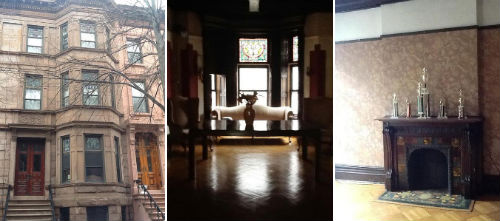

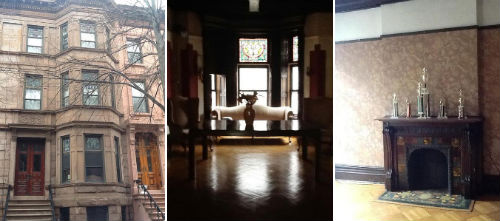

"Crooklyn" House Closes for $1.7M

The beautiful George P. Chappell-designed house at 7 Arlington Place, which was featured in the movie “Crooklyn,” has sold for $1,700,000. That’s not quite as high as we first reported, but it’s still indicative of how hot the Bed Stuy market is right now, as DNAinfo reported. The ask was a lot less: $1,300,000. Do you think…

The beautiful George P. Chappell-designed house at 7 Arlington Place, which was featured in the movie “Crooklyn,” has sold for $1,700,000. That’s not quite as high as we first reported, but it’s still indicative of how hot the Bed Stuy market is right now, as DNAinfo reported. The ask was a lot less: $1,300,000. Do you think these prices will last, or are we in some kind of a bubble right now? How do you think it will affect the neighborhood?

“Crooklyn” House Sells for $1.7M, a Reflection of Bed-Stuy Boom [DNAinfo]

7 Arlington Place Gone for $500K Over Ask [Brownstoner]

The real question people have to ask themselves is what are the other options? Buy a condo in the Heights or Park Slope and your looking at over $1m anyway (for anything with more than one real bedroom at least), and with tax abatements drying up in the near future carrying charges will be astronomical. In my opinion multis in brooklyn will always be attractive because taxes are low and rents are always good. Bedstuy will be a good long term hold since there is such a large concentration of beautiful homes, and close proximity to the city/jobs. Real estate goes in cycles, but if you think longterm you will never get hurt buying now.

Brownstoneshalfoff still lives in his mammys garden level rental. Be a good son and thank her today.

It seems to me the bubble was because people were paying more than they could afford. Here, it seems buyers re putting a lot down, if not an outright all cash deal, and banks are being more restrictive. Prices might level off, but I would be surprised if they went down again.

i wouldn’t use the word bubble to describe this, but probably say we’re a year or so off of the peak.

If you look at the actual selling price of literally 150+ houses in Bed Stuy, they are being bought for 200k to 500k by investors, who then turn around and sell them for 600k to 800k without putting in a cent. If they renovate the houses, they sell them for 900k to 1.4 MM or more. I think these people are doing questionably illegal things because I know I would pay more for those houses than the investors, and imagine I’m not alone.

do you even know what a preforclosure is? it means nothing.

BHO, you were funny for a while but it’s old now.