Brooklyn Investment Market Booming

A new report out from real estate firm Massey Knakal finds that the Brooklyn investment market is on track for another record year, eclipsing even the bubbly markets of 2006 and 2007. In the first half of 2014, 1,068 investment properties (apartment buildings, mixed use, industrial and office buildings as well as development sites) sold, a…

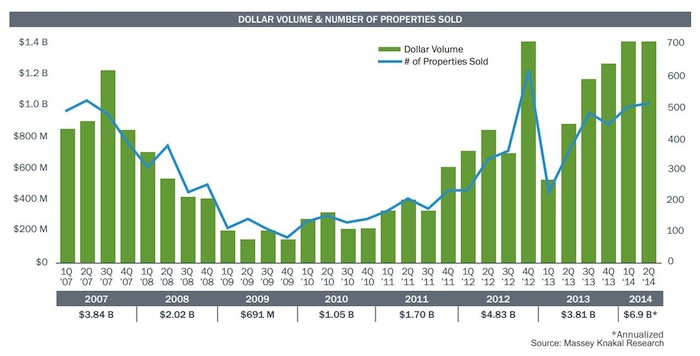

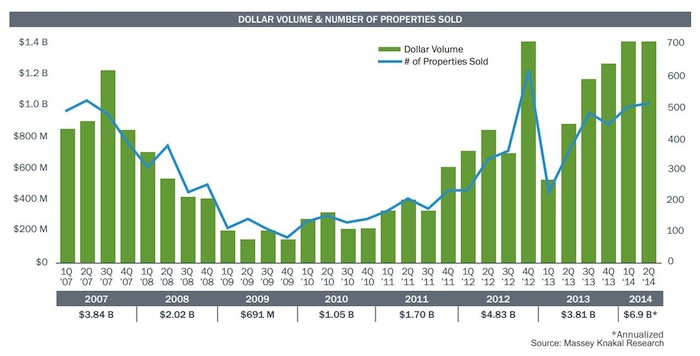

A new report out from real estate firm Massey Knakal finds that the Brooklyn investment market is on track for another record year, eclipsing even the bubbly markets of 2006 and 2007. In the first half of 2014, 1,068 investment properties (apartment buildings, mixed use, industrial and office buildings as well as development sites) sold, a 92 percent increase over the first half of 2013. And that is the largest number of sales of any year, beating out the previous high from the first half of 2007. Purchases of elevator buildings were up 342 percent in the first half of 2014 over the same period the previous year. Even the total dollar amount of sales was up dramatically: 142 percent over the first half of 2013. The total dollar figure of all Brooklyn deals, $3.4 billion, far surpassed the previous high of $2 billion in the first half of 2006.

For investors, this boom is drawing in far more cash and resulting a lot more deals than we saw during the real estate bubble in the run up to the financial crisis. If investors are throwing this much money around, should the rest of us be worried?

Chart: Massey Knakal

Brooklyn Real Estate has proven time & time again through all the cycles of up & down that it is a safe place to put your money. Yes, there have been some nail biting periods for rental investors, but those that stayed calm and carried on through the 60’s & 70’s are mostly the ones selling now. It was hard work and hopefully City politicians will not make the same mistakes again, but Rent Stabilization is self destructing so it will be difficult to go back to that destructive faze. NYC is and always will have a long term rental market.

Sales can go boom & bust but that is mostly due to if the Banks are in the home owner mortgage market, when they are not…just rent your space out and the rents go up and the sales market comes back stronger than ever with the pent up demand to buy caused by the Banks and the Fed doing what it does to slow the market for a while. Other Cities do not have the strong rental back up to float all property owners through the dips of the market.

The other equation to this high buying is that investors either write a check to the IRS or buy another building to absorb the cash flow, they can carry the losses for a few years. It obviously makes more sense to buy more buildings than to pay more taxes, that they will never see again.

Investors and home owners are not on the same market swings but they do cross paths at the roundabouts!

It is much better than putting your money in the stock market for unknown robots and other volatile unknowns to control your investment.