Yes, It's True -- Brooklyn Homes Are Now More Expensive Than Ever

Home prices in Brooklyn are now higher than ever and rising quickly, third quarter reports reveal.

Fuggedabout a slowdown in Brooklyn. Home prices in the borough keep on going up, up, up.

Closed-sale prices for all types of homes in the borough set a new record in the third quarter, rising to a median sale price of $675,000 and an average square foot price of $950.

The uptick was a steep one: The median sale price increased 18 percent during the year and 13 percent in the quarter. The average jumped 27 percent year over year and 22 percent for the quarter, according to a report from Corcoran (PDF).

Average price per square foot rose 12 percent over the year. The median price per square foot now stands at $908, an increase of 4 percent vs. a year ago.

Even luxury homes — defined as the top 10 percent of the market and reportedly in a lull elsewhere — did well, with the median luxury sale price leaping 23.5 percent to $2,500,000, according to Douglas Elliman’s quarterly report.

In other respects, also, the market was hot: The number of sales increased during the quarter while the available inventory fell. Days on market increased, however, to 82 days, an uptick of 26 days compared to the previous quarter, even as the listing discount fell to zero. Douglas Elliman interpreted that to mean the pace of the market can’t continue to increase.

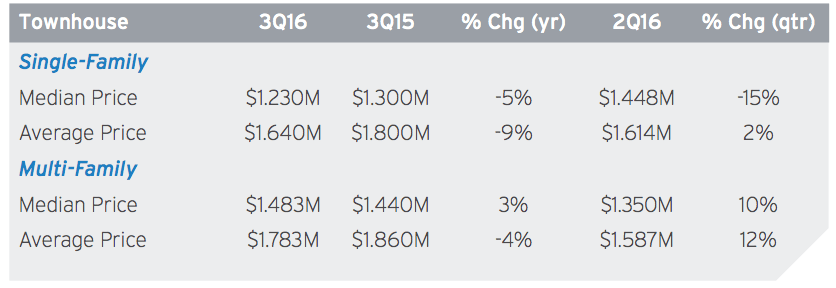

The number of contracts signed in the quarter decreased 6 percent vs. the quarter before, to 741, said Corcoran. Townhouse prices also declined. The median price for a townhouse now stands at $780,000, a dip of 4 percent vs. the year earlier.

The price gains were distributed pretty evenly around the borough, with median price gains ranging from 7.1 percent in east Brooklyn to 14.2 percent in north Brooklyn, according to Douglas Elliman.

Related Stories

- Find Your Dream Home in Brooklyn and Beyond With the New Brownstoner Real Estate

- Brooklyn Real Estate Boom Continues, With Prices Up, Inventory Down in Second Quarter

- Good News for Brooklyn Economy: The Real Estate Boom Is Still Booming, Reports Reveal

Email tips@brownstoner.com with further comments, questions or tips. Follow Brownstoner on Twitter and Instagram, and like us on Facebook.

What's Your Take? Leave a Comment