Streetlevel: Still No Takers for Gage & Tollner Space

The former space that was occupied by Gage & Tollner from 1879 until T.G.I.F. took it over just a few years has been sitting empty for more than six months, an apparent sign of the immediate area’s current identity crisis. The landmarked interior is calling out for a first-class establishment; the nearby sneaker and electronics…

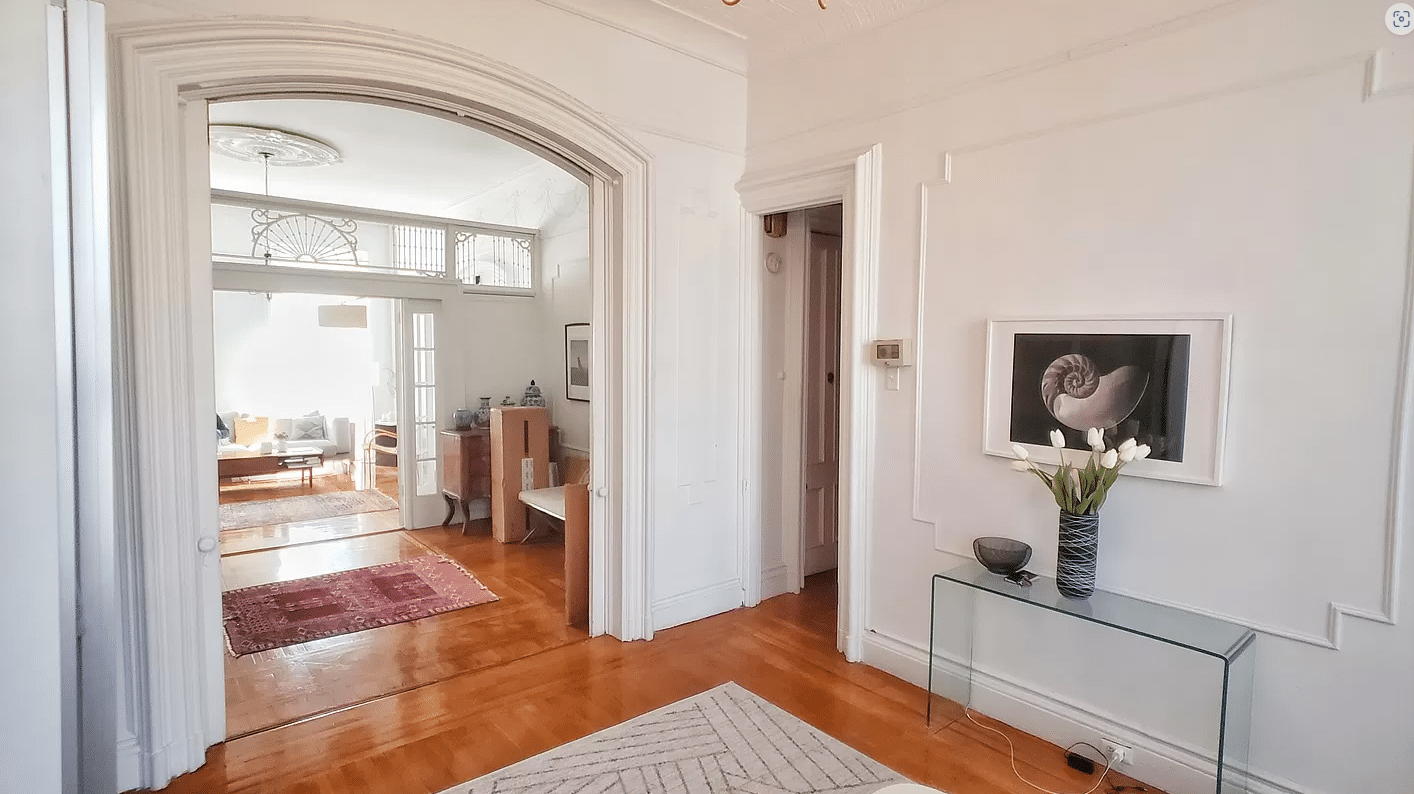

The former space that was occupied by Gage & Tollner from 1879 until T.G.I.F. took it over just a few years has been sitting empty for more than six months, an apparent sign of the immediate area’s current identity crisis. The landmarked interior is calling out for a first-class establishment; the nearby sneaker and electronics stores probably aren’t helping the cause. Maybe the new occupants of 110 Livingston should start a letter-writing campaign to Danny Meyer.

Thank God It’s Gone: TGIF Space for Rent [Brownstoner] GMAP

Today’s Crain’s is reporting that Amy Ruth’s has just least the G&T space and will open their second NYC restaurant there in the coming year.

http://www.newyorkbusiness.com/apps/pbcs.dll/article?AID=/20071012/FREE/71012009/1050/newsletter01

Don’t they serve semen burgers at Applebee’s?

I’m lucky enough to have a spouse whose guilty pleasure is crummy chain restaurant dinners. Even he didn’t like this TGIFridays. The service was terrible and it was a lot more expensive than Applebee’s at the other end of Fulton Mall. We only went once.

I also agree that the fact that the mall is totally dead after 8 does not help business here.

My wife and I went to G&T many times. I loved the southern food. The demographic was distinctly on the higher end as we were often the youngest by at least 2 decades. Over the years we went, the space stayed the same, but the quality of the food and service declined to the point it just wasn’t worth going. When it became a TGIF, it didn’t seem worthwhile going 5 blocks for that (Adams/Bk Bridge Blvd does create quite a wall for the Hts). After hours, Fulton is still desolate so you need a real good reason to venture out there for dinner especially with all the places on Atlantic and Smith these days. I’ve also heard that Fulton mall has some of the highest retail rents in the City. Low end retail can be extremely profitable. I agree that no young enterprising chef is coming to that space to create a dining destination given the economics. Probably need to have the owner open his own restaurant and hire a young chef.

LOL @ The What (4:01)… No more log in, deleted posts, everyone hates you. You really thought you’d roll in here and be the voice of reason, didn’t you?

Pathetic.

2:29 AM: That definition is for the country as a whole, not New York City. In places like Chicago, tenants who cannot afford to pay market rent increases upon lease expiration are forced to move elsewhere. The vast majority of rental apartments in New York City are subject to some kind of rent regulation that guarantees the right of renewal with a fixed, low renewal increase.

You have renters and owners – if most renters are protected from increases in rents as well as arbitrary eviction, how are people displaced? Surely, owners are not displaced.

So, why don’t you tell us – who exactly is displaced? Who has been forced to flee their neighborhood by this evil of gentrification?

We’re all waiting for an answer.

TGIF failed because the food was basic and the service was really poor. I liked going to the space when it was the old G&T. The woodwork & gaslight was great and the food was special. I thought TGIF would make an understandable replacement so I gave it a try as an alternative to other fast food joints. Service was poor and the place was loud. If it was in any other location, the old G&T would have lived on.

Gentrification, or urban gentrification, is a phenomenon in which low-cost, physically deteriorated neighborhoods undergo physical renovation and an increase in property values, along with an influx of wealthier residents who may displace the prior residents.[1][2]

Proponents of gentrification focus on the benefits of urban renewal, such as renewed investment in physically deteriorating locales, improved access to lending capital for low-income mortgage seekers as their property values increase, increased rates of lending to minority and first-time home purchasers to invest in the now-appreciating area and improved physical conditions for renters.[3] Often initiated by private capital, gentrification has been linked to reductions in crime rates, increased property values, increased tolerance of sexual minorities[4], and renewed community activism.[citation needed]

Critics of gentrification often cite the human cost to the neighborhood’s lower-income residents when debating the topic. They expound that the increases in rent often spark the dispersal of communities whose members find that housing in the area is no longer affordable. [citation needed] Additionally, the increase in property taxes may sometimes force or give incentive for homeowners to sell their homes and seek refuge in less expensive neighborhoods. While those who view gentrification as a positive phenomenon praise its effect on neighborhood’s crime rates, those with different paradigms believe that the crime has not truly been reduced, but merely shifted to different lower-income neighborhoods.

they should hold dogfights there