2010, then-city Public Advocate Bill de Blasio placed Bistricer on a list of “worst landlords,” citing thousands of housing code violations at Flatbush Gardens. The complex was back on the list last year, with current public advocate Jumaane Williams citing Bistricer’s son, Jacob Bistricer, the chief operating officer of Clipper Realty, for thousands of violations at the site.

/cdn.vox-cdn.com/uploads/chorus_asset/file/24823253/080123_flatbush_gardens_2.jpg)

In addition to Flatbush Gardens, which already appears to be profitable, Bistricer’s real estate holdings range from luxury apartment houses in Tribeca and near Lincoln Center to the office building at 141 Livingston Street in Downtown Brooklyn that houses the borough’s Housing Court. The city pays Bistricer’s firm approximately $10 million a year under a 10-year lease.

City housing officials said the tax break was needed to keep rents at the project low while improving conditions. The owner’s savings will be used to “help finance repairs to keep buildings in livable condition while creating or preserving affordability for decades into the future,” said William Fowler, a spokesperson for HPD. The deal originated, Fowler said, when Jacob Bistricer asked city housing officials for the tax break.

The agreement calls for Clipper Realty to make at least $25 million in capital improvements to the complex over the next three years, including to roofs and plumbing systems. Those problems, housing officials said, have contributed to the vast majority of the 2,988 violations throughout the complex.

Rodents, Roaches, Mold

Many of the housing code violations stem from the kind of leaks and plumbing problems that the anticipated system repairs might cure. But there are also hundreds of violations involving basic maintenance failures that have led to rodents, roaches, mold, rotting windows, missing doors and lead paint, conditions deemed by the city as the most hazardous.

Six times in the past year, records show, lawyers from the city’s Housing Litigation Division have gone to court to compel Bistricer’s Renaissance Equity Holdings LLC, the managing entity for Flatbush Gardens, to make repairs, including replacing bricks missing from an outer wall and missing compactor doors, and providing hot water. In March, city attorneys alleged in a court filing that managers at the complex had falsely certified repairs of violations in apartments at a building at 1350 Brooklyn Ave., including a broken sink, peeling paint, and missing smoke and carbon monoxide detectors.

For his part, Bistricer has sued hundreds of tenants in the buildings for nonpayment or for alleged illegal possession of apartments. In the past year, records show more than 500 eviction petitions have been filed by his management company in Brooklyn Housing Court. Since 2017, records show, some 248 evictions have been carried out by city marshals at the complex.

Bistricer and Clipper Realty did not respond to repeated requests for comment.

The East Flatbush tax agreement comes one year after tenants staged a boisterous protest over conditions outside Bistricer’s management office on Foster Avenue. Among the demonstrators was local City Councilmember Farah Louis. “It’s deplorable, it’s uninhabitable, and it’s not fair,” Louis told the crowd, according to a news report of the rally. “We have other companies that can come in and manage these buildings in a more equitable way,” she said.

Among the protesters was Marietta Small, the longtime president of the Flatbush Gardens Tenant Association, who criticized management for failing to meet with tenants and for being slow to respond to complaints. Tenant association secretary Kimberly Oliver told a reporter from the Brooklyn Paper, “We don’t get repairs done on time. Our buildings are not being cleaned.”

/cdn.vox-cdn.com/uploads/chorus_asset/file/23438150/050322_roe_presser_louis_1.jpg)

All three of those protesters, however, agreed this year to support the lucrative tax break for the owner. Louis, who voted in support of the measure at the Council, declined to discuss her decision with THE CITY. Unless the local Council member objects to an exemption, approval is “pro forma,” said Justin Brannan, chairman of the Council Finance Committee. Brannan served as sponsor of the tax measure, which he said was requested by city officials.

Small sent a letter of support on the tenant association’s letterhead to Council leaders, stating that the landlord had agreed to provide “a letter of commitment to retard all fears and reservations regarding their selling or leaving repairs undone.” Small also refused to discuss her decision.

In a telephone interview, Oliver said she was hopeful the tax deal would lead to needed fixes at the complex. “This is a very old property,” she said. “This is one way of getting it done.” Oliver said she will be watching warily as work unfolds at the complex. “I am still going to be a tough critic of Mr. Bistricer and his company if he doesn’t comply with what is legally our right,” she said.

Seething Anger

Some tenants who are currently battling for repairs in their apartments, however, voiced skepticism — and more. At 3104 Newkirk Ave., where city records show 158 outstanding violations, a woman in a ground-floor apartment said she has lived in the complex since 1993. “I’ve got holes in the living room wall, a hole in the floor of my daughter’s bedroom and rotting window sills,” said the woman, who gave her name as Ms. Jackson. Management came to take photographs, she said, but never returned.

Asked about the new tax break awarded to the landlord, she said: “If they’re not going to do the work then they don’t need it.”

Four floors above her, another longtime tenant, Darlene Massey, who lives with her two children and works as a home health aide, filed suit in Brooklyn Housing Court last month. She said she is seeking to compel the landlord to fix a buckling ceiling in her kitchen and mold that permeates the bathroom, bedrooms and windows. Management, she said, “is hostile. They don’t care about the families in these buildings.”

Stanley Drummond, who lives in a fourth-floor apartment at 3103 Foster Ave., said managers refused to respond when he told them of leaks throughout his home. Eventually, he said, ceilings in the bathroom and kitchen collapsed. “Thankfully I wasn’t home,” said Drummond, 64, who is on disability assistance. “Their whole attitude is ‘We’ll fix it if we want to,’” he said.

The landlord’s multimillion-dollar tax break was “obscene,” he said. “My lease says I am entitled to a habitable living area. How could someone be rewarded for not abiding by the rules?”

Streisand, Williams, Profits

Originally known as Vanderveer Estates, the cluster of 59 contiguous six-story buildings spread across 21 acres along Foster Avenue between Nostrand and Brooklyn Avenues opened in 1950 offering affordable working-class homes. Among its claims to fame is that in the 1950s a young girl named Barbra Streisand lived at 3102 Newkirk Ave. Decades later, the late actor Michael K. Williams also grew up there. He was still living at the complex during the first season of the HBO series, “The Wire,” in which he played the stickup man Omar Little.

Bistricer’s company purchased the property in 2005 for a reported $138 million. Renaming the complex Flatbush Gardens, he launched a marketing campaign that included television ads promoting the complex to young professionals as an affordable alternative to pricier Manhattan enclaves like Stuyvesant Town. But in 2010, a bitter labor battle erupted as management locked out its unionized maintenance workers, many of whom lived at the complex, after they rejected cuts to wages and health benefits. The 16-month-long lockout ended in 2012 after a judge ordered the workers reinstated to their jobs but at reduced wages, and not before a spate of stories focused on poor conditions there.

Despite its problems, the complex has been rising in value. In 2020, Clipper Realty refinanced the property for $329 million, a deal that brought the company $83 million in new capital. Last year the company put the complex up for sale at a reported asking price of $425 million. An offering memo circulated to potential purchasers and obtained by THE CITY noted large staffing cuts in 2021 that helped increase operating profits at the complex.

Under the terms of the tax exemption, Clipper Realty needs city approval for any future sale of the project, although the company may add “passive” investors who will have no control over operations. The tax deal includes an added bonus for the landlord, allowing Clipper to collect enhanced government rental subsidies for some of its apartments. In a filing to the SEC this month, Clipper Realty estimated that the added subsidies could amount to as much as $8 million per year as leases are renewed over the next two years. City officials said the additional subsidies will go toward maintaining rents. “This is part of the overall tool set we are using to address maintenance issues going forward,” said Fowler, the HPD spokesperson.

Housing analysts said that the tax exemption will likely benefit most tenants in the long run, although that plus comes with a crucial policy question.

“The big picture from the perspective of the tenants is that they get to remain rent-stabilized, and they will get to see repairs they’ve been denied for years,” said Samuel Stein, a policy expert at the Community Service Society. “The question is, should a landlord who has systematically disinvested in the buildings be rewarded with a large tax break to achieve that?”

Massey, who recalled visiting her grandmother’s apartment in the complex as a child, said that while owners came and went over the years, “management used to be on top of maintaining the premises. They’d try to respond to problems.” Even contacting current managers is a challenge, she said. “They are not answering the phone. The office is only open limited hours. It takes days just to file a complaint.”

THE CITY is an independent, nonprofit news outlet dedicated to hard-hitting reporting that serves the people of New York.

Related Stories

- Tenants at Flatbush Gardens Protest Against Management and ‘Unjust’ Living Conditions

- Flatbush Tenants Rally to Demand Building Improvements After Fires

- Flatbush Tenant Organizer Faces Eviction in Midst of Rent Strike Over Living Conditions

Email tips@brownstoner.com with further comments, questions or tips. Follow Brownstoner on Twitter and Instagram, and like us on Facebook.

What's Your Take? Leave a Comment