Taking the Pulse of Townhouse Sales in the Slope

Last week we received a document entitled Charles Ruoff’s Townhouse Report, the first in a biannual series Ruoff, a Brown Harris Stevens broker who specializes in townhouse sales in Park Slope and Prospect Heights, intends to produce. Ruoff’s recent big-ticket listings include 598 2nd Street ($3,450,000) and 909 Union Street ($2,495,000). The broker’s assessment of…

Last week we received a document entitled Charles Ruoff’s Townhouse Report, the first in a biannual series Ruoff, a Brown Harris Stevens broker who specializes in townhouse sales in Park Slope and Prospect Heights, intends to produce. Ruoff’s recent big-ticket listings include 598 2nd Street ($3,450,000) and 909 Union Street ($2,495,000). The broker’s assessment of the current townhouse market in the Slope and Prospect Heights is as follows:

We are once again faced with limited supply of homes in all price points. The third quarter of 2007 produced some noteworthy sales and in fact record-breaking prices in both the North and South Slope as well as in the adjoining neighborhood of Prospect Heights. Inventory as well as demand seems to be especially lacking in the high $1 million dollar to low $2 million dollar range. The limited supply of multi-family homes on the market can best be attributed to the dramatic rise in rents for landlords now receiving very healthy cash-flow.

Sound about right to you?

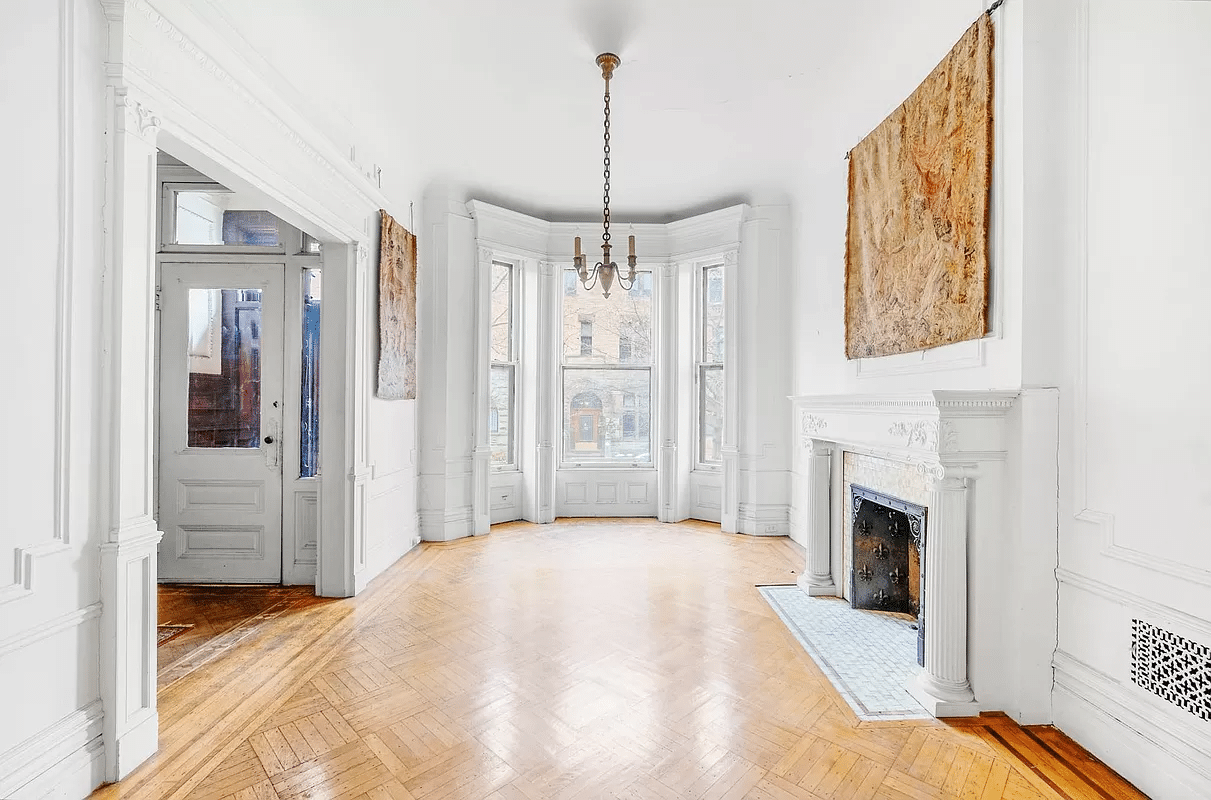

Photo by Da Nator.

To the last post, selling real estate is based on supply and demand. If you think most brokers keep prices artifically high to obtain higher commissions then you are completely ignorant. Some may, I do not. It is not in the best interest of the seller nor of the firm who has the listing to employ this philsophy. You attempt to price a townhouse based upon: location, condition, buyer preferences, width, comparable sales, etc.. Clearly it is not an exact science and obviously many listings come to the market insanely overpriced from the start. This can be attributed in many cases to a broker/agent’s hope that if they provide an aggressive price they are assured to obtain the listing. This most often backfires and this speaks more closely to the point you raised above. Pick an agent/firm with clear track records of selling many houses, interview former sellers, ask for references, make certain that the firm you pick will co-broke with other real estate firms and demand this in writing as many of the smaller players will provide lip service but rarely back it up. Look for an agent who has demonstrated the ability to get the job done well.

In today’s market banks are becoming more financially responsible for assessing value prior to extending financing. So the so called “idiot among us” (from the prior post)can provide an offer subject to appropriate bank financing being obtained and reduce the risk of overpaying.

In the Park Slope market we are fortunate that supply is low and prices remain at healthy levels..

Sincerely,

Charlie Ruoff

Brown Harris Stevens

I agree that it is worthless to read/quote Brokers’ commentary. The only useful information they should provide is data (i.e. prices asked, prices sold, locations etc). They will never provide any valuable interpretation to any trend as their main objective is to keep the market prices high.

Just look at the listings in the NYT. Look at the listings for the new developments on -hideous but up & coming- 4th avenue that remain unsold or -like the Argyle- in the middle of construction.

Brokers have not modified any pricing even though the market has crashed all week, everyone acknowledges the onset of recession, the regulation of the mortgage industry, the elimination of exotic mortgages and the difficulty experienced by credity worthy borrowers to obtain a plain vanilla mortgage.

Most brokers have not/will not change any price even if they are negotiable or the sellers are willing to accept less. This is mainly because their commission depends on it and they will be lauded by colleagues in the industry for “making the sale in a tuff market” (i.e. finding the idiot among us).

Let’s see how they do with the remaining units and how many flippers and buyers who wish to rent them get their prices, if we go into a recession there will be no trees along this area, and the place will look bleak and ugly. The rents will be low. The only people who purchase along 4th Avenue are the folks who can’t afford to live near the Park for the same amount of space

this is nothing like florida.

most of those condos were bought by either flippers, or people who bought them as investments and never lived there. there’s a big difference between that and buying a place to live in. how is nyc like tampa?

i see neither of those scenarios playing out on 4th avenue.

what condos are you talking about anyway? novo, crest and even argyle are more than 60% sold. i believe novo is more like 75% sold.

No, what I am saying is that similiar to Florida, if a ton of the 4th Avenue places find no buyers then the developers are going to have to rent them, bringing down prices.

why doesn’t it make sense, 8:05?

rents increased during the last recession…

if less people are buying, more people are renting.

landlords don’t care if we are in a recession or not, if there is increased demand for their apartments.

you are assuming there will be a mass exodus from new york city.

which makes little sense because the rest of the country is far worse off than nyc at this given time.

IF the condos don’t sell on Fourth Avenue then a huge influx will come on the market for rent. We are starting to see negative pressure on rents. Rents will most likely not increase if we are in a deep recession it just makes common sense.

Wait, where exactly is this neighborhood Park Slope?

if all the people who were in on the buying frenzy of the pas few years now choose to rent instead of buy, there will be more demand for rentals, thus higher prices.

so if you REALLY think prices are going to crash hard, you should be prepared to pay a lot higher rents to compete with all the people cashing out of their homes, foreclosing and generally not buying houses as you all seem to claim.

either way, i’m happy i own. even if the price of my house decreases of the next couple years. i bought here for a place to live on a fixed cost without having to deal with wondering each year whether or not i could afford the impending rest increase that of course came every year i was a renter.

personally the thought that i’ll have the same housing cost for the next possibly 29 years if i don’t move, that sounds great to me. at least i know what it will be. that gives me a lot of peace of mind.