New York Businesses Say Cash Advance Firms Sent Threats and Looted Bank Accounts

Business owners say cash advance lenders with Brooklyn addresses are draining their bank accounts and threatening their livelihoods and safety — and there are few regulations to keep them in check.

A New York state law bans the use of confessions of judgements in cases involving out-of-state businesses, but the judgements are still allowed in cases filed by or against businesses based in New York, and are filed regularly in Brooklyn Supreme Court. Photo by Ben Fractenberg/THE CITY

This story was reported by George Joseph of The City and Ben Brachfeld of Brooklyn Paper.

At the beginning of 2020, Laurence Girard had big ambitions for his Manhattan-based company, Fruit Street Health.

“Our goal is to really prevent hundreds of thousands, or even millions of cases of Type II diabetes,” Girard, just 27 at the time, told an interviewer at a startup festival in San Francisco that January.

The company’s diabetes-prevention software model was fairly simple: connecting patients with dieticians on video, enabling them to share photos of their meals, and tracking their weight-loss progress with wireless scales and Fitbits.

But a few weeks later, Covid-19 began its blitz across the United States, paralyzing the nation’s economy and evaporating the cash reserves of many companies, including Girard’s.

So in 2021, in order to keep operating the young entrepreneur began securing financing from several “merchant cash advance” companies.

For Girard, that sounded better than a traditional loan. Instead of having to make fixed payments on a set schedule, he could pay back the advance and then some by furnishing the financier with a cut of his future revenue as it trickled in.

To secure that up-front money, the merchant cash advance companies would gain access to Fruit Street’s bank accounts and withdraw daily sums. But if those were larger than his actual revenues, the contracts stipulated he could ask for a refund and get the daily payments lowered, a process known as “reconciliation.”

One of the cash advance companies Girard signed up with was BMF Advance LLC, a company headquartered in Midwood, Brooklyn. He received several cash infusions, adding up to just over a million dollars, between August and September of 2021, according to a lawsuit he would file a year later.

But in the weeks that followed the funding, Girard’s suit alleges, BMF Advance took thousands of dollars out of Fruit Street Health’s bank account every day without any assessment of the “ebbs and flows” of his revenues.

In November when Girard texted Gavriel Yitzchakov, one of BMF Advance’s higher-ups, asking for the payments to be lowered because they didn’t line up with his assessment of his revenues, Yitzchakov seemed to treat the request as if it were a negotiation, rather than a contractually mandated calculation based on his bank statements, according to messages cited in the suit.

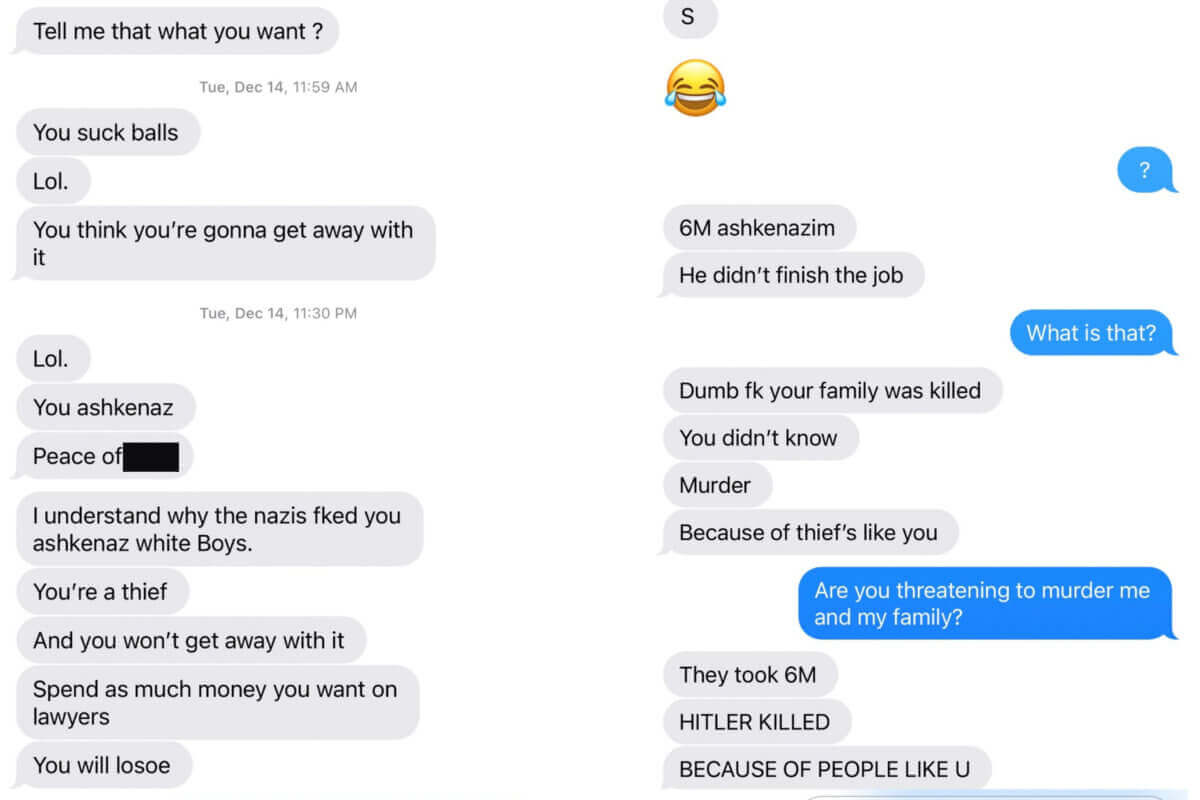

That December, as Fruit Street Health continued to argue with BMF over how much it was withdrawing from the business’ accounts each day, Girard began receiving disturbing messages from Gavriel’s brother, Binyamin Yitzchakov, himself an employee of another cash advance firm that had also financed Fruit Street Health around the same time, according to texts cited in the suit and provided to THE CITY and Brooklyn Paper by Girard.

“I guess You don’t want me to help you // And you want a Enemy,” Binyamin Yitzchakov allegedly told Girard on December 7, after the business owner didn’t reply to a previous text.

As Girard stayed silent, Yitzchakov’s purported text messages kept escalating, including vulgar, anti-Semitic attacks — coming from a fellow Jew.

“You ashkenaz// Peace of shit.// I understand why the nazis fked you ashkenaz white Boys. // You’re a thief // And you won’t get away with it,” Yitzchakov allegedly wrote on December 14th, suggesting that Hitler did not “finish the job” in the Holocaust and that Ashkenazi Jews were murdered en masse “because of thief’s like you.”

After receiving the messages, Girard, who is an Ashkenazi Jew, said he remembers being nervous about just going for a cup of coffee outside his home.

“It’s one thing if you want to sue us, right? Anybody can go to court, right?” he told THE CITY and Brooklyn Paper in an interview. “But obviously, you’re crossing a different line when you’re basically making death threats to the company you’re lending money to.”

Toward the end of that December, BMF Advance pulled out its trump card in court: a “confession of judgment,” a controversial legal agreement that has borrowers waive their right to a legal defense over any future payment disputes and has often enabled merchant cash advance companies to unilaterally empty out businesses’ bank accounts. Girard had signed one three months earlier.

On January 5th, a Manhattan court clerk certified the judgment, which held that Fruit Street Health had to pay more than $800,000, an amount Girard has not yet forked over since he does not have that amount in a New York state bank account, according to his lawyer.

Since then, the startup founder has been seeking to vacate the judgment with his own lawsuit against BMF Advance LLC.

A Bum Steer for New Yorkers?

Girard’s case is one of hundreds churning through New York’s courts thanks to a state law that puts businesses here on an unequal footing with those of others across the country.

In 2019, Albany lawmakers banned the use of confessions of judgments in New York courts for out-of-state businesses after a Bloomberg series exposed how they enabled merchant cash advance companies to obtain judgments against borrowers thousands of miles away of failing to make their payments with little to no evidence. But the reform did not stop companies from filing confessions against New York-based businesses like Girard’s.

“New York banned the confessions [for] out-of-state debtors, but they’re still using it for in-state debtors, which I don’t understand,” said Shane Heskin, a partner at White & Williams LLP who has challenged confessions of judgment for businesses across the country, including Fruit Street Health. “They’re treating their own residents worse than out-of-state residents.”

Asked about the lack of protections for New York businesses, State Senator Brad Hoylman (D-Manhattan) and Assembly Member Jeffrey Dinowitz (D-The Bronx), the 2019 law’s sponsors, explained that the bill had been proposed by New York’s Office of Court Administration, which was concerned about filings clogging the docket and the inability of out-of-state businesses to contest faraway court cases.

Still, both lawmakers said further legislation to protect New York businesses may be necessary. “I’m proud that Albany took steps to protect out-of-state businesses from predatory practices by banning uses of confessions of judgment,” said Hoylman, chair of the Senate Judiciary Committee. “We should consider the same to protect our homegrown small businesses here in New York state.”

“There ought to be a core premise in our legal system that people are able to fully understand the contracts that they sign,” said Dinowitz. “And I am committed to continue working with my colleagues in the Legislature to address any and all predatory activity around confessions of judgment that is happening in New York.”

Gavriel Yitzchakov and his brother Binyamin, who allegedly sent the text messages to Girard, did not respond to repeated requests for comment. BMF’s two named attorneys on the case also did not respond to requests for comment.

THE CITY and Brooklyn Paper also attempted to visit BMF Advance’s office, but the address listed in its incorporation papers turned out to be a tiny metal mailbox tucked inside a shipping store in Midwood.

In a sworn affidavit submitted in court — filed in the spring from Cancun, Mexico — Gavriel Yitzchakov said that his firm “worked in good faith” to reduce the fixed payments following requests from Girard, despite Fruit Street Health allegedly being “in default” of their agreement.

Murky Industry, Few Regulations

Merchant cash advance companies have been around since the late 90s, but the industry picked up steam following the 2008 financial crisis, which made traditional banks more reticent about lending and shrank the footprint of many smaller, regional banks that had been willing to take risks on loans for small businesses.

With lending to small businesses down, the cash-advance industry moved in to fill the void and grew rapidly, nearly doubling from an $8.6 billion to a $15.3 billion industry between 2014 and 2017 by one estimate.

Because courts have generally not classified these cash advances as loans, the industry has evaded many licensing requirements and regulations, like state usury caps, and scrutiny from agencies like the Consumer Financial Protection Bureau, which monitors payday lenders.

And with this lack of protections, attorneys and small businesses claim, many cash advance companies would resort to lurid tactics to secure repayment.

The owner of a movie camera rental company, in debt to a company called Par Funding, told Bloomberg in 2018 that a muscular man named Renato “Gino” Gioe walked into his Los Angeles office and mentioned that another client behind on payments had been mangled in a car crash, declaring “these are the kinds of things which strongly affect wives and children.”

More recently, Heskin, the attorney, alleged in the Fruit Street filing that a BMF Advance principal came by the North Carolina home of an assisted living facility owner and demanded to see their watch collection, seeking to “borrow” one of the prized timepieces when that owner couldn’t make payments during the Omicron surge.

And that’s to say nothing of Jon Braun, a marijuana smuggler-turned-lender who secured a presidential pardon from Donald Trump. Free on bail before his prison stint, he plunged headfirst into the merchant cash advance industry and became notorious for his tactics, telling one real estate developer he could “make your life a living hell” and would “take your daughters from you,” and informing a plumber that his family would “would find you floating in the Hudson” if only he were located in New York, according to court filings by state Attorney General Letitia James.

Such stories went under the radar especially in New York, where county courts frequently rubber-stamped confessions of judgment resolving disputes in favor of merchant cash advance companies, which could file from anywhere in the country and today remain some of the court system’s most prolific users.

The court system’s ability to efficiently process the filings and state judges’ consistent willingness to rule that merchant cash advance firms were not usurious lending companies made New York a magnet for the industry.

In 2018, state authorities began scrutinizing the industry after Bloomberg’s explosive series about the industry’s hard-nosed tactics and leaders with criminal histories. Over the next two years, Albany passed two laws, the one to ban confessions of judgment for out-of-state debtors and another to force more transparency in merchant cash advance contracts.

In 2020, around the same time Albany was taking action, the state attorney general sued three New York City based merchant cash advance companies — accusing the principals, including Braun, of harassing and threatening debtors with litigation and even violence.

Lawyers for the merchant cash advance industry say most companies, especially larger ones, willingly refund and lower payments for businesses more often than not so long as those businesses can prove that their revenues have indeed dropped below projections.

“My experience with the more established companies…is that if a reconciliation request comes in, and it shows a decline in revenues, they’ll grant it,” said one attorney who represents merchant cash advance companies and requested anonymity to speak freely. Heskin, the attorney frequently on the other side of merchant cash advance firms in the courtroom, appreciates efforts by law enforcement to crack down on particularly egregious actors, but argues those have a limited effect on the cash advance industry.

“They don’t need a license. Anyone can do it,” he said. “They’re not regulated unless the attorney general has the time to crack down on them. And they can’t go after everybody because it’s like whack-a-mole, right? They’ve only got some many resources.”

He Owed Them Money — They Texted Him a Photo of His Daughter

This July, a home repair contractor in Orange County, N.Y., was feeling so threatened by a merchant cash advance company that he went to police after a man affiliated with the south Brooklyn-based company texted him a photo on WhatsApp of his four-year-old daughter.

A few months earlier, he signed up for a cash advance totaling a half million dollar infusion from Eagle Eye Advance, a firm with a business address listed in Sunset Park, Brooklyn, according to state records. In exchange they expected him to pay back $861,925 in future revenue with $4,750 coming out of his bank account daily, plus a $75,000 “origination fee,” according to a copy of the merchant cash advance agreement submitted to Orange County Supreme Court by Eagle Eye and a subsequent complaint filed by the contractor.

A few weeks later, he signed the dotted line for an additional $150,000, in exchange for just under a quarter million dollars receivables.

But contrary to the first contract they had signed, the cash advance company refused to honor its reconciliation clause and refund the contractor the difference between what they’d taken out of his bank account and his actual revenues, according to the contractor’s suit filed last month in Orange County, so he began withholding payments.

About a month later, the home repair man began receiving messages from a man who said he owed him money.

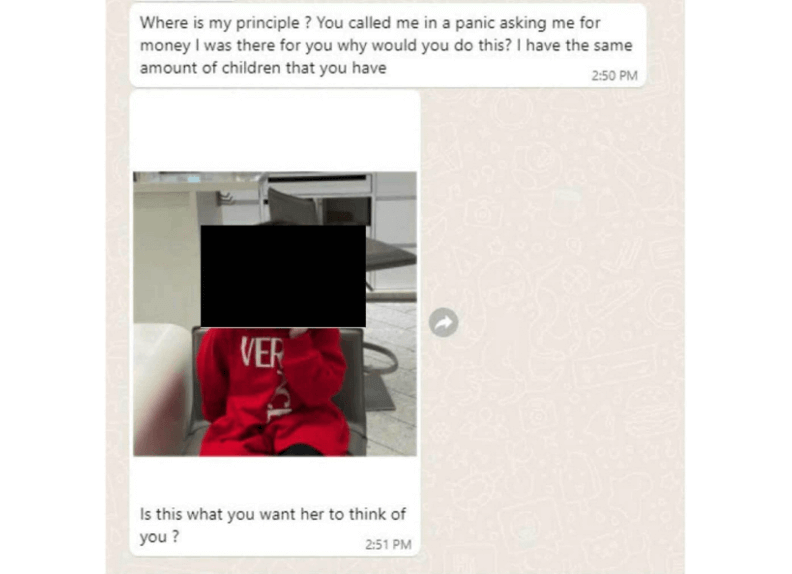

“Where is my principle? You called me in a panic asking me for money I was there for you why would you do this?,” texted Kevin Brown, CEO of Everyday Funding Group, a servicer of Eagle Eye Advance, according to the contractor’s suit.

“I have the same amount of children that you have,” Brown, who also goes by the last name “Schwartz,” continued. Brown then texted the contractor a picture of his toddler, asking: “Is this what you want her to think of you ?”

The texts were sent “on or about July 12,” according to court documents. On July 13, the contractor walked into a police station in Chester, N.Y., and reported that he felt threatened by the message.

“It’s a threat,” claimed the contractor, who spoke to THE CITY and Brooklyn Paper on the condition of anonymity in a subsequent interview. “I know they would put money on people’s head. It’s too much money involved. So that’s exactly what it is.”

Two weeks later that July, Eagle Eye Advance provided him with a reconciliation, acknowledging that he had overpaid more than $16,000 in April but claiming that he had also underpaid more than $22,000 in May. The contractor’s attorneys disputed this, claiming in their subsequent lawsuit that the company had failed to provide an “explanation as to the method of calculation” they’d used.

The next month, as the two parties continued to argue, Eagle Eye Advance filed a confession of judgment in August against the contractor. Six days later, an Orange County clerk court clerk signed off on the judgment, which held that the contractor owed just over a million dollars to Eagle Eye Advance, including about a quarter million dollars in attorney’s fees.

The contractor’s suit against Eagle Eye Advance, Everyday Funding Group, and Kevin Brown is still being litigated in court. His bank account has been frozen since the confession of judgment was filed.

Brown did not respond to repeated requests for comment.

When THE CITY and Brooklyn Paper attempted to visit the address of Eagle Eye Advance listed on its incorporation papers, it found an office in Sunset Park that was empty and cleared out except for broken bits of glass, office supplies and other scattered debris.

As of last Thursday, a tenant termination notice was affixed to the door declaring that “MCA Capital Holdings LLC,” another debt servicer of Eagle Eye Advance according to the lawsuit, had to leave by the end of August.

In an email, Eagle Eye’s attorney, Gene Rosen, told THE CITY and Brooklyn Paper that the reconciliation his client made “was calculated based on the bank statements” that the contractor’s business had provided, and that his company was given a “detailed explanation as to how the reconciliation was calculated.”Rosen also alleged that the contractor’s company “was dishonest in its dealings,” and that Eagle Eye never requested the business deliver more revenue than was agreed upon.

The attorney said that the text was not meant to be a threat, adding that the image of his daughter came from the contractor’s WhatsApp profile picture, and pointing out that opposing counsel had made its own “obnoxious” comments to Eagle Eye.

“The text message containing a picture of a child was not a threat,” Rosen told THE CITY and Brooklyn Paper via email. “While the text message certainly did not help the situation, it is unlikely tensions would have escalated to the point they did if [the] attorney had not harassed and baited Eagle Eye. There is no other incident in which Eagle Eye has sent a customer a picture of the customer’s child.”

For now, the contractor is still in court hoping a judge will unfreeze his assets and vacate the confession of judgment, arguing that the merchant cash advance was, in actuality, a criminally usurious loan and that Eagle Eye Advance violated its own agreement provisions.

“I don’t know if you can understand what filing means. Filing means they stop your life,” he told THE CITY and Brooklyn Paper, referring to confessions of judgment in general. “I lose everything, I lose access to my accounts, my customers, my business, I can’t go on.”

Editor’s note: A version of this story originally ran in Brooklyn Paper. Click here to see the original story.

Related Stories

- Mayor Adams Wants to Keep the BQE, Plans to Counter Highway’s ‘Racism’ With Parks, Plazas

- Here’s How Grocery Delivery App Workers Are Treated in NYC

- Quick-Delivery Startups Fold While Bodegas Hold On

Email tips@brownstoner.com with further comments, questions or tips. Follow Brownstoner on Twitter and Instagram, and like us on Facebook.

What's Your Take? Leave a Comment