Rising Rents in Brooklyn Force Navy Yard Modular Factory Capsys to Close

Brooklyn’s affordability crisis has priced out yet another longtime business, 19-year-old modular manufacturer Capsys. Capsys had a nearly decade-long monopoly of New York’s modular market following its 1996 founding. Today, it neighbors Forest City Ratner’s competing modular factory in the Brooklyn Navy Yard. But not for long. While space at the Navy Yard often leases for $20…

Brooklyn’s affordability crisis has priced out yet another longtime business, 19-year-old modular manufacturer Capsys.

Capsys had a nearly decade-long monopoly of New York’s modular market following its 1996 founding. Today, it neighbors Forest City Ratner’s competing modular factory in the Brooklyn Navy Yard. But not for long.

While space at the Navy Yard often leases for $20 a square foot or more, Capsys’ $4 per square foot lease has allowed them to stay in business by remaining relatively close to their clients, like the developers of Fort Greene’s Atlantic Center and East New York’s Nehemiah Spring Creek complex.

The company has been searching for space since 2010, when they learned their long-term lease would not be renewed, The Real Deal reported. Unfortunately, founder Nicholas Lembo discovered the only spaces within Capsys’ budget were outside New York City, and thus too far for any current employees to commute.

Relocating to Pennsylvania or New Jersey — while affordable — would make it difficult for Capsys to have such a close working relationship with its clients. Transportation is another issue. The city is already restrictive when it comes to moving modules, and requires an expensive police escort. Fabrication outside of NYC would only compound the logistical issues and costs of moving modules.

As well, developers have been turning to overseas fabricators for modular units. Polish maker Polcom will construct modular units for Williamsburg’s forthcoming Pod hotel at 626 Driggs Avenue.

The Brooklyn Navy Yard has recently signed new tenants, such as WeWork, and more development is planned. A Wegman’s grocery is set to open near Admiral’s Row in 2017.

Capsys’ dilemma is in no way isolated. As Brooklyn becomes increasingly popular as a destination to live, more and more people want to work here as well.

With the commercial market the tightest it’s been since WWII, office space — and even light industrial space — is in high demand, and unfortunately for many businesses that means landlords are able to increase asking rents beyond what they can afford.

The company’s more than 40 current employees will get job placement help through the Brooklyn Navy Yard, and are expected to be reemployed quickly, some likely at founder Lembo’s other businesses, according to The Real Deal.

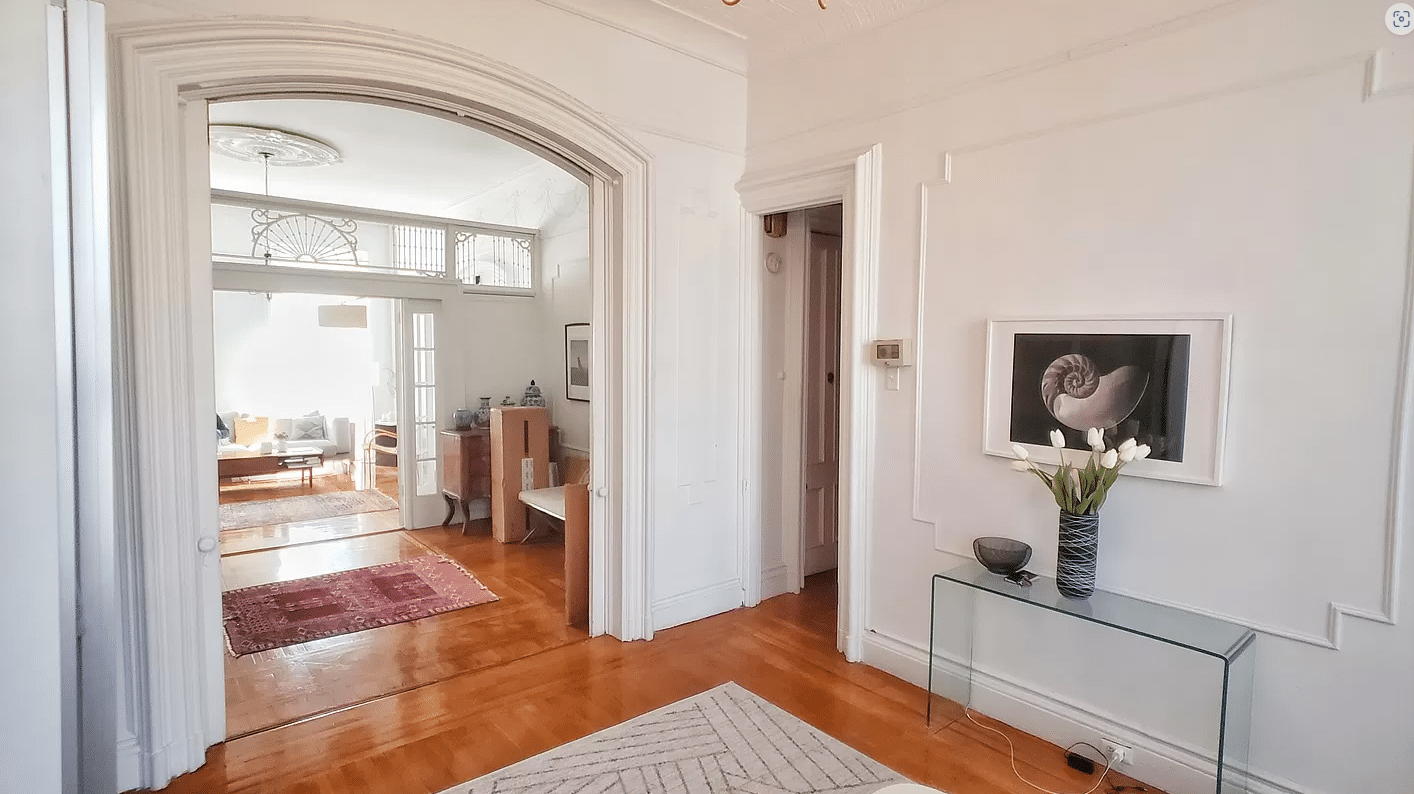

[Source: TRD | Photo: Barbara Eldredge and Capsys]

Related Stories

Dumbo Office Space So Rare, Sugar Crystal Building Developer Drops Condo Plan

Rising Property Values Lead Salvation Army to Close Third Brooklyn Store

Retail Rents Are Highest in Hipster Haven Williamsburg, Followed by Fulton Mall

What's Your Take? Leave a Comment