Walkabout: Machinations at the Mechanics Bank, Part 1

Researching the architectural and historic origins of the Mechanics and Traders Bank Building in Greenpoint unearthed some very interesting stories. The Biblical King Solomon once famously said that there was nothing new under the sun, and as if to prove that, here are some banking shenanigans worthy of today’s headlines. The starched collars and mourning…

Researching the architectural and historic origins of the Mechanics and Traders Bank Building in Greenpoint unearthed some very interesting stories. The Biblical King Solomon once famously said that there was nothing new under the sun, and as if to prove that, here are some banking shenanigans worthy of today’s headlines. The starched collars and mourning coats may have been replaced by Armani’s best, but the temptation of money, and persistent voice of ego, that insistent voice that tells the perpetrator that no one else is as smart as he is, remains as old as time. Today, I give you the tale of David A. Sullivan.

The Mechanics and Traders Bank of Brooklyn was founded in 1867. It grew on the strength of the renewed economy in New York and Brooklyn after the Civil War. and soon An independent bank with the same name had headquarters in Manhattan. Its earlier years were peppered with daring robberies, attempted forgery and check kiting, and other schemes to part the bank from its funds. For a bank, business as usual. One did not expect the bank officers, the president, no less, to be one of the robbers.

In December of 1906, the New York Times announced that the Union Bank of Brooklyn was going to buy The Mechanics and Traders Bank of Manhattan. Union Bank was controlled, along with several other banks, by a group of financiers and businessmen called the Thomas Group, after their leader, Mr. E.R. Thomas. Union Bank of Brooklyn had offices at 44 Court Street, and nine branches around Brooklyn. The president of Union was a lawyer named David A. Sullivan. The board of directors appointed him president of the Mechanics and Traders Bank, and he would continue to remain president of the Union Bank. He did not remain president of both banks long.

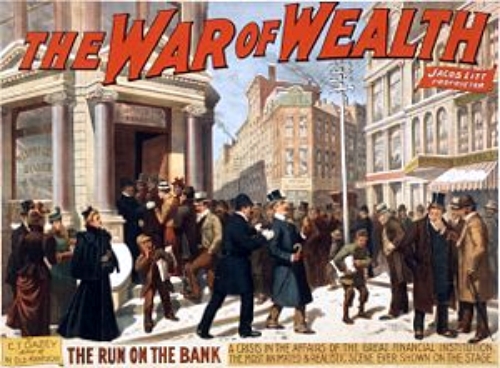

In 1907, a banking panic raged through the city, and the Mechanics and Traders Bank almost closed permanently when a run on the bank occurred at the main branch on the corner of Broome and Broadway, in Manhattan. The bank had to close for a day, but survived the run, with all funds covered. In the summer of 1908, the papers reported that the District Attorney of Kings County was investigating the Merchants and Traders Bank, now a subsidiary of Union Bank. According to the New York Times, David A. Sullivan, in his tenure as president, had overseen some shady business himself, and the investigators were looking at doctored books and transactions that did not seem to be on the up and up. The Grand Jury was empanelled, but they didn’t want to interfere with further merger plans of the bank, and the matter was dropped.

Two years later, in 1910, the Union Bank closed. The reason given was that Union had never been able to meet all of its obligations inherited from Mechanics and Trader’s. The president of Union cited the Panic of 1907 as the root cause of the problems, saying that Brooklyn’s real estate slow down had resulted in the bank having less deposits, and a delay in the paying back of loans. They also cited the merger with a third Brooklyn bank, that had also taken its toll on their coffers. A special investigator was going to look into the matter, and in 1911, State Assemblyman Louis E. Goldstein, of Brooklyn, was charged with finding out why Union had folded. The other two men looking into the matter were Special Deputy Bank Examiner E. L. Dodge, and Brooklyn Assistant District Attorney, Mitchell May.

Their investigations centered on the time that David Sullivan had been president of Mechanics and Traders Bank. And it didn’t take long before people started talking. Allegations had been made that bank officers had been pocketing bonuses on loans made, that many questionable loans had been made to dummy companies, and that when the bank had been closed, during the mergers and the panics, and was supposed to be under the jurisdiction of the State Banking Department, bank officers had been allowed into their offices, totally unsupervised, to “look at the books”.

During court testimony, Clark Williams, a former State Superintendent of Banks stated that he had received several letters of complaint from stockholders who had sold their stock in specific branches of the bank because of the way business was being transacted in those branches. One letter specifically told the State Superintendent that fraudulent real estate loans were being made, and that high ranking bank officers were using bank funds to make unsecured loans. The letter went on to say that investigation would show that large transactions had been made in the name of bank clerks, either employed by the bank, or one of its officers, and illegal loans on behalf of those officers were flying out of the bank’s doors. Those same officers were then collecting bonuses on those loans. At the top of the list was the Mechanics president, David Sullivan.

During the course of the investigation, Clark Williams continued, Mr. Sullivan gave contradictory answers to questions, raising his suspicions. When asked if Williams had given Sullivan permission to look at the books while the bank had been closed, he denied that any such permission had been given. Testimony by a janitor at the Atlantic Avenue branch of the bank told a different story. While investigations about the bank were going on, in February of 1908, Sullivan and several other bank officers came to the Atlantic branch at night and went over the books. The books were kept in a special safe, and were to only be opened by a representative of the State Banking Department during the investigation. One Silas Stafford of that same Banking Dept. was said to have given them permission. His later testimony was that “he didn’t recall” allowing permission.

Long story long, Assemblyman Goldstein was convinced that the collapse of Union/Mechanics Bank was due to the fraudulent loans made by Sullivan and his cohorts. Hundreds of unsecured real estate loans, which turned out to be mostly in Brownsville, which was being developed at that time, had been made. Each of these loans earned a 10 to 15% bonus, all of which went into Sullivan’s pocket. When many of these loans were defaulted on, the losses were credited to the banks, eroding their bottom line, and eventually causing them to fail. Bonuses and profits to Sullivan and crew; failures and losses to Union and Merchants and Traders Banks. It was that simple, and heads would roll. David A. Sullivan’s head, especially. The trial and aftermath next time.

Pride cometh before a fall.