What Is a Commercial Property? A Prospective Home Buyer's Need-to-Know Guide

Home hunters need to know what commercial property is and that different rules apply — from taxes to down payment requirements.

Greenpoint’s 144 Franklin is a commercial property. Photo by Richard Caplan

Home hunters, especially in an old city, may occasionally encounter a tantalizing prospect that is, confusingly, actually a commercial property rather than residential one. Such a candidate could be a townhouse with more than four apartments, a home with a store on the ground floor, or even a standalone mansion housing a doctor’s office, to name just a few of the possibilities.

Homeowners, whether actual or hopeful, do not typically deal with commercial property, but it is important to know that different rules may apply — especially when it comes to taxes, rent regulation, borrowing money and down payment requirements.

A quick definition of commercial property

Generally, a commercial property is any non-residential building, although some define it more narrowly as for-profit property. There are many types. Commercial property can include anything from a small storefront building to an apartment building to a shopping mall. Even community buildings such as schools and churches count as commercial property, in the broad sense of the term.

Home hunters in New York City are most likely to encounter two types: Townhouses or small apartment buildings with more than four units, and small mixed-use buildings, which include both commercial and residential units.

Conversely, residential properties can be defined as “properties that have one to four units with no commercial space,” according to mortgage banker Sarah Edelman. “A mixed-use property would be considered commercial because it has residential and commercial usage.”

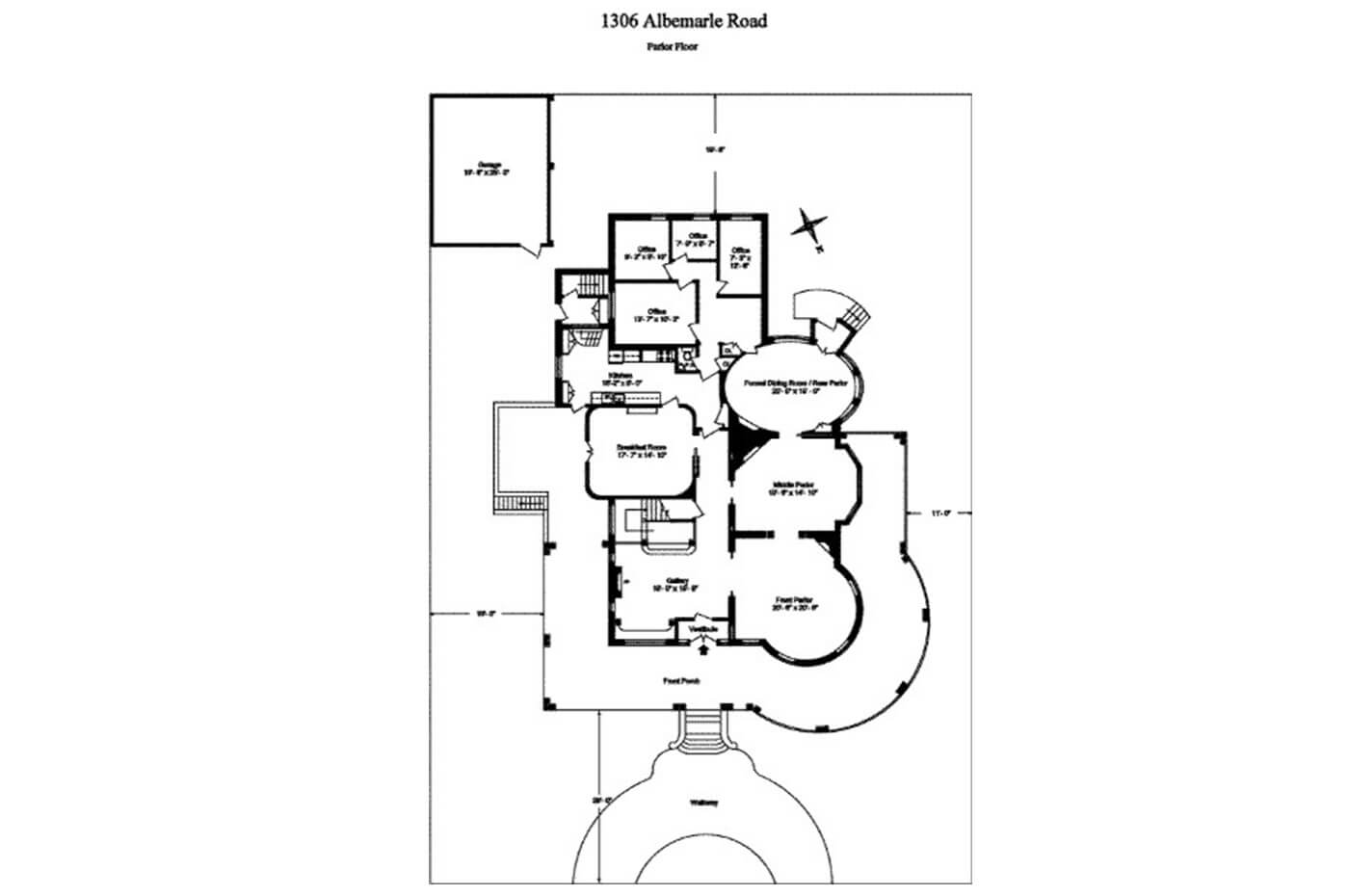

Examples of the sorts of buildings prospective buyers are likely to encounter in Brooklyn include 144 Franklin in Greenpoint and 1306 Albemarle Road in Prospect Park South, both pictured. The first was a commercial building originally: the Mechanics and Traders Bank of Brooklyn, built in 1895 in the Renaissance Revival style.

In the ’80s, it went co-op and was divided into four units, including three apartments and one commercial unit. So although the structure is small and contains apartments, it remains a commercial building.

The second, a sprawling standalone house with extravagant interior details such as an oval dining room with tapestry-covered walls, seems an unlikely candidate to be a commercial building. But in fact, it was one until quite recently: Medical offices were located in what had originally been the kitchen, in the rear of the parlor floor. (The current owner converted the whole building back into a single-family home in 2014.)

Things to know before buying a commercial or mixed-use property

“Mixed-use properties can be partially owner occupied…however, they require a minimum downpayment of 20 percent,” Edelman told Brownstoner, adding that “borrowers can put down as little as 3.5 percent on residential multi-families,” depending on the number of units. Edelman also noted that the rental income from a multi-family can offset the monthly mortgage payment.

It is also important to understand that a commercial certificate of occupancy, say in the case of a storefront, can’t be changed to residential without significant difficulty.

Commercial properties require a commercial loan, which have higher interest rates. Closing costs will also be higher for commercial property.

Even after purchase, different rules apply. Commercial property is taxed at a higher rate than residential property, and insurance rates will be higher.

Multi-family buildings with five or more apartments may fall under New York rent regulation laws (depending on a variety of factors). City requirements for health and safety — such as as sprinklers, fire escapes, and fireproofing — are more stringent for commercial property than for homes with only one to three units.

Understanding a property’s certificate of occupancy and the implications of a commercial tenant

According to Citi Habitats commercial property broker Chris Havens, the advantages of having a commercial tenant is that they are often on a five- or even 10-year lease and can be very stable — so long as they are not a restaurant, which can have an assortment of issues. “A store is not complaining about the heat overnight and it is easier to evict stores,” Havens told Brownstoner.

Havens also emphasized the importance of understanding a commercial property’s certificate of occupancy before purchasing it. “The main thing is you should look at what the certificate of occupancy — an arcane document comparable to a building’s birth certificate — says about the space, because it could be being used as a store illegally,” Havens said, adding that he’s seen cases where buyers failed to look at the certificate of occupancy and did not realize until after purchasing a building that it was commercial.

Related Stories

- What Is a Garden Apartment, Anyway? The Answer May Surprise You

- What Is a Self-Managed Co-op and What You Need to Know Before Buying One

- What Is a Prewar Apartment and Why Are They Great?

Businesses Mentioned Above

[blankslate_pages id=”d5730d80496b1f, d5776a6761f394″ type=”card” show_photo=”true” utm_content=””][/blankslate_pages]

Email tips@brownstoner.com with further comments, questions or tips. Follow Brownstoner on Twitter and Instagram, and like us on Facebook.

What's Your Take? Leave a Comment