Pierhouse Condos More Than Half Gone, Toll Brothers Expecting $250 Million in Sales

Toll Brothers’ Pierhouse condos in Brooklyn Bridge Park, some of the priciest real estate in Brooklyn of any sort, are more than half sold (in contract, that is) since sales launched in February. Prices are averaging $1,850 per square foot and the developer expects to realize at least $250,000,000 in revenues from the project. It…

Toll Brothers’ Pierhouse condos in Brooklyn Bridge Park, some of the priciest real estate in Brooklyn of any sort, are more than half sold (in contract, that is) since sales launched in February. Prices are averaging $1,850 per square foot and the developer expects to realize at least $250,000,000 in revenues from the project. It has invested almost $39,000,000 into the development, said executives during an earnings call Wednesday reported by The Real Deal.

The development, designed by Marvel Architects, is still under construction in Brooklyn Bridge Park, and has angered preservationists such as Otis Pearsall and the Brooklyn Heights Association because a three-story rooftop structure housing mechanicals is unexpectedly blocking views of the bridge from the Brooklyn Heights Promenade, as we reported in September.

The units have proved so popular prices have increased six times during the two and a half months of sales, said the story. Of the 106 condos, 60 are in contract. Construction is expected to wrap in summer 2015. Toll Brothers plans to eventually sell the hotel portion of the project, which will be a 1 Hotel from Starwood, for about $100,000,000, said the firm’s chief financial officer.

Toll Brothers’ Pierhouse to See Big Payday [TRD]

Rendering by Marvel Architects

This rendering offers a view looking South west. From this angle the Brooklyn Bridge would not be there.

That’s some very old wood. 600 years???

The $39 million refers to the equity they’ve invested in the project, not the total costs of the project. In addition, only $24 million of that equity was for the residential project – the rest went to the partnership with Starwood for the hotel. The entire project was projected to cost ~$280 million to build, including the hotel. I don’t have an estimate for what the residential portion alone will cost, but pushing $200 million wouldn’t be outrageous.

I also cannot agree that parks are designed for peace and relaxation. There are soccer fields, restaurants, wine bars, concerts, movies, etc. There’s somebody out there that will and does find any or all of these things objectionable in a park. My opinion is that if by letting in minimal private development to pay for services to be enjoyed by the masses, then I’m generally for it. Again, I think the issue is how to keep it minimal.

@bonecrusher

They’re not “profiting 200 million”. That’s the figure for sales; developer profit will be a fraction of that.

Also, residents aren’t technically paying RE “taxes”, but they are contributing a basically equivalent amount to an annual PILOT stream for the park’s operating budget. Big stretch to call that a “tax break”.

I hear you bc. I’ll ignore bliz’s comment. Not sure what he/she means – if someone wants to work hard, that’s their perogative, as is bliz to apparently not work hard.

As far as building in a public park, im 50/50 on it. I think it’s an interesting concept to allow some private development in parks, and then allow taxes thrown off from those developments to pay for the upkeep of the parks. My concern is if it gets out of control and how to limit the amount of development. As always, it’ll be a balancing act, like most things in life.

Because life is all about working.

That is capitalism, I believe. If you’ve come up with a better system, please let me know what it is.

As for me, it inspires me to work that much harder.

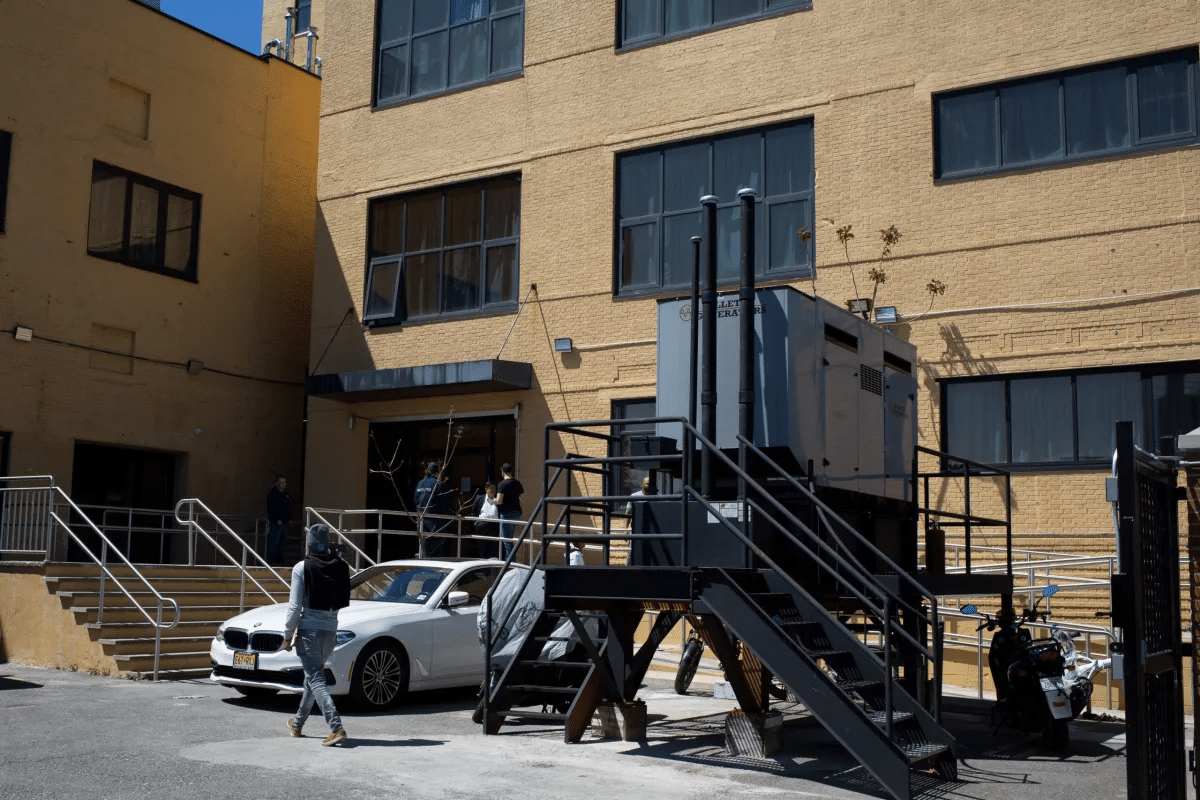

Sorry, I was trying to post a picture of what this *really* looks like! the rendering .. does not capture the true loss of the view of our iconic Brooklyn Bridge…