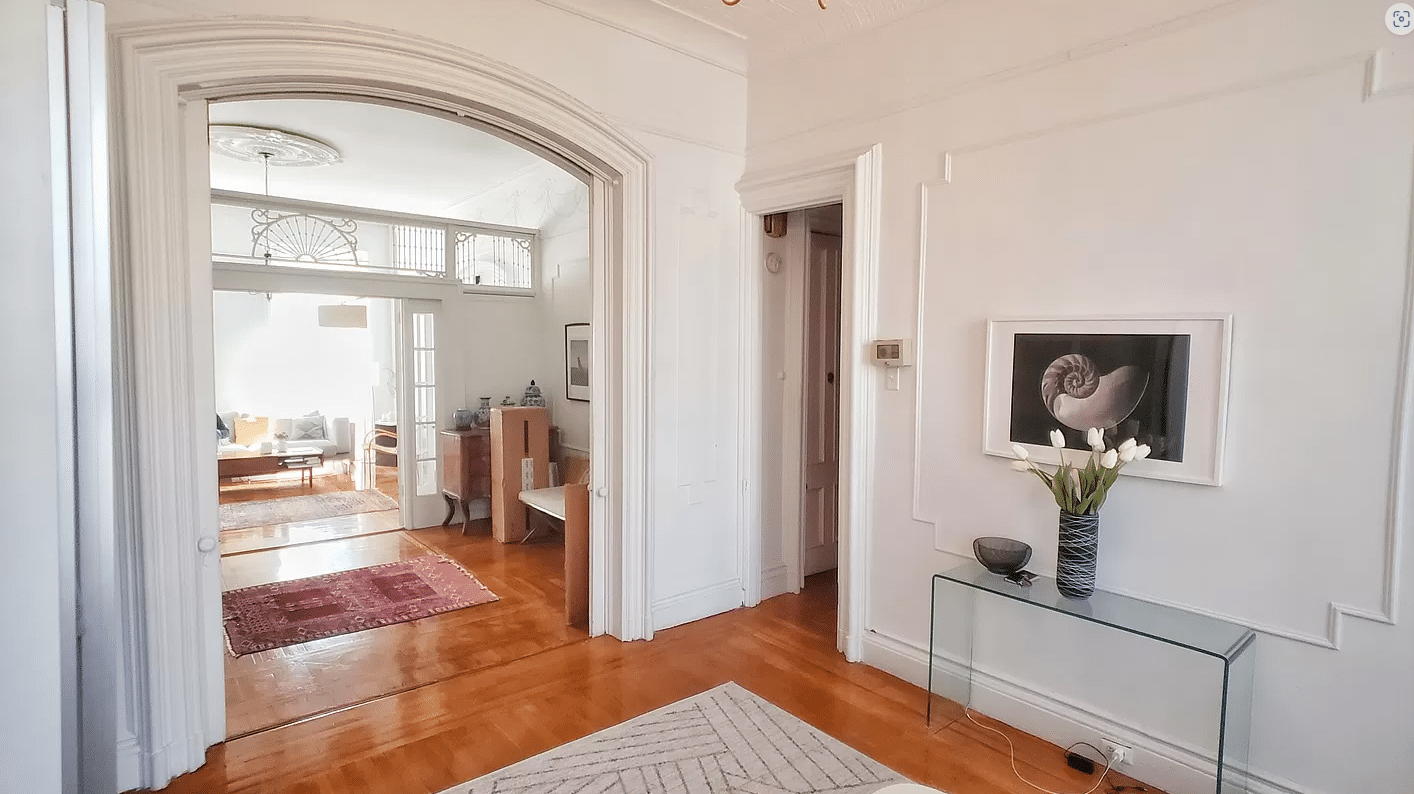

Brownstoner Listings Get a Makeover

We’re excited to announce that the new Brownstoner Marketplace launched over the weekend. In addition to improved aesthetics and performance, the new listings platform is designed to work well on all your devices and play nicely with the various social media platforms. To celebrate the launch, we’re offering sales and rental listings, normally $25 and…

We’re excited to announce that the new Brownstoner Marketplace launched over the weekend. In addition to improved aesthetics and performance, the new listings platform is designed to work well on all your devices and play nicely with the various social media platforms. To celebrate the launch, we’re offering sales and rental listings, normally $25 and $10 respectively, for the low, low price of $1 through the end of the month. Try it now! If you’re a real estate firm that would like to have your properties automatically feed into the Brownstoner platform (like Corcoran, Halstead and many others), please contact Brad@Blankslate.com. In related news, you might also notice a new section of Upstate New York listings. More on that later.

What's Your Take? Leave a Comment