Bed Stuy Reno: An Introduction

Editor’s note: We are very excited to present a new series about a renovation taking place in Bed Stuy that is being financed with a 203K loan. We know a lot of our readers are looking in Bed Stuy or similar neighborhoods and wondering if they should buy a fixer upper and finance the repairs…

Editor’s note: We are very excited to present a new series about a renovation taking place in Bed Stuy that is being financed with a 203K loan. We know a lot of our readers are looking in Bed Stuy or similar neighborhoods and wondering if they should buy a fixer upper and finance the repairs with a 203K loan. We hope this series will answer some questions about the process, such how to find a good contractor willing to work with the program and when the added costs are worth it.

In August, I closed on a house in Bed Stuy that needed work with a 203K loan to pay for the renovation. I plan to blog here about the renovation, including how the 203K process goes.

But first, a little bit about my story: If money were not an issue then I would have loved to search for a large brownstone in Fort Greene, which is where I’m currently renting. But without unlimited funds I widened my search to Bed Stuy. I was looking for a two- or three-family Brownstone that specifically needed work. Most of the renovated houses I viewed were pretty awful and I didn’t want to pay for someone else’s bad renovation job.

I moved to New York about three years ago planning to rent for a year and then buy. I had previously owned a few places in other cities and in those experiences, buying was cheaper than renting. I started looking at houses in Brooklyn after my one year mark but didn’t pull the trigger because I felt the market still needed a price correction. Boy was I wrong. I passed on some really good deals because I thought they were overpriced at the time. But you know what they say about hindsight.

Last summer, I got very aggressive in my house search but at that point the market had already starting to skyrocket. My real estate agent found my current house in December, which was listed with a small brokerage firm. By January, my offer was accepted but we didn’t close until August. Long story short, the seller was ill and they promised to deliver the place vacant but could not deliver on that promise.

The good news is that I was in contract for so long that I gained some equity by doing nothing.

At the time I started looking, I had no idea how a 203K loan worked. When I was researching traditional loan options, a loan officer at Wells Fargo told me I should go with the 203K instead.

Basically, the 203K loan allows you to borrow an amount based on what the house will be worth once it’s renovated. For example, if you purchase a house for $500,000 and the appraisal of the house post renovation is $625,000, then theoretically you could borrow an additional $125,000 for the renovation work. Of course there are a lot of other factors but that’s the basic gist of how a 203K loan works. The other benefit of the 203K loan is that it’s still an FHA loan product -– which means I only needed to put down 3.5 percent.

I purchased a two-family home with two boarders, as the 1930s certificate of occupancy puts it. (It’s not an SRO. What that means in modern terms and for my house is that there are two self-contained studios with a shared bath in the upper duplex.) My goal is to upgrade the rental units and complete a full gut renovation on the owner’s duplex. So far, I’m nine weeks into the process. I started blogging about it at The Bed Stuy Reno Blog, so you can read all about my progress so far. Next week: My first draw inspection by the 203K consultant.

It’s nice to see all the progress a home renovation can do. I don’t live in the city but, as i get more and more into renovating my own home, i can’t help but feel addicted to home renovation sites. Anyone find using portable storage useful for organizing their displace things? I go through this company and find the whole process is a bit less stressful.

I don’t think I’ve ever seen brownstones with upper floors that have vinyl siding like that. I’m assuming those used to be wood at the top and over time were downgraded – is that more common than I think it is?

Can you flesh out these numbers? What was the price of the house, and what is the 203k loan amount?

Congrats on your purchase. We had a similar story with our contract. Tenant had to be bought out before he vacated. Long story short, we entered contract in Dec 2012 and closed in April 2013. 203k loan is a great product but you must find a contractor willing to work with you. Fortunately we used the 203k streamlined which allows you up to 35k in renovations. Got a new (flat) roof, gut reno of kitchen and bath and other misc… Contractor gets half $$ at closing and half at work completion.

You have to stay on top of the contractor all the time. Sometimes you have to come out with a little xtra $$ to cover any upgrade in materials. Instead of $2 Sq ft tile, u pay a lil xtra to get $4 per sq ft out of pocket. The most important thing is a good contractor with enough funds to cover the project. Contractor will need to be vetted, credit check,reference check etc and licensed.

The 203k program is great if u don’t have funds for a renovated brownstone. But if u have the stomach to go thru a reno(patience) you will be good. There will be lots of sleepness nights and frustrating days. Sometimes you want to strangle your contractor. Good luck.

Hi Amzi- Great that you’ve been in the house! I actually don’t know much about house’s history.

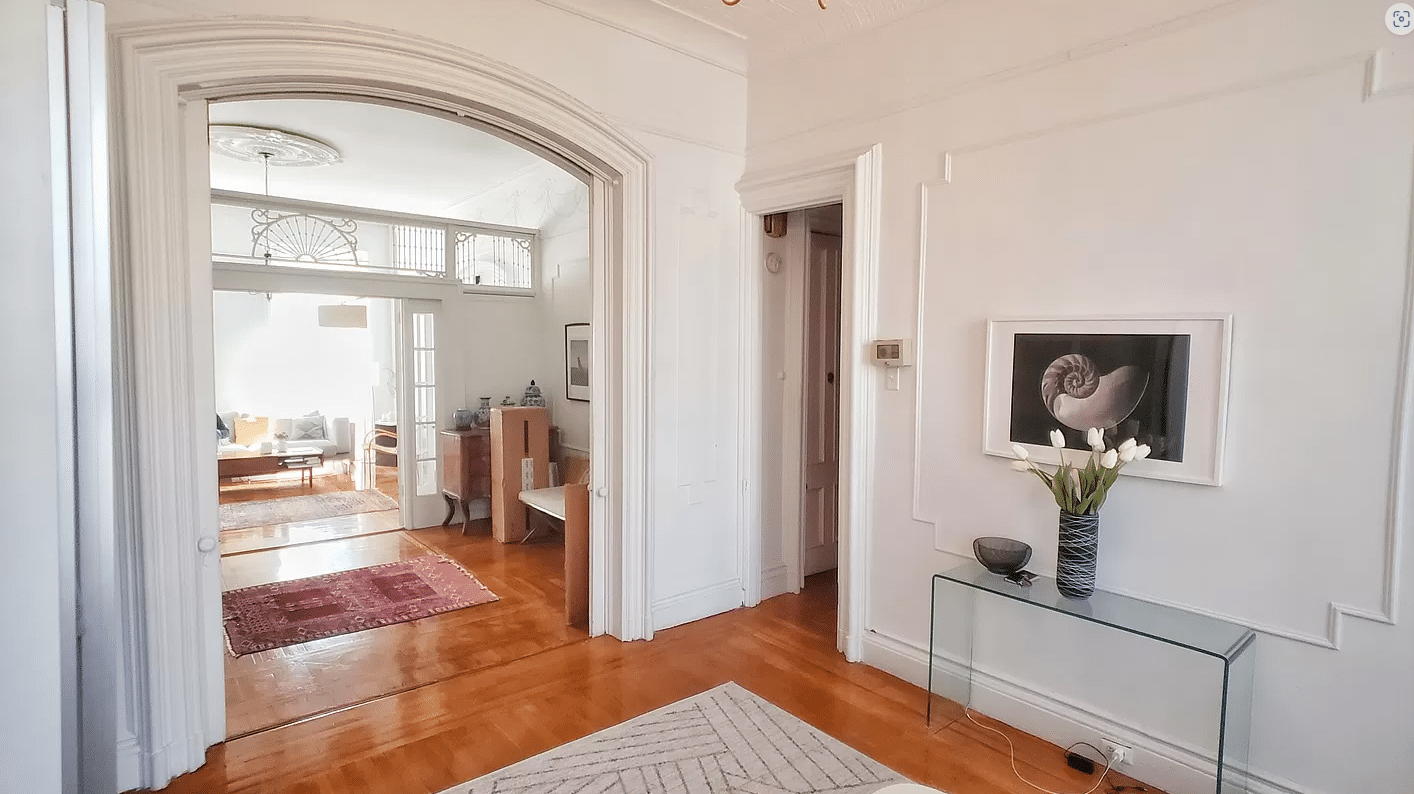

Sadly all the original detail was stripped from the house with the exception of four marble fireplaces.

I have been inside this house and it needs LOVE! Glad that they are doing a Bed Stuy Reno on here…