Is the Housing Bottom Here?

Has the housing market bottomed out? That’s what they’re saying over on the Calculated Risk. Noting that the data shows that new home sales hit a low in mid-2010 and have gone sideways since, the soothsayers at the economics blog predict that housing prices, a metric that hits a lot closer to home for buyers…

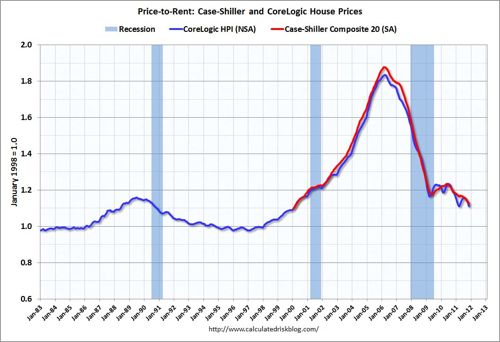

Has the housing market bottomed out? That’s what they’re saying over on the Calculated Risk. Noting that the data shows that new home sales hit a low in mid-2010 and have gone sideways since, the soothsayers at the economics blog predict that housing prices, a metric that hits a lot closer to home for buyers and sellers, will hit a low point next month and rebound from there. The writer cites three reasons for the optimism: (1) the national price-to-rent ratio (historical graph on the jump) is finally back to “normal” levels; (2) there’s been a large decline in listed inventory; (3) housing policy initiatives are likely to lessen the downward pressure of distressed sales. Of course, all real estate is local, so results may vary.

The Housing Bottom is Here [Calculated Risk]

BHO, you missed your chance. You should have bought in 1992!

reading these status for ny’ers is like analyzing a foreign country. author basically sidesteps shadow inventories by rationalizing that they will be solved politically, and makes no mention of how the economy might perform without a 1.3 trillion dollar deficit (i.e.worth about 3 years of economic growth, placed on the credit card).

Private equity coming to the distressed housing sector may help: http://tinyurl.com/7ooy4sk – – in fact, this may be a good pressure relief valve on shadow inventory that the market needs.