Fed Holds Off on Interest Rate Rise, Brooklyn Real Estate Boom Expected to Continue

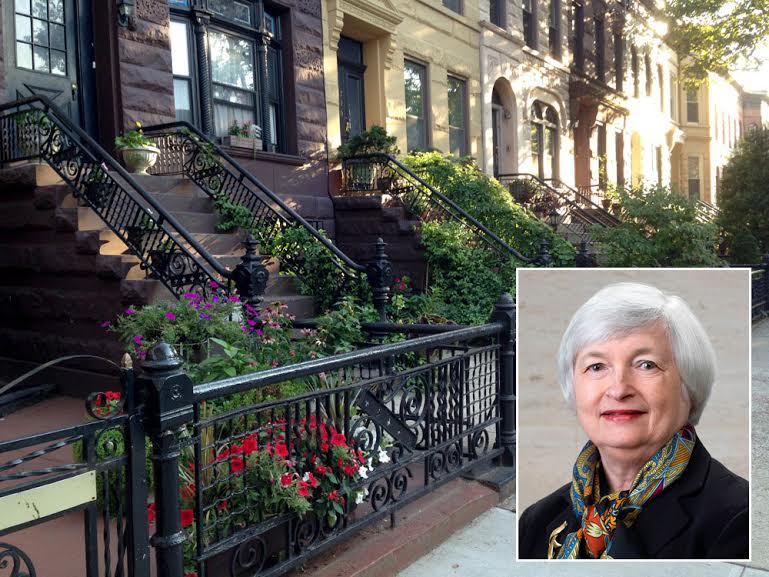

Federal Reserve Chairman Janet Yellen and Macon Street brownstones. Photo via Federal Reserve The Federal Reserve Board this afternoon announced it will hold off taking action to raise short-term interest rates — so for now, expect the Brooklyn real estate boom to continue. But when and if the Fed does raise the interest rate, it’s…

Federal Reserve Chairman Janet Yellen and Macon Street brownstones. Photo via Federal Reserve

The Federal Reserve Board this afternoon announced it will hold off taking action to raise short-term interest rates — so for now, expect the Brooklyn real estate boom to continue.

But when and if the Fed does raise the interest rate, it’s unlikely to put much of a damper on Brooklyn real estate, mortgage broker Adam Dahill told Brownstoner.

“People buying now in Brooklyn are well qualified and not that sensitive to interest rates,” he said. “I’m very bullish on Brooklyn.” The one big change he does see coming is that formerly “fringe” areas will continue to increase in value, while price appreciation in “prime” areas will slow.

“A lot of the brownstone Brooklyn markets will be more similar in the future as neighborhoods [and amenities] get built out,” he said. Dahill is Mortgage Loan Originator for Mortgage Master, also known as LoanDepot.com LLC.

Rumor has it the Fed is itching to raise rates soon but has held off because of recent global economic uncertainty. The Reserve Board also indicated in its statement today that when it does raise rates, it will do so in a restrained and moderate manner.

The rate it is considering is the overnight borrowing rate for banks. The Fed already started backing off quantitative easing of Treasury backed bonds in 2013. Both can have an effect on mortgage rates for borrowers.

“The Committee anticipates that it will be appropriate to raise the target range for the federal funds rate when it has seen some further improvement in the labor market and is reasonably confident that inflation will move back to its 2 percent objective over the medium term,” the group said in a formal statement, which you can read on its website.

“When the Committee decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 percent,” it continued. “The Committee currently anticipates that, even after employment and inflation are near mandate-consistent levels, economic conditions may, for some time, warrant keeping the target federal funds rate below levels the Committee views as normal in the longer run.”

The group is next scheduled to meet in October and again in December, so higher short-term interest rates could kick in after that.

Related Stories

Question: Should We Worry About the Fed Raising Interest Rates?

Claim: There’s a Brooklyn Real Estate Bubble and It Will Never Pop

Construction Defects Accompany Brooklyn Building Boom

So many well versed economists on this thread today…